NUCA has released fourth quarter data, and the final numbers for 2014 show credit unions are doing well on every measure of financial performance. The industry posted growth in members, loans, and savings; it has stable earnings, record capital levels, and normal levels of delinquency and charge-offs. Its balance sheet and investment portfolio are well positioned for any potential rise in rates. And its market share is strong; for example, it set a new record of 8.4% of all first mortgage originations.

Despite this success, NCUA has issued a revised risk-based capital rule totaling 450 pages. This burdensome, complex proposal is a call to action for the industry to speak out again.

The Need And Impact Of RBC II

NCUA’s second risk-based capital proposal contains many changes from the first version. For example, it modifies 20 risk weightings; introduces 21 new variables, bringing the total asset categories covered to 76; raises the asset threshold of a complex credit union to more than $100 million; lowers the top-tier, well-capitalized bar to 10%; and extends the implementation period to three years from the rule’s final adoption.

However, year-end data clearly proves there is no capital problem or shortfall in the credit union system. Total net worth increased by 9% in 2014 to more than $123 billion. Adding the $7 billion allowance account to net worth shows the system with a total capital (simple leverage) ratio of 11.4% at year-end.

The proposed regulation will cover most of the industry’s assets. At year-end, 1,520 of the nation’s 6,400 credit unions held more than $100 million in assets. These institutions managed a combined $1 trillion that’s nearly 90% of the industry’s assets. With the three-year phase in, current growth trends suggest a final rule would include another 160-200 credit unions, pushing the total percentage even higher. Even if the complex rule application starts at $100 million, it will impact the entire system.

Even when applying the new RBC formula to the 1,520 credit unions directly subject to the proposal today, only 19 would be subject to the RBC II ratio of 10%. Almost all are near the 10% well-capitalized level. The RBC II formula does not identify outliers that the standard 7% well-capitalized leverage ratio would not identify on its own.

A Theory That Doesn’t Fit The Facts

U.S. banking regulators have had more than 30 years of direct experience applying three major versions of Basel risk-based capital rules. What do they have to say about the banking industry’s efforts?

It doesn’t work, concludes FDIC vice chairman Thomas Hoenig. It’s a fatally flawed experiment that has lasted too long.

Read more on the FDIC vice chairman’s position on RBC: Here&’s What the FDIC Really Said, Training Fleas and RBC.

RBC is a complicated set of rules and ratios based on a theory that has not worked in practice. In contrast, the simple and easy-to-understand leverage ratio has served the cooperative system well through good times and multiple economic crises. RBC for banks has become so complex and even brought adverse, unintended consequences that the U.S. banking regulators in April 2014 unanimously adopted credit unions’ simple leverage approach to capital adequacy to supersede RBC’s multiple measures.

NCUA says its proposal is forward looking. However, there are no future facts to prove any RBC formula is correct. As a result, RBC requirements for banking have undergone continuous adjustments and fine tunings that add to the complexity and uncertainty.

However, there is current, real data to test the assumptions that underlie this second effort. In NCUA’s revised RBC rule, the risk weightings are supposed to reflect the relative credit risk of the different asset classes. These weights vary from 0% risk (no credit risk) for government securities to 150% for other assets, such as delinquent loans and CUSO investments.

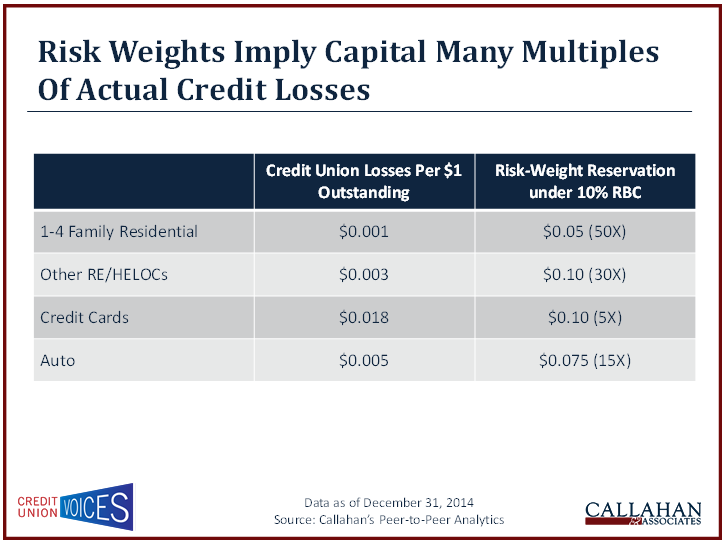

NCUA’s risk weightings show no correlation to actual 2014 loan-loss experience or to the longer-term (five-year) credit losses in first mortgages. The following charts show that risk weightings and required capital level in the new RBC for loan categories cover almost 84% of all loans. Bottom line: The capital requirements required by the risk weights vary from 15 to 50 times the actual 2014 losses.

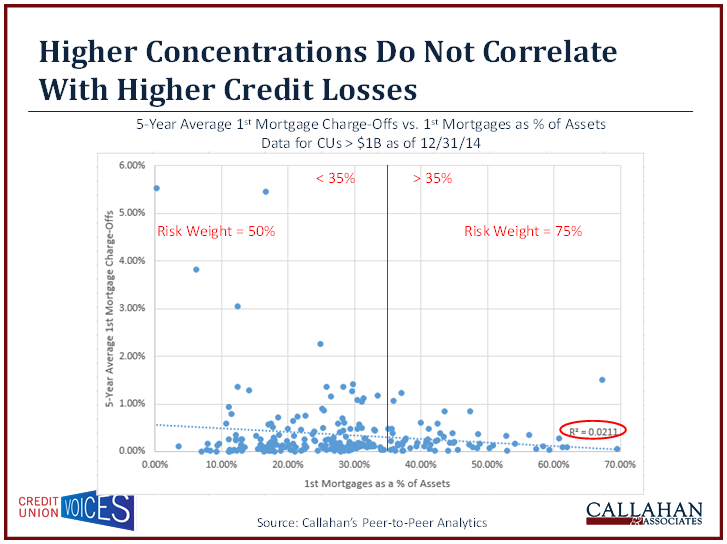

The proposal requires higher risk weightings if first mortgage loans are greater than 35% of the balance sheet. The real estate losses during the five-year period between 2009 and 2014 shows there is no correlation between the percentage of mortgage loans to assets and charge-off losses. In fact, the data shows just the opposite. Mortgage losses decline as the percentage of mortgages on the balance sheet grows.

A Solution That Won’t Work For A Problem That Doesn’t Exist

Credit unions sent more than 2,000 comments responding to NCUA’s first RBC proposal. As a result, the agency drafted a new rule with hundreds of changes and offered a second comment period.

Some have reacted to NCUA’s efforts with satisfaction; others are resigned about what they believe to be an inevitable outcome; and some, maybe many, are just tired of the debate.

The long-term record of credit union success and even more so, the recent past shows no need for a new capital requirement. Risk-based capital has failed the banking industry. As Doug Fecher, CEO of Wright-Patt Credit Union, commented at a public discussion on the merits of the second RBC proposal this week:

To say that NCUA’s revised RBC rule is a problem looking for a solution is a too kind, because it presumes that if there were an actual problem, RBC II would be a reasonable solution. I prefer to say it this way NCUA’s revised RBC rule is a solution that won’t work for a problem that doesn’t exist.’

Reactivating Credit Union Voices

The credit union community’s engagement on the first proposal made a difference. But new issues have now surfaced, including NCUA’s authority to make the rule.

NCUA has demonstrated in both of its RBC proposals how arbitrary the risk-weighting concept is. However, this time comments need not focus on details. Changing a ratio, risk weighting, or formula will not make RBC work.

These are the questions to address instead: Is RBC a good or bad public policy for the cooperative system? Is RBC a better approach than the existing capital measure?

During CUNA’s Governmental Affairs Conference this week, more than 60 attendees expressed their views and filed comments at the Credit Union VoicesBooth. Now it’s time for all professionals, directors, and members to speak up before the April 27 deadline.

If NCUA receives fewer comments for RBC II than the 2,000 it received for the initial proposal, then the agency could interpret the silence as an endorsement of the second draft. Moreover, although most in the industry might have clear objections to the proposed rule, without active participation by many credit union voices, it will be difficult for those outside the industry, or even within the agency, to make changes if RBC II passes.

Visit www.credituionvoices.com for examples of comments and for the link to file your own response.

What Does Fourth Quarter Data Mean For The Risk-Based Capital Proposal?

NUCA has released fourth quarter data, and the final numbers for 2014 show credit unions are doing well on every measure of financial performance. The industry posted growth in members, loans, and savings; it has stable earnings, record capital levels, and normal levels of delinquency and charge-offs. Its balance sheet and investment portfolio are well positioned for any potential rise in rates. And its market share is strong; for example, it set a new record of 8.4% of all first mortgage originations.

Despite this success, NCUA has issued a revised risk-based capital rule totaling 450 pages. This burdensome, complex proposal is a call to action for the industry to speak out again.

The Need And Impact Of RBC II

NCUA’s second risk-based capital proposal contains many changes from the first version. For example, it modifies 20 risk weightings; introduces 21 new variables, bringing the total asset categories covered to 76; raises the asset threshold of a complex credit union to more than $100 million; lowers the top-tier, well-capitalized bar to 10%; and extends the implementation period to three years from the rule’s final adoption.

However, year-end data clearly proves there is no capital problem or shortfall in the credit union system. Total net worth increased by 9% in 2014 to more than $123 billion. Adding the $7 billion allowance account to net worth shows the system with a total capital (simple leverage) ratio of 11.4% at year-end.

The proposed regulation will cover most of the industry’s assets. At year-end, 1,520 of the nation’s 6,400 credit unions held more than $100 million in assets. These institutions managed a combined $1 trillion that’s nearly 90% of the industry’s assets. With the three-year phase in, current growth trends suggest a final rule would include another 160-200 credit unions, pushing the total percentage even higher. Even if the complex rule application starts at $100 million, it will impact the entire system.

Even when applying the new RBC formula to the 1,520 credit unions directly subject to the proposal today, only 19 would be subject to the RBC II ratio of 10%. Almost all are near the 10% well-capitalized level. The RBC II formula does not identify outliers that the standard 7% well-capitalized leverage ratio would not identify on its own.

A Theory That Doesn’t Fit The Facts

U.S. banking regulators have had more than 30 years of direct experience applying three major versions of Basel risk-based capital rules. What do they have to say about the banking industry’s efforts?

It doesn’t work, concludes FDIC vice chairman Thomas Hoenig. It’s a fatally flawed experiment that has lasted too long.

Read more on the FDIC vice chairman’s position on RBC: Here&’s What the FDIC Really Said, Training Fleas and RBC.

RBC is a complicated set of rules and ratios based on a theory that has not worked in practice. In contrast, the simple and easy-to-understand leverage ratio has served the cooperative system well through good times and multiple economic crises. RBC for banks has become so complex and even brought adverse, unintended consequences that the U.S. banking regulators in April 2014 unanimously adopted credit unions’ simple leverage approach to capital adequacy to supersede RBC’s multiple measures.

NCUA says its proposal is forward looking. However, there are no future facts to prove any RBC formula is correct. As a result, RBC requirements for banking have undergone continuous adjustments and fine tunings that add to the complexity and uncertainty.

However, there is current, real data to test the assumptions that underlie this second effort. In NCUA’s revised RBC rule, the risk weightings are supposed to reflect the relative credit risk of the different asset classes. These weights vary from 0% risk (no credit risk) for government securities to 150% for other assets, such as delinquent loans and CUSO investments.

NCUA’s risk weightings show no correlation to actual 2014 loan-loss experience or to the longer-term (five-year) credit losses in first mortgages. The following charts show that risk weightings and required capital level in the new RBC for loan categories cover almost 84% of all loans. Bottom line: The capital requirements required by the risk weights vary from 15 to 50 times the actual 2014 losses.

The proposal requires higher risk weightings if first mortgage loans are greater than 35% of the balance sheet. The real estate losses during the five-year period between 2009 and 2014 shows there is no correlation between the percentage of mortgage loans to assets and charge-off losses. In fact, the data shows just the opposite. Mortgage losses decline as the percentage of mortgages on the balance sheet grows.

A Solution That Won’t Work For A Problem That Doesn’t Exist

Credit unions sent more than 2,000 comments responding to NCUA’s first RBC proposal. As a result, the agency drafted a new rule with hundreds of changes and offered a second comment period.

Some have reacted to NCUA’s efforts with satisfaction; others are resigned about what they believe to be an inevitable outcome; and some, maybe many, are just tired of the debate.

The long-term record of credit union success and even more so, the recent past shows no need for a new capital requirement. Risk-based capital has failed the banking industry. As Doug Fecher, CEO of Wright-Patt Credit Union, commented at a public discussion on the merits of the second RBC proposal this week:

To say that NCUA’s revised RBC rule is a problem looking for a solution is a too kind, because it presumes that if there were an actual problem, RBC II would be a reasonable solution. I prefer to say it this way NCUA’s revised RBC rule is a solution that won’t work for a problem that doesn’t exist.’

Reactivating Credit Union Voices

The credit union community’s engagement on the first proposal made a difference. But new issues have now surfaced, including NCUA’s authority to make the rule.

NCUA has demonstrated in both of its RBC proposals how arbitrary the risk-weighting concept is. However, this time comments need not focus on details. Changing a ratio, risk weighting, or formula will not make RBC work.

These are the questions to address instead: Is RBC a good or bad public policy for the cooperative system? Is RBC a better approach than the existing capital measure?

During CUNA’s Governmental Affairs Conference this week, more than 60 attendees expressed their views and filed comments at the Credit Union VoicesBooth. Now it’s time for all professionals, directors, and members to speak up before the April 27 deadline.

If NCUA receives fewer comments for RBC II than the 2,000 it received for the initial proposal, then the agency could interpret the silence as an endorsement of the second draft. Moreover, although most in the industry might have clear objections to the proposed rule, without active participation by many credit union voices, it will be difficult for those outside the industry, or even within the agency, to make changes if RBC II passes.

Visit www.credituionvoices.com for examples of comments and for the link to file your own response.

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

The Numbers That Matter Most To Credit Unions

The Affordability Crisis Is Reshaping Credit Union Balance Sheets

Meet The Finalists For The 2026 Innovation Series: Employee Enablement

Keep Reading

Related Posts

Markets React To Consequential Announcements

Financial Nihilism Is Real, But How Can Credit Unions Respond?

2026 Begins With Market Sentiment Similar To 2025

The Numbers That Matter Most To Credit Unions

Aaron PassmanThe Affordability Crisis Is Reshaping Credit Union Balance Sheets

Sherry VirdenMeet The Finalists For The 2026 Innovation Series: Employee Enablement

Callahan & AssociatesView all posts in:

More on: