In the wake of the Great Recession, financial institutions flooded the market with messages proclaiming their safety and soundness. But Florida-based Suncoast Credit Union did more than reassure a shaky population that it, too, met the baseline standards expected from America’s FIs. It doubled down on its brand values in a public manner.

We pushed off a number of projects during the recession, says Patti Barrow, vice president of marketing at Suncoast ($5.8B, Tampa, FL). Once we came through that, we were ready to serve new members and focus on the community.

The credit union undertook a complete rebrand that included redesigning its aged website, converting from a federal to a state charter, and updating the member experience in both physical and virtual touch points.

In doing this, the credit union had to address a challenging question: How do we modernize and expand our footprint without alienating longtime members and eschewing a nearly 40-year-old brand identity?

So Suncoast approached its rebrand as something more akin to restating what was already there.

Website Design

Suncoast’s old website was sorely in need of an update, Barrow says. In its planning, the credit union tried to translate those variables that membership valued in the institution onto its site.

Community, member, and non-member research revealed that respondents value Suncoast for three main reasons its honesty, transparency, and community focus. The new website places each of these front and center.

On the homepage, animated graphics compare loan rates, and the resulting savings, of Suncoast and other Florida banks. And an interactive wheel illustrate how much and where the credit union gives back to the communities it serves.

Photo headers on each of the credit union’s product and service pages show actual Suncoast members. And members can publicly review the institution though a site tool that asks them to rate their satisfaction, whether they would recommend Suncoast, and why they rated the institution the way they did. Out of nearly 9,000 product reviews, Suncoast has a cumulative product rating of 9.6 out of ten, and 99% of more than 2,000 reviewers said they’d recommend Suncoast.

When someone posts a negative review, credit union representatives follow up to try to repair the relationship better and identify improvements in products, processes, services, or communications.

According to Barrow, the reviews are more than a marketing tool.

They are a process improvement tool that allows us to build loyalty.

Charter Conversion

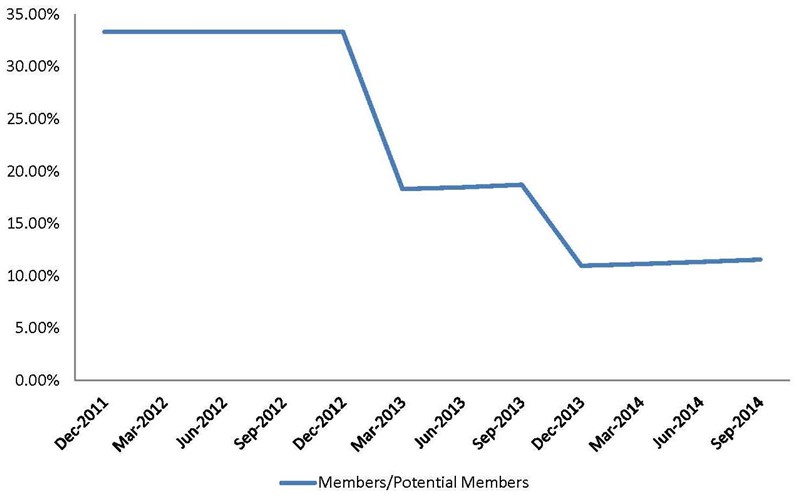

It was during website planning that Suncoast decided to convert from a federal to a state charter, a move that has increased its field of membership. Subsequently, the percentage of members to potential members it is serving has decreased; [See graph below] however, its total potential member base has grown from slightly more than more than three million to more than five million, according to Callahan Associates.

SUNCOAST CREDIT UNION MEMBER PENETRATION

Data as of Sept. 30, 2013

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

What made the most sense for the charter change was to get away from confusing eligibility criteria, Barrow says. Now anyone living in the counties we serve is able to join our credit union.

Suncoast changed charters to interact more closely with its local community. Although its new charter is not yet 12 months old, the credit union has already taken steps toward meeting this goal. In March 2014, Suncoast received a low-income designation from the NCUA and in early October it received certification as a community development financial institution. It’s now the largest institution to receive the certification.

Between the state charter and the CDFI certification, we have more ammunition to serve others, Barrow says.

The CDFI certification allows the credit union to apply for program and services grants that benefit underserved populations. According to David Gonzalez, vice president and compliance officer, Suncoast will explore lending grants for community development services. Before it decides for which grant it will apply each institution can apply for only one grant per cycle Suncoast will run an emerging market analysis in each of its 17 counties to identify glaring areas of need where it can make an impact.

Our goal is to serve the underbanked and the non-banked, Gonzalez says. These grants will help us strengthen our commitment to our members and prospects and include efforts to teach financial literacy to as many people as we can.

Member Experience

With a new name and logo, the credit union set out to update its member experience, starting with its brick-and-mortar branches and expanding into its mobile channels.

The credit union is currently remerchandising its branches, a project that entails updating logos and colors as well as bringing in a pronounced digital element to appeal to members the average age of which is 42, according to Barrow.

Branches play an important role in Suncoast’s operations, as it operates 57 in its geographical footprint stretching down Florida’s West Coast. That’s more than double the average for asset-based peers, but Barrow points to research that shows despite consumers’ online fact-finding and product research, they prefer to discuss and undertake complex transactions face-to-face.

We need to deliver service that our members want to experience, she says.

However, Barrow still believes technology, specifically mobile, is crucial to the success of the institution. Suncoast is in the midst of a core conversion that, when finished in February 2015, the credit union will use to overhaul its mobile banking experience for members who don’t want to use the institution’s app.

This move underscores the credit union’s dedication to improving member-facing technologies and services while keeping some things familiar for longtime members.

We are building our mobile capabilities, Barrow says. But we are not going to lose sight of the face-to-face interactions that many in our market expect.