CommunityAmerica Credit Union ($2.7B, Lenexa, KS) is committed to making its workplace a dream come true for its nearly 850 employees. So much so that the suburban Kansas City financial cooperative has created a position called dream manager whose job it is to help staffers identify and pursue their life goals. The dream manager helps them feel good, too, by adding an emphasis on physical well-being.

“The dream manager position is part of the human resources vision for CommunityAmerica,” says Debra O’Bryan, the 15-month CACU employee who holds down the role. “We want to encourage, support, inspire, and empower our employees to live a wholehearted life.”

Here, O’Bryan talks about what being a dream manager is all about.

What is a dream manager?

Debra O’Bryan: The mission of the dream manager is to be a trusted life coach, friend, and compassionate, empathetic listener and to create a safe, judgment-free environment that supports sharing. The dream manager helps employees create their official Dream Action Plan, listing dreams to be achieved now and in the future. This document is signed, dated, and used as the foundation for reaching dreams and measuring progress.

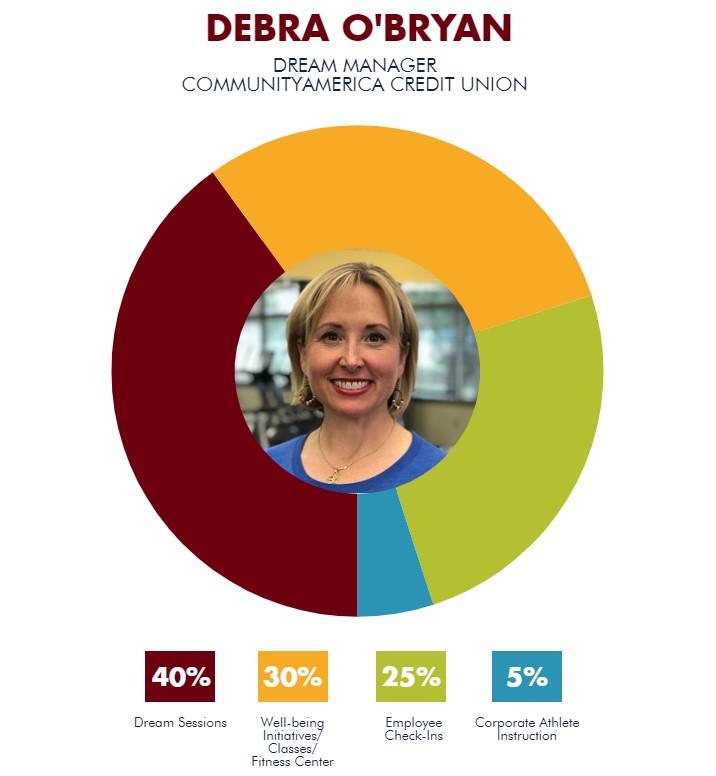

What are your areas of responsibility?

DO: I serve as dream manager, well-being coach, and corporate athlete facilitator, managing the fitness center and classes. The dream manager and well-being coach are closely integrated since almost all employees are focused on healthy living as part of the dreams.

Is this a new role that CACU designed for you?

DO: No, but the role has allowed me to combine my passion for health and wellness with my experience as a life coach. It gives me the opportunity to live my true purpose and calling in life, so if feels that it is most definitely tailored to me.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What qualifications make you a great fit for this job?

DO: My work history includes an array of experience as a life coach and health and well-being coach. I’m also a certified yoga instructor and have taught classes for a variety of companies large and small, including the Kansas City Chiefs. My purpose in life is to help people find the joy that resides within them and live it.

What’s your daily routine?

DO: As the dream manager and well-being coach for CommunityAmerica, my day is filled with dream sessions. I check-in with employees through meetings, emails, cards, phone calls, and texts. I also serve as a certified instructor for the corporate athlete training program and lead several health and well-being challenges and lunch and learns. And, I teach yoga and fitness classes and oversee our new fitness center and yoga studio.

How do you track success in your job?

DO: The success of the program is based on the success of each employee in achieving specific action items. We work to reach all ranges of ages and tenure of employees to ensure a diverse and inclusive program.

How do you stay current with topics that fall under your role?

DO: I’m currently working toward a Master of Arts degree in human services counseling with a specialty in life coaching. In addition, I attend workshops, trainings, and events and study health and well-being.

This interview has been edited and condensed.