During the past five years, U.S. households have weathered one challenge after another — from the COVID-19 pandemic’s disruption of the labor market to stubbornly high inflation. Although some households are moving past these hardships, many are still under financial pressure. Prices for core necessities such as food, energy, and housing are pinching budgets; interest rates on credit cards and mortgages have remained persistently elevated; and insurance premiums continue to rise.

Prudent savings and debt management habits have mildly improved the financial situation for households across the United States in the past year. Nationwide, fewer households are considered financially vulnerable. Still, past teachings suggest these gains can be swiftly reversed.

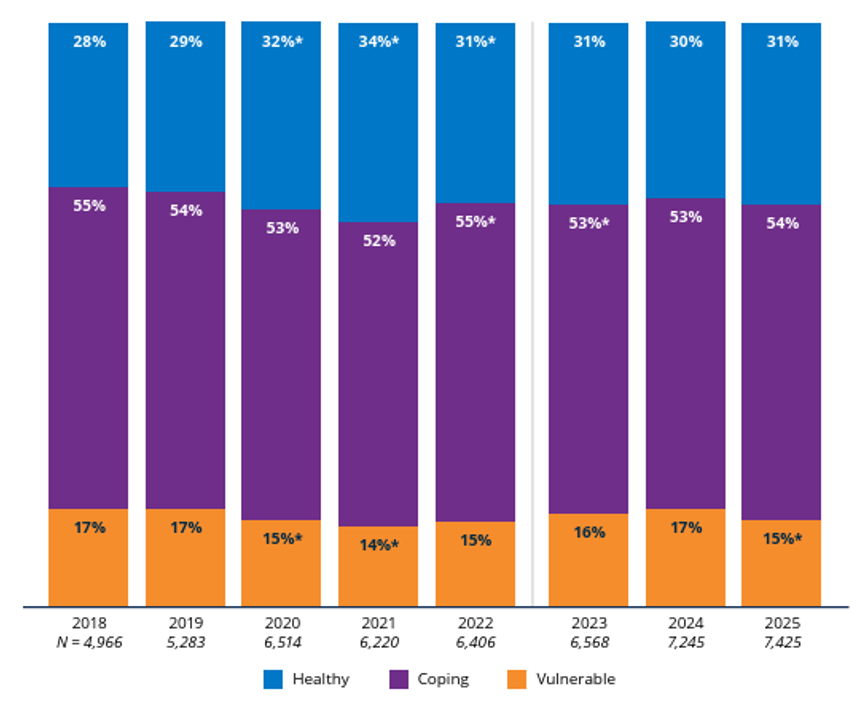

PERCENTAGE OF HOUSEHOLDS IN EACH FINANCIAL HEALTH TIER, BY YEAR

FOR U.S. HOUSEHOLDS

SOURCE: Financial Health Network

After years of distress, the past year’s mild decrease in household financial vulnerability suggests those struggling have some breathing room. Most promising, lower-income and lower-wealth households were less likely to be financially vulnerable in 2025 than in 2024, having decreased from 32% in 2024 to 28% in 2025, according to a September 2025 report from the Financial Health Network.

Despite this progress, the share of households that are financially healthy has not increased at a statistically significant level since 2021. Without focus and investment in the most vulnerable, progress is unlikely to last with each passing year.

Strategic Insights

- Year-over-year, the share of households that are financially healthy or financially coping has increased to 31% and 54%, respectively. Correspondingly, the financially vulnerable decreased to 15% during the same time period.

- Households without revolving credit card debt are more likely to be financially healthy. A quarter of households with revolving credit card debt are considered financially vulnerable.

- Only 56% of households are confident that their total insurance policies will provide enough support in an emergency, a meaningful decrease of 3% from 2024.

- Nationwide, 71% of households pay all of their bills on time, higher than pre-pandemic levels.

- Although still below pre-pandemic levels, 49% of households spent less than their income in the past year. This figure represents a meaningful rise from 2024.

- Geographically, the South has the highest share of financially vulnerable households whereas the West has the lowest. There is little difference between rural and urban households.

- The data from the Financial Health Network’s Trends Report was collected in the spring of 2025, from April to May. Since then, tariff policy and their impacts on prices could have adversely impacted households’ ability to spend less than their income. Similarly, layoffs in the labor market could hurt households’ status, increasing the share of financially vulnerable.

- Financial health is an objective metric, but that’s not the only thing that matters. People’s emotional connection to their financial situation is just as important. Gallup measures this as “Financial Wellbeing.”

- Financial wellbeing addresses a critical dimension in understanding the way someone’s financial situation impacts their life. Do they feel in control? Are they confident about their future? Do they believe they have a support structure they can count on?

It’s Time To Lead The Future Of Financial Wellbeing. Members stay when they feel seen, cared for, and confident in their credit union’s commitment to financial wellbeing. Credit unions who participate in the Member Engagement & Financial Wellbeing Consortium from Callahan & Associates and Gallup are already seeing behavior shifts and increased participation that improve wellbeing and drive sustainable growth. Will you join the next cohort?