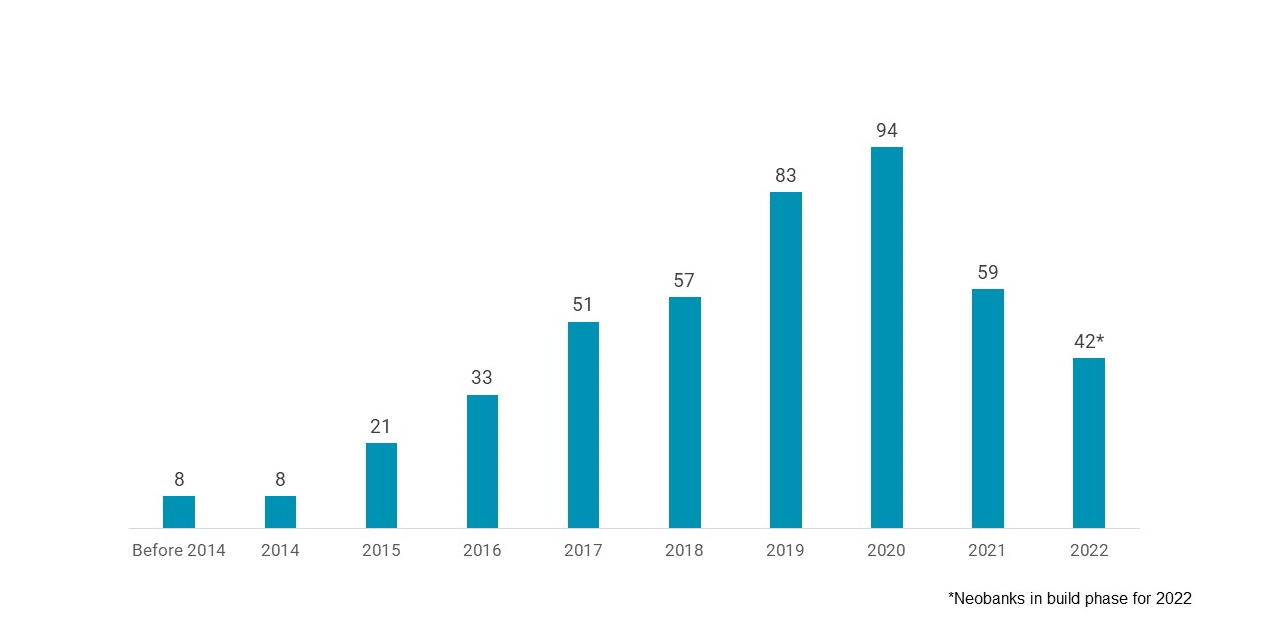

NEOBANK LAUNCHES BY YEAR

FOR ALL NEOBANKS GLOBALLY | DATA AS OF MAY 2022

Source: Simon, Kucher & Partners

- There could be good news on the competitive landscape for credit unions. Development of new neobanks — digital-only institutions backed by a traditional, insured banking entity — appears to be on the decline, according to a May 2022 study from Simon, Kucher & Partners. Roughly 400 neobanks are currently operating around the world, but year-by-year launch figures show a substantial decline in launches last year, with even fewer expected for 2022.

- There’s a good reason for that slowdown: Fewer than 5% of all neobanks are breaking even, let alone profitable, according to the study. An analysis of annual reports for 25 large neobanks found that in instances when those services do show profitability, it only amounts to a few dollars per customer, compared with per-customer losses ranging from a few dollars to more than $275.

- Credit unions have by and large stayed out of the neobank space — the most notable example being Dora. However, banks of various sizes, including some community banks with similar asset sizes and philosophies to credit unions, have chosen to back neobanks.

- As more credit unions move away from hyper-specific fields of membership, some neobanks are filling that void by launching services aimed at niche consumer groups. There’s Nerve, for musicians; Purple, for disabled consumers; Cheese, for Asian immigrants; Greenwood, for Blacks and Latinos; Squire for barbershop owners; and more.

- It’s important to not confuse the decline in neobank launches with a decline in broader fintech usage. Fintech — an umbrella term covering anything related to financial technology — continues to grow, with adoption rates rising among nearly all demographics, according to a 2021 study from Plaid.