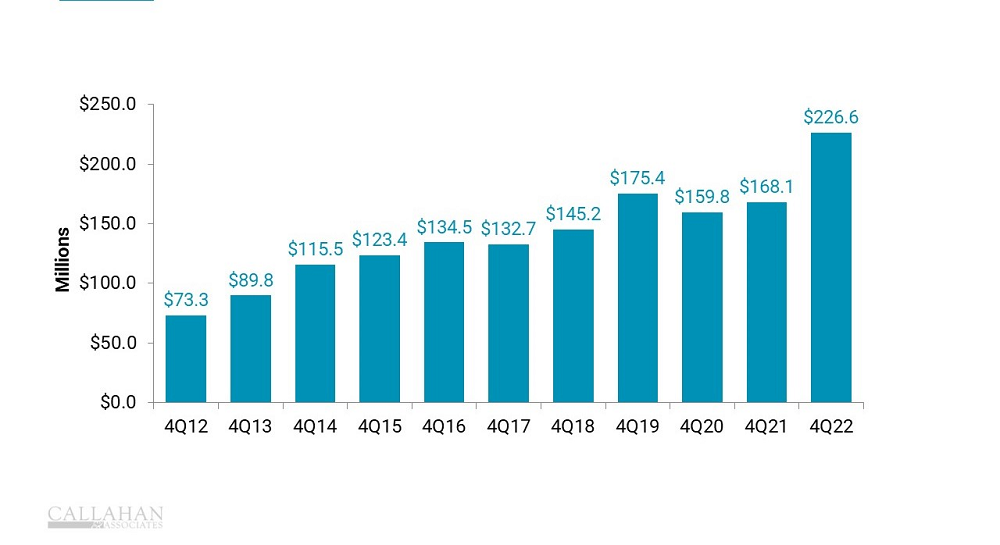

PAYDAY ALTERNATIVE LOANS GRANTED YEAR TO DATE

FOR FEDERALLY CHARTERED U.S. CREDIT UNIONS | DATA AS OF 12.31.22

© Callahan & Associates | CreditUnions.com

- Federally chartered credit unions originated $226.6 million in payday alternative loans in 2022. That’s 29.2% higher than the $175.4 million granted in 2019 and the highest amount since the program’s inception in 2010.

- Borrowers can take out up to $2,000 with repayment terms of up to 12 months. Interest rates can reach as high as 28% APR; however, rates for traditional payday loans can reach into the triple digits.

- The surge in PAL activity in 2022 is a sign that inflation, persistent recession fears, and rising interest rates are squeezing members’ wallets.

- PALs save borrowers hundreds of dollars compared to payday loans, auto-title lending, and rent-to-own agreements. Members that take advantage of this lower-cost alternative can address immediate financial needs with more reasonable terms and, eventually, graduate to traditional financing options.

Note: State-chartered credit unions frequently offer their own small-dollar lending programs; however, the National Credit Union Administration’s PAL program is open only to federal charters, and rules for similar loans from state charters might differ.

How Do You Compare?

Use industry lending data to determine how your credit union performs against others, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?

Schedule Your Peer Demo