The backbone of the credit union customer experience is satisfaction. Part of the credit union mission statement is to satisfy the needs of the members who own and operate their financial institution.

For the third consecutive year, the CFI Group, an Ann Arbor, MI-based provider of customer feedback technology and service, released a Credit Union Satisfaction Index (CUSI) for 2015. The report, available as of Sept. 22, finds an exceptional level of satisfaction among credit union members.

From the report:

The results of the CUSI 2015 study highlight the evolving landscape of financial institutions, most notably the growing presence of online and mobile banking, as well as the importance of other differentiating factors such as reward programs and local community involvement. Although the market is changing, the study also indicates that credit union members continue to value the availability of physical branch locations.

The survey and its findings give credit union executives information that, combined with their own internal surveys and gauges of member satisfaction, contribute to operational decision-making and bottom-line performance. For a more detailed understanding of the methodology, download the report here; in the meantime, here are three takeaways from the report.

1. Seven Factors Drive Member Satisfaction

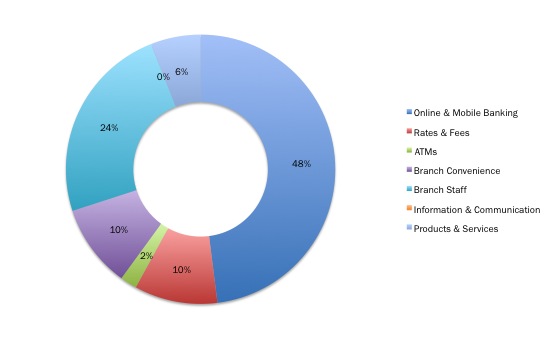

The study identified and scored seven factors according to how strongly they influenced member satisfaction. Aspects of the member experience that score low but have a high impact are opportunities for credit unions to improve member satisfaction.

The seven factors that influence overall credit union member satisfaction are:

- Products & Services

- Information & Communication

- Branch Staff

- Branch Convenience

- ATMs

- Rates & Fees

- Online & Mobile Banking

These factors contributed to an overall satisfaction score of 87 for the industry, according to the study, up from 86 in 2014 but down slightly from 90 in 2013, the first year of the study. To see the CUSI score for each individual factor, please refer to the survey.

2. Online And Mobile Drive Satisfaction

Although members might be satisfied or dissatisfied with any of the above factors, each specific factor influences total member satisfaction in its own way. Seeing this, a credit union can weigh the importance of one aspect of its business model against another.

Relative Driver Leverage To Improve Satisfaction

Data as of 09.22.15

Source: CFI Group

The biggest driving factor of member satisfaction are an institution’s online and mobile banking capabilities, with 48% of respondents citing digital as the most important piece to their overall satisfaction. Of particular note, branch staff (24%) and branch convenience (10%) were the second- and third-most powerful satisfaction drivers, an indication of branch relevancy in the age of the mobile phone.

3. Credit Union Products Drive More Satisfaction Than Bank Products

Although products and services represent a 6% impact on total member satisfaction, 30% of respondents said they planned to sign up for additional services next year a number consistent with 2014 survey results.

That said, based on 2015 CUSI scores, the products and services at credit unions drive more member satisfaction than those at banks.

Products And Scores For Banks And Credit Unions

Data as of 09.22.15

Source: CFI Group

The margins might appear close, but 16% of survey respondents said finding the right product and service offerings for their own personal needs was the primary reason for becoming a member, the third-highest rate out of seven listed reasons.

Credit unions would be wise to remember this information when creating new products and services, setting rates, or developing new marketing materials. The financial service marketplace is a competitive one; driving every bit of satisfaction counts.