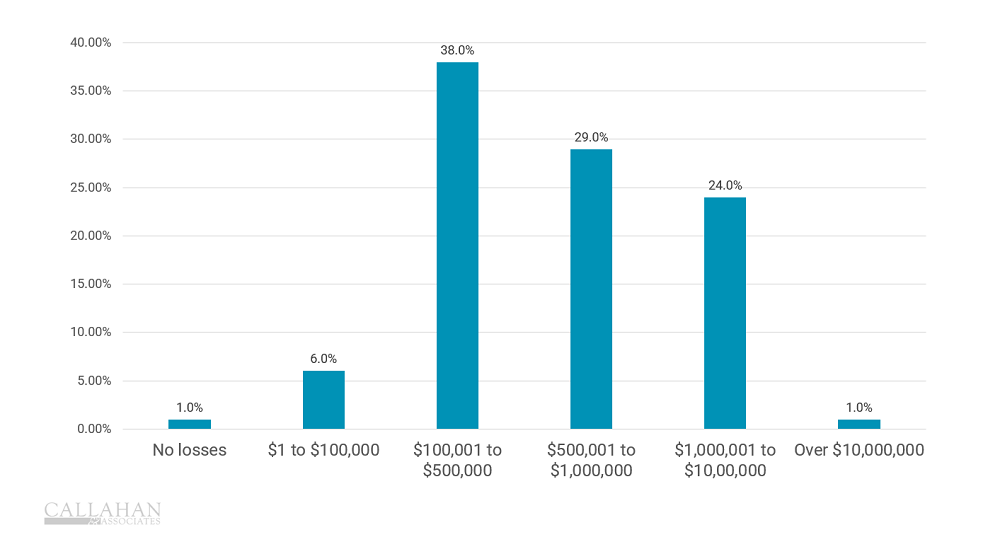

TOTAL ORGANIZATIONAL LOSS TO FRAUD IN 2023

FOR SURVEYED FINANCIAL SERVICES COMPANIES IN THE U.S. AND U.K. | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

SOURCE: Alloy’s 2024 State of Fraud Benchmark Report

- In 2023, 54% of financial institutions reported organizational losses exceeding $500,000, according to Alloy’s 2024 State of Fraud Benchmark Report.

- Making fraudulent payments and opening new accounts using stolen personal details such as date of birth, social security numbers, and addresses are the most common ways fraudsters scam credit unions. In turn, credit unions are working together with law enforcement to educate members to prevent fraud.

- As technology improves, however, criminals are gaining greater access to tools to commit their duplicitous schemes. To overcome this, credit unions are investing in new technology to prevent future fraud.

- More stringent due diligence in underwriting (especially with higher dollar loan products), stronger controls for digital product enrollment, and better call screening for member services all help credit unions combat fraud. In fact, the 2024 Alloy report noted that 95% of respondents told surveyors their organizations could manage fraud issues in-house. Unfortunately, this might not be realistic for smaller credit unions.