In his presentation during the Emerge Forum presented by the Center for Financial Services Innovation (CFSI) and American Banker, Raul Vasquez, chief executive officer of Oportun, ended his speech with a quote from Abraham Lincoln:

I do not like that man. I must get to know him better.

It’s a statement Vasquez used in the context of lending to low-income Hispanic borrowers, and it underscores the importance of getting to know an individual’s values and motivations before passing judgment.

Later during the three-day conference taking place in Austin, TX, in a panel titled Millennials Trending: How They Are Changing Mobile, Connectivity, And Financial Expectations, panelists applied Lincoln’s wisdom to the millennial generation as well.

How Millennial Are You, Anyway?

Millennials represent a cohort of individuals between the ages of 18 and 34. The oldest millennials were born around 1980 and the youngest around 1997.

Gen Y is a bridge generation between two eras, said panelist Rourke O’Brien, a Robert Wood Johnson Health & Society Scholar at Harvard University whose research focuses on household and public finance. This is a group that has traditional experiences [with financial institutions] and has some loyalty. But it is also ripe for disruption.

But sometimes breaking 18- to 34-year-olds into age-based sub-groupings can be more enlightening than lumping them into one cohort, according to panel moderator Sarah Parker, director at the CFSI.

In fact, data from a 2015 CFSI study of more than 7,000 respondents older than 18 found millennials in different age brackets have not only differing levels of financial wellness but also differing attitudes and behaviors.

The study split the millennial generation into three age brackets: 18-24, 25-29, and 30-34. Additionally, the CFSI study segmented financial health into seven different categories, ranging from at risk to thriving.

The youngest millennials, according to the study, had the lowest levels of financial health. Thirty-nine percent of millennials 18 to 24 and 38% of 25- to 29-year-olds had financial health the CFSI study classified as at risk and unengaged. By comparison, only 29% of millennials 30 to 34 and 25% of those 35 and older had such financial health.

On the other end of the spectrum, the study categorized 17% of 18- to 24-year-olds and 15% of 25- to 29-year-olds as focused and thriving, the top two levels. One-quarter of the study’s 30- to 34-year-olds and 30% of those older than 35 shared the same categories.

So, are these differences affirmations of generational trends or representations of life stages?

The CFSI study Understanding and Improving Consumer Financial Health in America found:

Of millennials aged 18 to 24:

- 47% were working.

- 34% were the primary financial decision maker.

- 10% had kids.

- 4% were married.

Of millennials aged 25 to 29:

- 71% were working.

- 80% were the primary financial decision maker.

- 31% had kids.

- 38% were married.

Of millennials aged 30 to 34:

- 72% were working.

- 83% were the primary financial decisions maker.

- 52% had kids.

- 58% were married.

As this generation ages, its members accrue wealth, independence, and expenses that positively affects their financial health. This might not be a drastic deviation from previous generations, but data also shows variations in millennials’; attitudes and behaviors toward their finances.

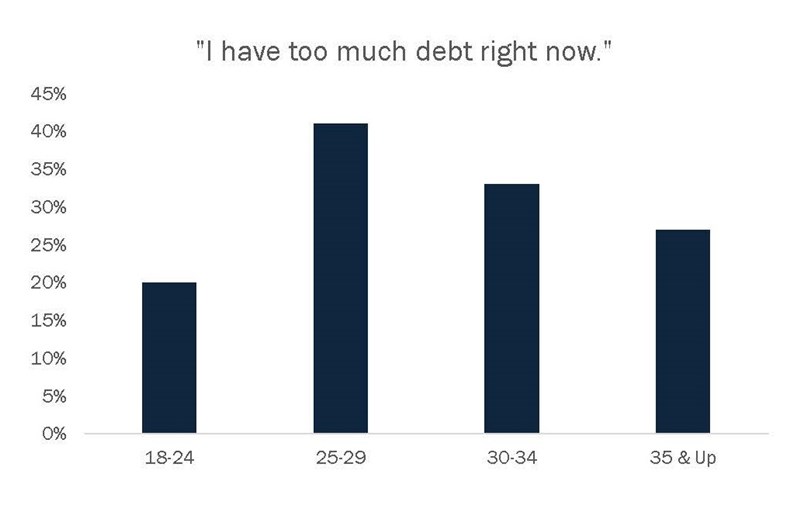

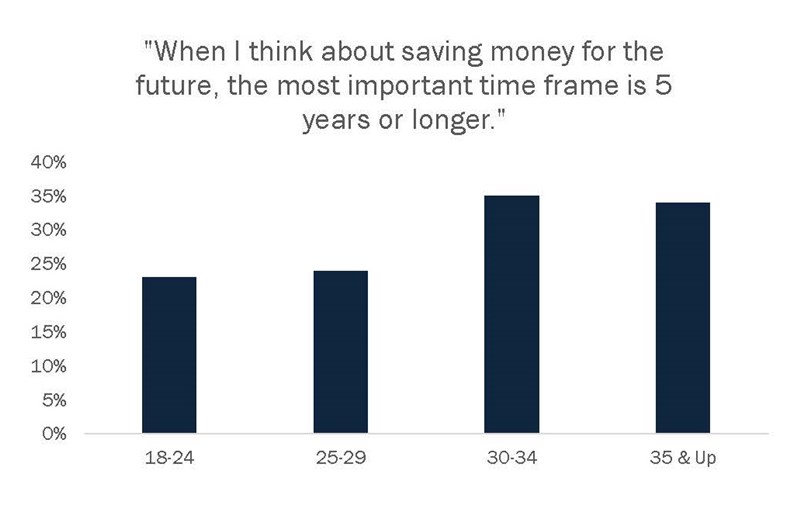

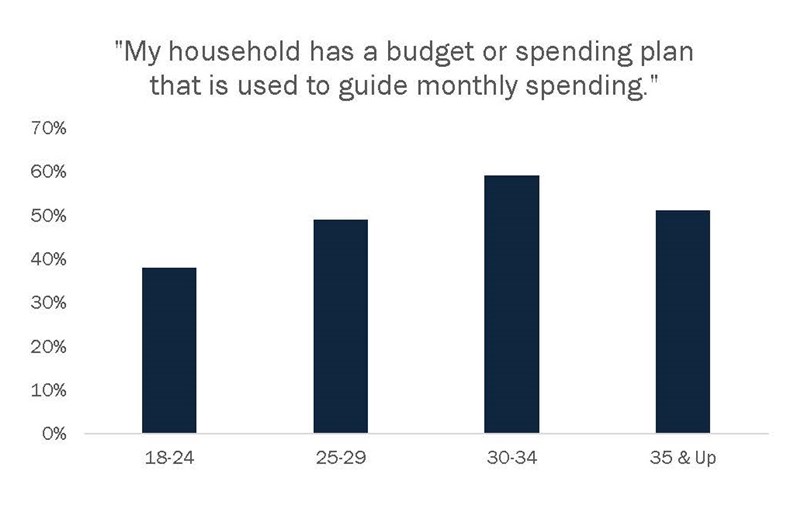

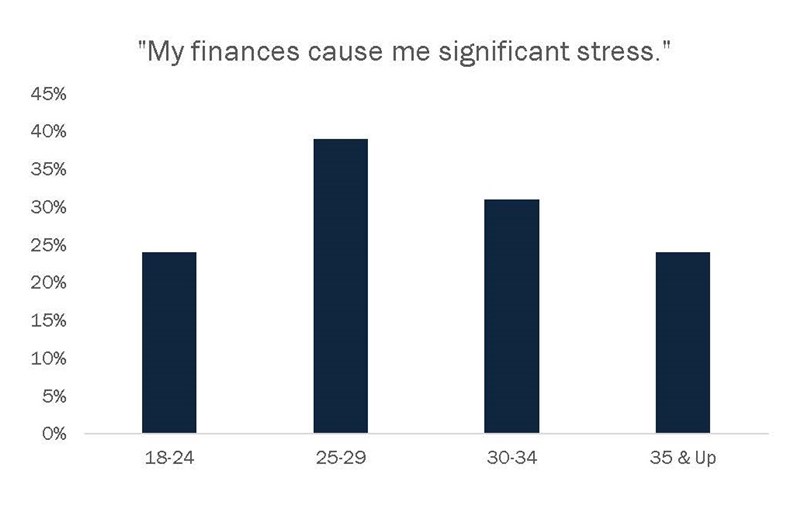

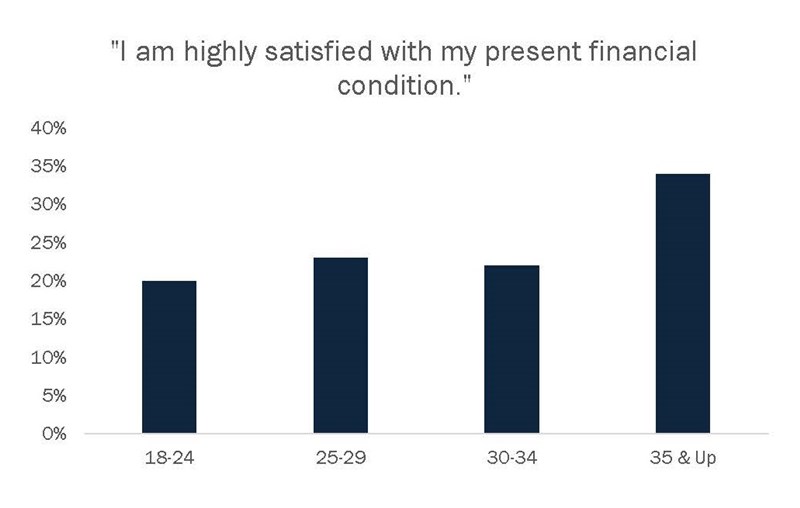

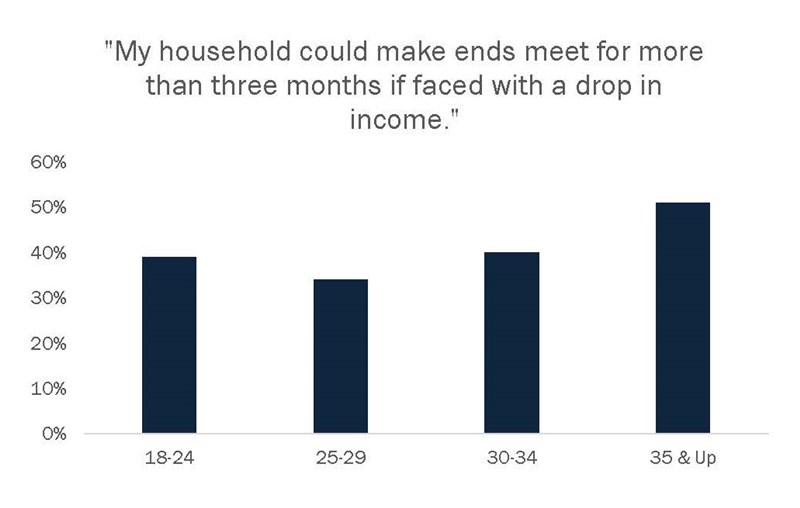

The following charts show the percentage of survey respondents who agreed with a series of statements:

For many of these questions, aging millennials report improvements in their financial health and satisfaction as well as less stress and lower levels of debt, indicating millennials might not be so different from other generations after all. Perhaps credit unions don’t need to re-invent the wheel when it comes to products that appeal to them?

They say things get better with age. For credit unions, it appears millennials will, too.