Adele Glenn is an emerging channels innovation architect at Credit Human Federal Credit Union ($2.9B, San Antonio, TX). The interesting title she’s held for three years speaks to the pioneering spirit and agile approach to change embraced by her employer. According to her job description, the person holding this role is accountable for adding value for the future, which requires the holding together of business in the present while at the same time building for the future.

The role develops and executes strategies that push the boundaries of channels rather than simply extending what’s there. And the person holding the role does so in a team structure so they can draw on the intellectual capital that exists in the brains of people across Credit Human.

Here, Glenn talks about the daily life of an emerging channels innovation architect.

What does an emerging channels innovation architect do?

Adele Glenn: My role falls all over the map. In sum, I’m the senior executive leader in applied research, innovation, strategy, and optimization. I guide the design and development of user-centric solutions to business problems.

What’s your daily routine?

AG: It depends on the day. If I’m in the office, I start each day with my wall, which is a compilation of projects, ideas, and inspirations. I host innovation lab sessions for peer executives in the company, lead project teams through RD, write business cases, and sometimes even implement projects.

I also spend a great deal of time out of the office. Travel and networking is key to this role. I attend conferences and educational opportunities all over the globe. I also speak regularly as a panel guest or speaker, sharing and gathering credit union intel on technology advancements, innovations, and social mission-based initiatives.

From Finovate, to SXSW, to the Systems Dynamics International Conference getting out there and networking with others across all spectrums of industry allows me to keep my mind open and my ear to the ground for opportunities Credit Human can translate into member enhancements in products and services.

Whether on the road or at home, I allocate a portion of my day for reflection and information sharing. I love to create graphical sketches that I can text to colleagues and share whatever is exciting at the moment.

I also host a quarterly what’s cool session with Credit Human’s executive team to keep them up-to-date with what’s out there everything from new apps to sub dermal digital tattoos, not just credit union solutions.

What’s It All Mean?

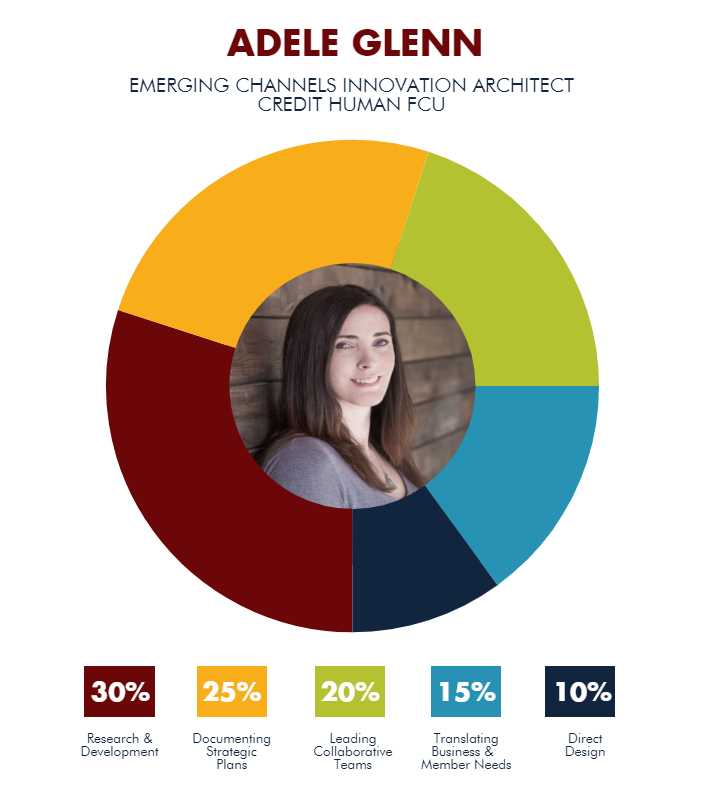

Adele Glenn, emerging channels innovation architect at Credit Human FCU, breaks down her new role in greater detail.

- Research & Development: Discovering business and end user needs through research, analysis, and user-centered design.

- Documenting Strategic Plans: Defining strategy and business cases for innovative solutions to achieve strategic road maps.

- Leading Collaborative Teams: Leading high-performing, cross-functional teams of technical, creative, and business experts with an entrepreneurial spirit across all levels of the organization.

- Translating Business & Member Needs: Translator between Business, UX, and IT.

- Direct Design: Directing the design and development of solutions to meet end user needs.

What made you a great fit for this job?

AG: My background is in software development. Specifically, creating solutions for credit unions through core banking systems and third-party API integrations. I have been working in the credit union industry for just over 20 years now. I started in this industry with a high school diploma.

Credit Human encouraged me to seek higher education to advance through the ranks. That led to two bachelor’s degrees and eventually my MBA, which I completed in 2016. I was a self-taught developer initially, but over the years, I have pursued not only formal degree programs but also various technical certifications to feed my curiosity and progress my career. I hold a black belt in Lean Six Sigma and an ACE in Management, Information, and Technology from MIT Sloan School of Management among others.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

How do you track success in your job?

AG:I track success as achievements in my strategic goals as stated in my most recent two- to five-year strategic plan. I also track productivity statistics, time to completion, and overall ROI on all initiatives implemented. Part of this role is knowing when to stop an initiative after the credit union has already invested RD time and dollars. That can be one of the toughest parts of the job.

Who do you report to? Who reports to you?

AG:I report to the COO and CEO. Our credit union is divided into Direct and Indirect, which is a little different from most orgs. I am currently sitting on the Direct side of the house parallel and in the office next to the CIO, but I work with both Direct and Indirect groups.

I have no direct reports at this time. I am currently the only senior executive in an individual contributor role in the entire company. This is by design to optimize my time no reviews to write, no overhead of staff. I can request resources from my peers to accomplish project work as needed. It’s a very effective design.

Why did Credit Human decide it needed this role? Could it not have fit under an existing role? If not, why not?

AG: The individual contributor role was developed to allow for focus and results. Previous to this role, I held an individual contributor role in our eServices division and was made great advancements in that channel as a result. Could Credit Human have lumped this into a chief information officer role? Yes, but I wouldn’t be as effective if I also had the distraction and time pull of the day-to-day.

Do you know of anyone else with a similar role or responsibilities?

AG: No, not yet in a credit union and I ask everywhere I go. Yes, in non-credit union organizations. I have met my counterparts at companies such as USAA, Google, and Apple. Usually they go by the title of chief technology officer, chief innovation officer, or director of innovation.

From The Desk Of Adele Glenn

To stay current on topics that fall under her role, Adele Glenn, the emerging channels innovation architect at Credit Human FCU, attends conferences and networks. She also reads. A lot.

“I follow 150-plus online journals/zines and more than 300 Twitter feeds,” Glenn says.

Here are some highlights from the networking nave:

- Callahan/CUFSLP Group

- MIT Sloan Management Review

- Harvard Business Review

- Finovate

- American Banker

- Apple

- ATM/Kiosk Marketplace

- BEST innovation

- TRC Group

- Source Media Events/Journal

- NAFCU

- CUNA Councils (she’s also a volunteer member)

- Tech Crunch

- Wired

- SXSW

- Kickstarter/IndieGogo

- Paythink

- @ValaAfshar

- @BrettKing

This interview has been edited and condensed.