Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: EMPLOYEE ENGAGEMENT

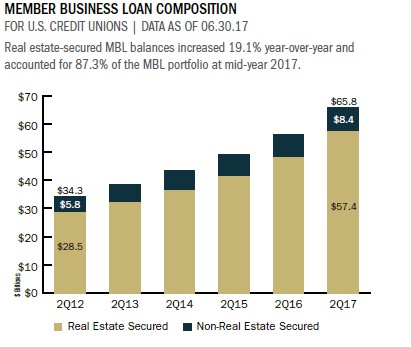

Member business loan balances at credit unions reached $65.7 billion as of June 30, 2017. MBLs expanded 16.7% over the past 12 months and are one of the fastest-growing loan segments in the credit union loan portfolio.

Credit unions added $3.0 billion in MBLs in the second quarter alone and originated $13.1 billion in MBLs during the first half of the year. Credit unions are increasingly adding member business lending to their overall loan strategy. At the end of second quarter 2017, 37.8% of credit unions held business loans on their balance sheets. That’s an increase of 1.8 percentage points over the first quarter of the year.

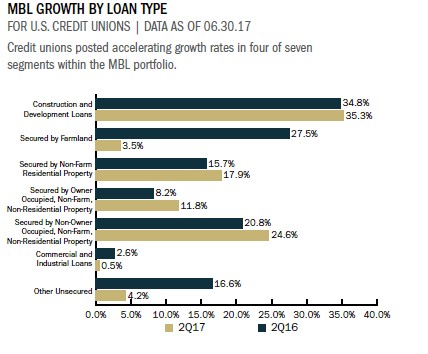

The industry’s business lending portfolio totaled $65.8 billion at the end of second quarter 2017. Real estate-secured MBLs comprised 87.4% of that portfolio, an increase of 1.8 percentage points in the past 12 months. Balances for non-farm, non-residential, non-owner occupied MBLs topped $24.6 billion at mid-year. These were the fastest-growing loans in the business lending portfolio annual growth in balances jumped from 20.8% in 2016 to 24.6% in 2017.

Curious how your loan portfolio stacks up to credit union and bank peers? Callahan analytics gives you answers fast.Learn more.

With the growth in balances came an increase in MBL delinquency. As of second quarter 2017, delinquencies were up to 1.61% from 1.48% one year ago. The souring of taxi medallion loans is a factor in the delinquency uptick. Expect to see this trend carry on as ride-hailing apps continue to put significant pressure on the taxi industry in major metropolitan markets.

Removing the delinquent loans that are secured by taxi medallions from the equation puts the overall MBL delinquency rate closer to 0.61% for America’s credit unions. Delinquency for real estate-secured MBLs was 0.40% in the second quarter, down 15 basis points from June 30, 2016, which highlights the strength and quality of these loans.

Click the graphs below to enlarge and then continue reading to see how a Great Lakes Credit Union uses constant analysis of its business loan portfolio to stay compliant.

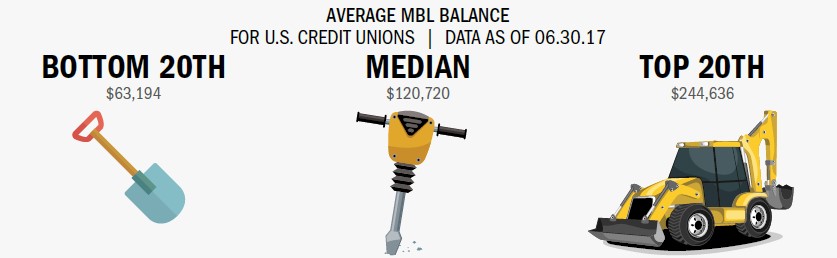

MBL balances increased across the industry. The average MBL balance jumped $14,860 to $243,230, an increase of 6.5% over June 30, 2016.

CASE STUDY

GREAT LAKES CREDIT UNION

For Great Lakes Credit Union, constant analysis of its business loan portfolio helps the credit union stay compliant. The strategy also helps the Illinois credit union monitor risk and keep the portfolio top-of-mind in daily operations.

Loan reviews are critical to the risk management of GLCU’s commercial portfolio, says Eric Vessele, vice president of commercial lending. They allow us to gauge the accuracy of our loan risk ratings and the overall operationaleffectiveness of the credit union’s risk-rating processes and procedures.

That’s why the credit union follows these three steps it has identified as best practices.

First, GLCU evaluates loans throughout the year, rather than in one lump sum at the end of the year, and uses each review period to gather new information about loans.

For example, as part of the review, GLCU measures the ability of the guarantor to support the loan as required. GLCU also uses market data to help determine the strength or weakness of the loans.

Second, the credit union uses data from its loan reviews to determine if there are events or variables that are increasing risk in the portfolio. In this way, the loan review is an early warning tool to spot problematic loans as well as detect majorindustry changes.

According to Vessele, loan review data allows GLCU to manage concentrations, analyze trends, and adjust loan structures and requirements on future transactions. Changes in profit and loss statements or loan-to-value ratios, for example, might indicatean economic downturn that could affect the rest of the credit union’s business. And if changes are positive, then the credit union might want to take on more risk.

Finally, GLCU uses a third party to review all transactions initiated through its originations team. If that review identifies a loan as risky, then the credit union has a third-party underwriter review the loan.

Read The Whole Story

Strategy & Performance 2Q 2017

Credit unions are indeed having an outstanding 2017 right on the heels of a very strong 2016 and 2015. Eliminating barriers and connecting with members distinguishes credit unions from other financial institutions and makes the movementstronger than it’s ever been. Learn what the industry’s most successful credit unions are doing in this issue ofStrategy & Performance.

Read More

RETURN TO INDUSTRY PERFORMANCE BY THE NUMBERS 2Q 2017