Wintering in Vermont is no picnic. The average lows in January hover around a frosty 10 degrees and the average annual snowfall exceeds 90 inches. With the chill of Jack Frost in the air, energy efficiency isn’t just a nice idea it’s a matter of survival.

VSECU (Vermont State Employees Credit Union, $1.1B, Montpelier, VT) began offering energy efficiency loans to members more than 15 years ago, and it didn’t take long for demand to grow. The credit union’s green lending portfolio totaled $2.5 million within a decade and today has grown to $92 million. The program supports weatherization, solar arrays, home battery backups, green vehicles, and even electric bikes.

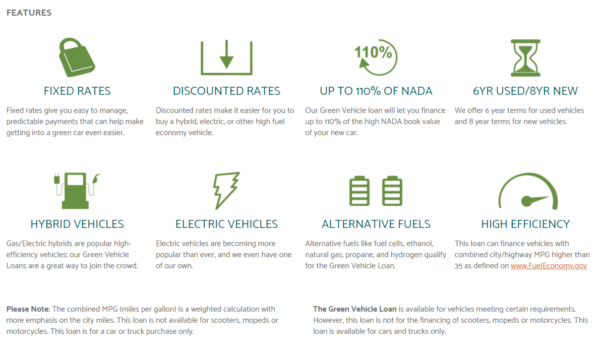

“VGreen loans are for anything that eliminates or reduces fossil fuel usage,” says Laurie Fielder, who became director of VSECU’s VGreen program in 2013. “Our products are designed to maximize these purchases, so they have discounted interest rates compared to our regular loan offerings and either extended terms or specialized terms to maximize the economic benefit.”

For example, VSECU can offer lower initial payments for a solar loan while borrowers wait for the government to process and refund their federal investment tax credit. Borrowers also can apply that government subsidy to the loan principal to pay back the loan faster. And through a partnership with the Vermont Energy Investment Corporation (VEIC), VSECU can buy down interest rates and offer a home energy loan for as low as 0% for qualifying members.

Relationships with contractors, VEIC, Efficiency Vermont, and other organizations are driving VSECU’s investments in solar and energy efficiency loans. Member concerns about climate change and more frequent severe weather events play a part, too.

“People are being cost conscious and resilient,” Fielder says. “We’re seeing more solar projects that are including a home battery storage component. It’s not just solar, they’re investing in something that’s going to be a backup in the event of a power outage.”

VSECU’s green loan for vehicles offers lower rates and extended terms to make financing hybrid, electric, and alternative fuel vehicles more attainable for individuals as well as businesses. “We financed a small fleet of about three vehicles just a couple months ago,” says Greg Huysman, director of business lending and services at VSECU. “We’re looking for those opportunities as more people want to switch to electric or even hybrid.”

Over the years, VSECU has created a variety of loan products to meet Vermonters’ needs. To date, its portfolio includes short-term and 20-year energy improvement loans, state-subsidized home energy loans, loans for vehicles with a fuel efficiency of 35 miles per gallon or more, energy equity loans, and business energy loans. It also offers off-grid mortgages for members who want to completely unplug.

We’re seeing more solar projects that are including a home battery storage component. It’s not just solar, they’re investing in something that’s going to be a backup in the event the grid goes down.

Solar lending for businesses also has been growing, and a typical loan amount today can easily reach $50,000, says Greg Huysman, director of business lending and services at VSECU. That’s notable, but the cooperative isn’t stopping there.

“We’re also looking for opportunities to do more electric vehicle financing,” Huysman says. “We financed a small fleet of about three vehicles just a couple months ago. We’re looking for those opportunities as more people want to switch to electric or even hybrid.”

A New Approach To Underwriting

The VGreen business represents a new approach to underwriting loans at VSECU. The majority of these loans are not collateralized, which means the amount of unsecured debt on VSECU’s balance sheet has climbed along with loan growth. In September 2021, other unsecured loans accounted for 10.04% of VSECU’s portfolio. For comparison, the average is 3.61% for credit unions with more than $1 billion in assets.

We’re looking for opportunities to do more electrical vehicle financing.

According to Huysman, estimated costs savings and cash flow for paying down the loan are two key factors in underwriting green energy loans.

“Your analysis is a little bit different from traditional loans,” the business lending director says. “The big difference for lenders is it’s not collateral-based. You’re really looking at the cash flow.”

Accurate analysis is especially important for this kind of lending because borrowers might hear a wide range of estimates on costs and cost savings.

VSECU’s energy equity loan finances alternative or renewable energy projects, efficiency projects, or home energy improvements of any kind on primary residences. VGreen loans are for anything that eliminates or reduces fossil fuel usage, says VGreen program director Laurie Fielder. In fact, borrowers are investing in battery backups in the event the grid goes down, not just solar.

“They want to go to a trusted source,” says Valerie Beaudin, senior vice president of lending at VSECU. “We are a trusted source.”

To provide members with green savings options, VSECU offers two VGreen money market accounts, one for individuals and one for businesses. VSECU, then, uses those deposits to fund its energy efficiency and renewable energy projects and purchases.

Solar array and the power we produce offsets pretty much all of our electricity except for a couple of small components.

Walking The Sustainability Walk

In 2016, VSECU invested in a solar power array with a local contractor to reduce the credit union’s carbon footprint. As a nonprofit, VSECU couldn’t easily access the investment tax credit for the array, so VSECU simply buys and retires the solar net metering credits produced by the array to offset the credit union’s power bill.

“Almost all of VSECU is using the same utility except for one branch, so that solar array and the power we produce offsets pretty much all of our electricity except for a couple of small components,” Fielder says.

VSECU also is looking to expand its green energy business outside of Vermont. In 2017, the credit union formed a common bond partnership with the Northeast Sustainable Energy Association (NESEA) to offer services to members of the association who live in the six New England states of Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, and Connecticut plus New York, New Jersey, Delaware, and Pennsylvania.

“We collaborate with NESEA and go to each other’s events,” Fielder says. “That’s going to be key in our continuing plans to grow the program.”

This is part of the “Anatomy Of A Credit Union” series, presented every quarter by Callahan & Associates. Read more about VSECU or dive into a decade of archives. Contact Callahan to learn about gaining access today.