What happens in Vegas stays in Vegas, right? Not when it comes to credit unions and their CUSOs.

Last week’s annual conference of the National Association of Credit Union Service Organizations helped spread the word that the climate for these cooperative ventures is perhaps as strong as it’s ever been. That’s despite and in response to growing competitive and regulatory pressures and challenges.

After all, CUSOs are an ideal way to pull together and give scale to business and technological acumen that might otherwise be out of reach for the great majority of credit unions. Together, the movement can better meet member demands and expectations.

That’s the big takeaway for me from the NACUSO conference, which drew another really nice turnout for this year’s gathering at the Wynn Las Vegas. I’m honored to continue as a board member, and here are some reasons why I think the time is so right for the credit union movement to renew its embrace of the CUSO model.

You’ll Do Better

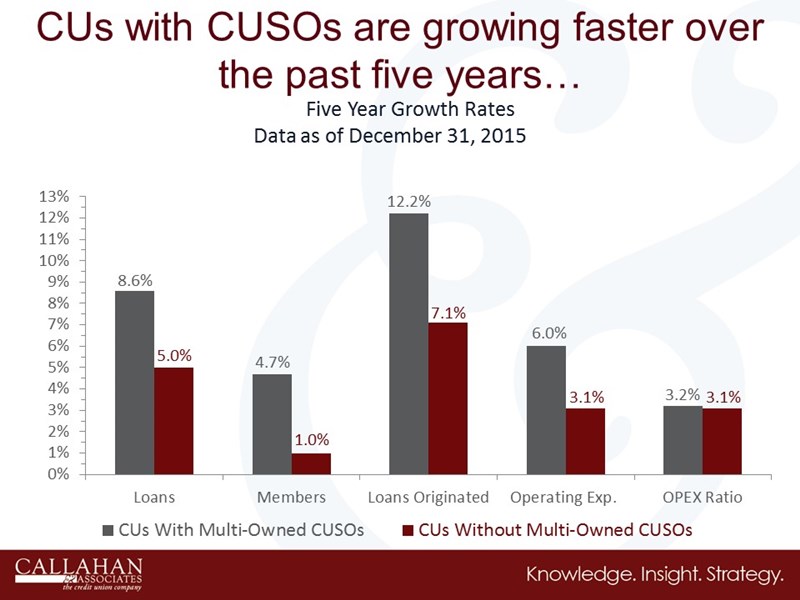

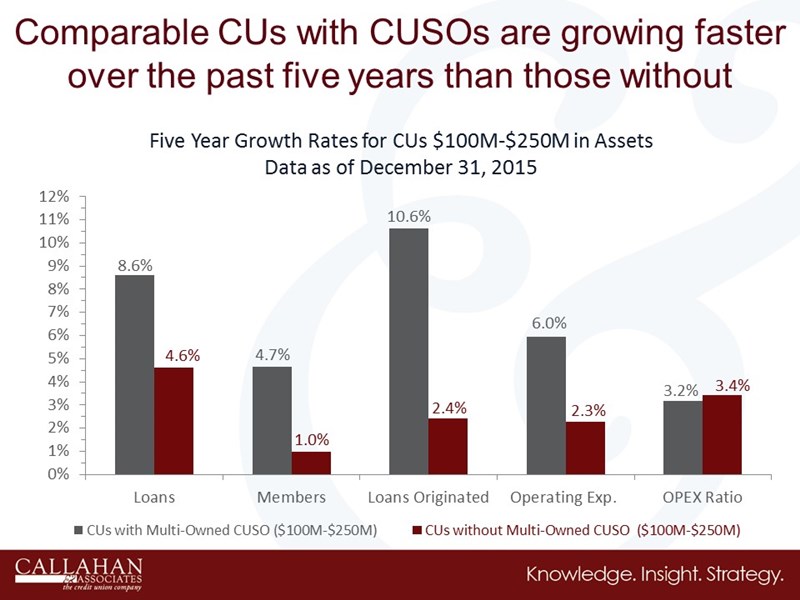

Here’s the bottom line first. The Peer-to-Peer data from Callahan & Associates shown below illustrates how credit unions with multi-owned CUSOs are growing faster than credit unions without, an effect especially true for credit unions of $100 million to $250 million in assets.

Why? They’re delivering products and services that today’s members expect but that might not be possible, or certainly not as affordable or efficient, without those CUSO relationships. They’re usually making some money from their ownership in the collaborative enterprises, as well.

Doing good while doing well.

Others Are Noticing

Credit unions are now a trillion-dollar industry, and we’re increasingly on the radar for a lot of companies large and small that would like a part of that action.

Many of these are innovators pushing out the leading edge with products like the winner of the Shark Tank style competition at NACUSO. That was Rate Reset, whose technology allows credit union members to change their own rates on their own loans.

Some of the entrepreneurs at the show were considering ways to convert their business into a CUSO model. Others were looking at other ways to collaborate, and they helped enliven the discussions with credit union leaders in forums focusing on the gamut of CUSO activities, from data processing and other back-office functions to member-facing products such as insurance, home mortgages, and business lending and services.

There was a disctinct entrepreneurial vibe this year that I hope can be sustained.

To me, that’s one of the things this conference really tries to do every year: create a forum for ideas to be explored and business people to get a better understanding of each other and connections that could possibly be formalized and leveraged. There was a distinct entrepreneurial vibe this year that I hope can be sustained.

Don’t Let Compliance Harsh The Mellow

While the 400 or so conference attendees focused on collaboration and big ideas, the issue of regulatory compliance was never far afield. The NCUA is now for the first time formally registering the approximately 800 CUSOs out there, and that has sparked concern that it’s just the first step in the agency’s very public efforts to gain regulatory authority over credit unions’ third-party suppliers.

As it likes to point out, the NCUA alone among its peers does not have that authority. However, credit unions have a much stronger record of safety and soundness than their for-profit counterparts. And such vendor oversight, if the hand is too heavy, could stifle innovation and put credit unions at an even larger competitive disadvantage to deep-pocketed banks with the time and money that credit unions typically don’t have unless they band together in CUSOs.

But there’s also reason to believe that regulators, credit unions, and their CUSOs can build a relationship based on trust and a common goal: the safety and soundness of the credit union system and its member-owners.

NCUA board member Mark McWatters was at NACUSO and he offered these words: We need to address the risks that are actually presented by CUSOs to the NCUSIF and to the credit union community. If there is something we see coming, let’s make sure those regulations are targeted to that specific threat to the credit union community and to the share insurance fund.

Hear. Hear. We just want the NCUA and other agencies who may become involved (the CFPB comes to mind) to ensure they recognize the value that CUSOs and credit unions as a whole bring to members, and that what we really want and need is an environment that supports that kind of collaborative activity.

The regulators have indicated they are open to that. Time will tell.

A Time For CUSOs

What happens in Vegas stays in Vegas, right? Not when it comes to credit unions and their CUSOs.

Last week’s annual conference of the National Association of Credit Union Service Organizations helped spread the word that the climate for these cooperative ventures is perhaps as strong as it’s ever been. That’s despite and in response to growing competitive and regulatory pressures and challenges.

After all, CUSOs are an ideal way to pull together and give scale to business and technological acumen that might otherwise be out of reach for the great majority of credit unions. Together, the movement can better meet member demands and expectations.

That’s the big takeaway for me from the NACUSO conference, which drew another really nice turnout for this year’s gathering at the Wynn Las Vegas. I’m honored to continue as a board member, and here are some reasons why I think the time is so right for the credit union movement to renew its embrace of the CUSO model.

You’ll Do Better

Here’s the bottom line first. The Peer-to-Peer data from Callahan & Associates shown below illustrates how credit unions with multi-owned CUSOs are growing faster than credit unions without, an effect especially true for credit unions of $100 million to $250 million in assets.

Why? They’re delivering products and services that today’s members expect but that might not be possible, or certainly not as affordable or efficient, without those CUSO relationships. They’re usually making some money from their ownership in the collaborative enterprises, as well.

Doing good while doing well.

Others Are Noticing

Credit unions are now a trillion-dollar industry, and we’re increasingly on the radar for a lot of companies large and small that would like a part of that action.

Many of these are innovators pushing out the leading edge with products like the winner of the Shark Tank style competition at NACUSO. That was Rate Reset, whose technology allows credit union members to change their own rates on their own loans.

Some of the entrepreneurs at the show were considering ways to convert their business into a CUSO model. Others were looking at other ways to collaborate, and they helped enliven the discussions with credit union leaders in forums focusing on the gamut of CUSO activities, from data processing and other back-office functions to member-facing products such as insurance, home mortgages, and business lending and services.

There was a disctinct entrepreneurial vibe this year that I hope can be sustained.

To me, that’s one of the things this conference really tries to do every year: create a forum for ideas to be explored and business people to get a better understanding of each other and connections that could possibly be formalized and leveraged. There was a distinct entrepreneurial vibe this year that I hope can be sustained.

Don’t Let Compliance Harsh The Mellow

While the 400 or so conference attendees focused on collaboration and big ideas, the issue of regulatory compliance was never far afield. The NCUA is now for the first time formally registering the approximately 800 CUSOs out there, and that has sparked concern that it’s just the first step in the agency’s very public efforts to gain regulatory authority over credit unions’ third-party suppliers.

As it likes to point out, the NCUA alone among its peers does not have that authority. However, credit unions have a much stronger record of safety and soundness than their for-profit counterparts. And such vendor oversight, if the hand is too heavy, could stifle innovation and put credit unions at an even larger competitive disadvantage to deep-pocketed banks with the time and money that credit unions typically don’t have unless they band together in CUSOs.

But there’s also reason to believe that regulators, credit unions, and their CUSOs can build a relationship based on trust and a common goal: the safety and soundness of the credit union system and its member-owners.

NCUA board member Mark McWatters was at NACUSO and he offered these words: We need to address the risks that are actually presented by CUSOs to the NCUSIF and to the credit union community. If there is something we see coming, let’s make sure those regulations are targeted to that specific threat to the credit union community and to the share insurance fund.

Hear. Hear. We just want the NCUA and other agencies who may become involved (the CFPB comes to mind) to ensure they recognize the value that CUSOs and credit unions as a whole bring to members, and that what we really want and need is an environment that supports that kind of collaborative activity.

The regulators have indicated they are open to that. Time will tell.

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Credit Union Data Predicts Who Will Win Super Bowl 2026

140 Million Reasons To Lend

Rethinking Auto Lending And The Choices Facing Credit Union Leaders

Keep Reading

Related Posts

Financial Nihilism Is Real, But How Can Credit Unions Respond?

2026 Begins With Market Sentiment Similar To 2025

Preparing For 2026: Why The NCUA’s New Succession Planning Rule Elevates The Strategic Role Of Credit Union Boards

5 Tucson Credit Unions Join Forces For Affordable Housing

Savana MorieHow APL FCU Builds A Board Succession Pipeline

Aaron PassmanHow 2 Credit Unions Reduce Recidivism 1 Class At A Time

Savana MorieView all posts in:

More on: