CREDIT UNION COMPENSATION COMPARED WITH CPI GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

© Callahan & Associates | CreditUnions.com

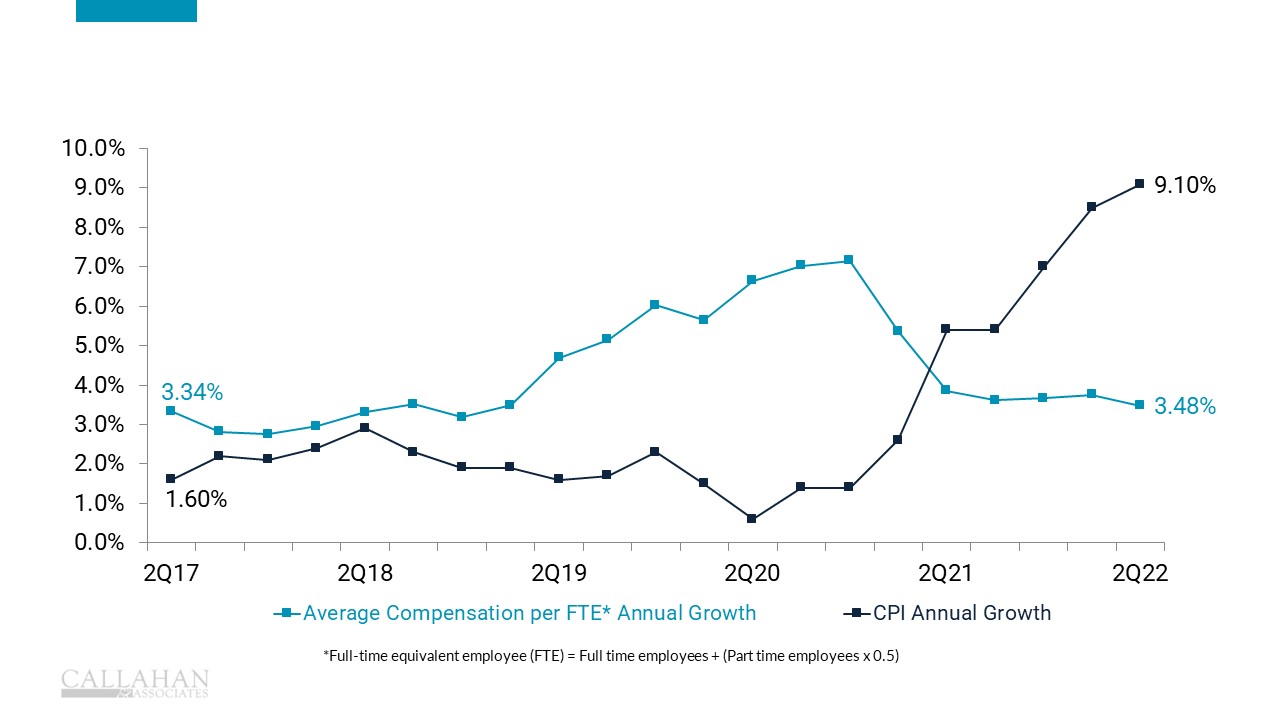

- The Consumer Price Index (CPI) – a primary measure of inflation – has climbed 9.1% annually, the highest rate in at least two decades. Many Americans are feeling the budget pinch, and the Federal Reserve has begun regularly increasing interest rates in an effort to combat this price growth.

- Most industries are struggling to attract and retain the talent necessary to serve their customer base. The U.S. labor market is strong, with employment above pre-pandemic levels, and employers are being pressured to raise wages. Median weekly earnings (across all industries) increased 5.5% year-over-year in the second quarter of 2022.

- Historically, employee-compensation growth rates in the credit union industry have been well above CPI growth. However, the compounding operational effects of the COVID pandemic and shifting labor market dynamics created challenges for cooperatives to invest in their employees. Average salary growth for credit union full-time equivalent employees slowed at the start of 2021 and has struggled to keep pace with inflation since then. This implies that credit union employees are now making less than they were a few years ago when adjusted for inflation. This dynamic not specific to credit unions, and must be considered as a factor for why some cooperatives have struggled to attract new staff.

- As credit unions work to serve their members and compete with growing fintechs, neobanks, and traditional financial institutions, conversations around operating expenses and employee compensation will be key for sustaining growth and strong service.