It’s reporting season, and Callahan’s FirstLook provides an early look at credit union data. Looking for crucial insight about quarterly performance results weeks before the official data release? Callahan & Associates has you covered. Catch up on the latest trends below or dive deeper into the trends that matter to you with Peer Suite, Callahan’s online performance benchmarking tool. Schedule your demo today.

According to this quarter’s FirstLook performance figures, what’s notable about fourth quarter performance? And what does it suggest about today’s trends?

02.12.26 Update

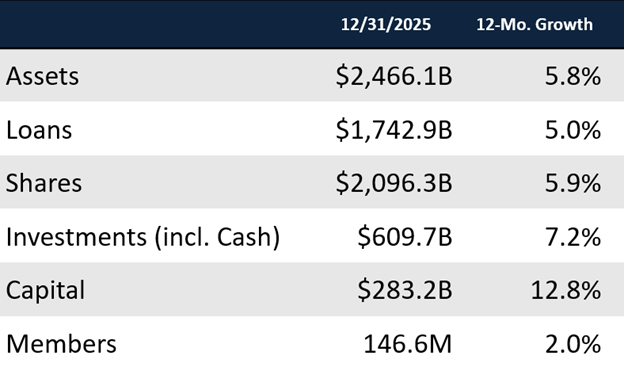

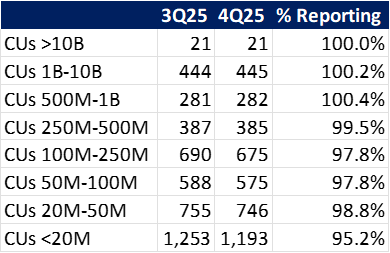

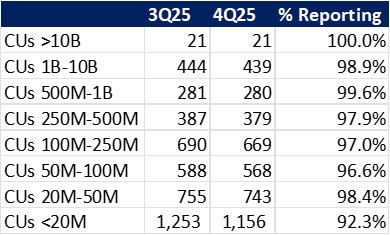

FirstLook data now includes 4,345 credit unions representing 99.8% of the industry by assets. Let’s turn take a look at credit resilience, member behavior, and how institutions are positioning themselves for what might lie ahead. Be sure to join Callahan & Associates on Feb. 24 for Trendwatch, where industry leaders will share what they’re seeing and doing as 2026 unfolds.

- Delinquency has topped above 1%; stress is evident across household balance sheets. Credit cards continue to drive overall delinquency, but payment pressures are broadening. Auto delinquency has matched its 10-year high at 0.96%. Residential delinquency is reaching levels not reported since 2014, with first mortgage delinquency at 0.89% and other real estate at 0.86%. Much of that first mortgage delinquency is concentrated in loans originated in 2022 and 2023, when rates were rising rapidly. Those borrowers likely face tighter margins and have less room to absorb budget pressure.

- In response to increasing delinquency, credit unions are strengthening their balance sheets, with a net worth ratio of 11.28% and year-over-year capital growth of 12.52% providing a solid buffer. The allowance for loan and lease losses now covers 131.2% of delinquent loans, leaving room for credit unions to charge-off all currently delinquent balances and then some. Provisions also remain elevated at 0.60% of average assets, a sign that credit unions are continuing to build reserves alongside rising delinquency.

- With ROA at 0.79% and net income rebounding sharply in 2025, credit unions have generated sufficient capital to reinforce reserves while maintaining solid capital ratios. Institutions appear to be positioning themselves to manage member delinquency challenges, although rates and economic conditions will ultimately determine how much credit unions need that buffer.

- Importantly, many credit union members are proactivity managing their finances. Residential other real estate balances — primarily HELOCs — are on track to jump 15.44%, thanks in part to homeowners consolidating higher interest debt into lower-rate, more affordable monthly payments. HELOC utilization rates have reached a five-year high of 56.4%, suggesting more members are turning to home equity to manage budgets.

- Credit unions can play a constructive role in helping members navigate affordability pressures, particularly for homeowners with available equity. Assisting non-homeowners facing similar household strain, however, often requires more targeted solutions.

02.05.26 Update

- Other real estate balances (HELOCs) are set to jump 15.99%; commercial lending is set to grow 11.59%. Analysts from Callahan & Associates expect first mortgage balances to increase 5.63%. Auto lending appears to be holding steady at 0.03%, with new auto now in its second consecutive year of contraction.

- A more notable shift is occurring in loan flow. First mortgage originations are up 22.95% year-over-year, whereas other real estate originations have risen 15.46%. It seems activity is beginning to thaw more quickly than outstanding balances suggest, an early sign that rate cuts late in the year might be re-engaging borrowers.

- Members continue to favor liquidity over longer term deposits; thus, money market and share drafts account for the bulk of share growth. Although share certificate growth remains positive, at 6.71%, it continues to lose momentum in the face of household budget pressures and falling rates. With 83.3% of certificates set to expire within one year, the deposit mix might shift in 2026.

- Changes within the investment portfolio reflect how credit unions are deploying excess funding across the balance sheet. Share growth is set to outpace loan growth, and Callahan analysts expect the loan-to-share ratio to fall to 83.1% in the fourth quarter of 2025. That’s a 79-basis-point decline from the fourth quarter of 2024. Credit unions are directing a larger portion of shares to investments, which are on pace to rise 7.17%.

- When looking at how credit unions are investing, it seems barbell strategy is in play, with cash accounts up 10.6% year-over-year and long-term investments — those maturing in more than three 3 years — up 9.52%. This positioning suggests institutions are attempting to balance flexibility and yield as multiple paths for loan demand and rates remain possible. Credit unions appear to be building capacity to respond to rising loan demand while also locking in elevated investment yields. The effectiveness of that balance will ultimately depend on how the rate environment evolves, a double-edged sword for earnings.

02.02.26 Update

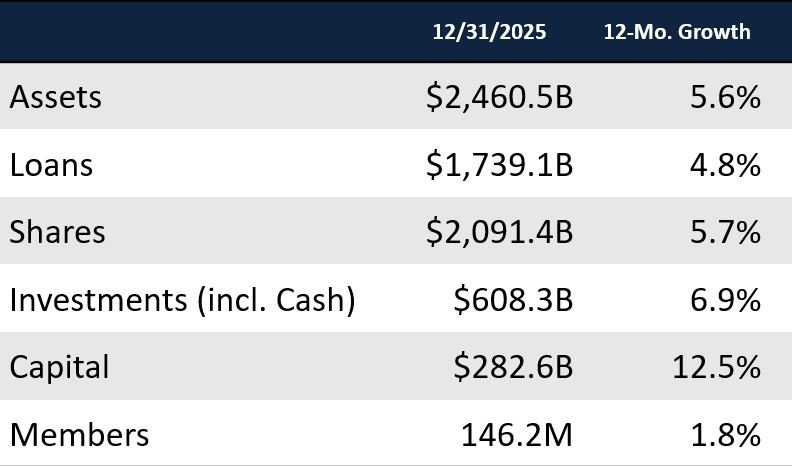

- Assets are set to climb 5.80% year-over-year; that’s more than double the 2.30% reported at the end of 2024. Callahan analysts forecast 4.95% growth in loans.

- Shares are on pace to grow 5.89%, driven primarily by money market (9.01%) and share draft (7.83%) accounts. Member growth remains a soft point for the industry, slowing down again to 2.01% in the fourth quarter, down 16 basis points from the end of 2024.

- Callahan analysts expect net income to grow 31.60%, a major reversal from the 4.60% decline last year. ROA is on pace to come in at 0.79%, supported by a net interest margin of 3.40% that has continued to benefit from elevated loan yields through much of 2025.

- Both the cost of funds and the operating expense ratio appear to have plateaued — at approximately 2.05% and 3.14%, respectively — as members prioritize transactional accounts, allowing recent margin gains to flow through more directly to the bottom line. With the Fed beginning to cut rates in the fourth quarter, the industry could be approaching an inflection point where margins begin to cool in 2026.

- Asset quality continues to weaken with delinquency set to reach 1.02% in the fourth quarter. This marks the highest level since 2013 — the last time delinquency surpassed 1% — underscoring the degree of pressure households face. Stress remains most visible in unsecured credit, with credit card delinquency near 2.15% and credit card net charge-offs inching up to 4.99%. Although rate cuts might provide gradual relief, data through 2025 suggests household stress is increasingly concentrating in revolving credit.

Trendwatch 4Q25. Explore year-end performance trends and learn about their impact on the industry today with Callahan & Associates. Callahan hosts and industry guest presenters highlight where credit unions are excelling, where challenges are emerging, and how peers are responding. Don’t wait to gain key benchmarks, strategic takeaways, and insights to navigate 2026 and beyond. Register for Trendwatch today.

Trendwatch 4Q25. Explore year-end performance trends and learn about their impact on the industry today with Callahan & Associates. Callahan hosts and industry guest presenters highlight where credit unions are excelling, where challenges are emerging, and how peers are responding. Don’t wait to gain key benchmarks, strategic takeaways, and insights to navigate 2026 and beyond. Register for Trendwatch today.

CreditUnions.com updates this page with the freshest FirstLook credit union performance data every quarter, so don’t forget to come back for more insights.

CreditUnions.com updates this page with the freshest FirstLook credit union performance data every quarter, so don’t forget to come back for more insights.