As the 2023 CUNA Governmental Affairs Conference winds down, here’s a look back at some of the big themes and discussion topics that dominated the second day.

No. 1: It’s DEI or die.

Tuesday marked the conference’s inaugural “DEI Tuesday,” with multiple sessions and speakers touching on diversity, equity, and inclusion.

The centerpiece was a breakout session with a panel discussion on DEI progress and the industry’s future. John Bissell, president and CEO of Greylock Federal Credit Union ($1.6B, Pittsfield, MA) said his credit union might not be in business today had it not embraced DEI nearly a decade ago. Since embracing those principles beginning in 2015, he said, membership has tripled — even as the region’s population has declined — and net income has doubled.

“When you hear DEI, please hear growth, please hear relevance, please hear sustainability,” he said.

Greylock is the dominant mortgage lender in its Western Massachusetts market, and its work to advance homeownership among minority communities has fueled its growth in recent years. According to Bissell, one of the keys to advancing the credit union’s homeownership work was partnering with local groups connected with minority communities. Specifically, the CEO highlighted the credit union’s relationship with Westside Legends, a local non-for-profit focused reversing the effects of redlining.

“We think that redlining happened in Baltimore, that it happened in Detroit — no, it happened in my hometown as well,” Bissell said.

To counteract the effects of redlining, Greylock’s mortgage team developed a product with no FICO or PMI requirements, and in 2022 the credit union wrote 48 mortgages totaling $5 million that increased black homeownership in the community.

Some conversations touched on the inevitable pushback against broader diversity efforts. For those battling a “woke” label attached to their DEI efforts, Quinetta Roberson — a Michigan State University professor and a member of the Filene Research Institute’s Center of Excellence in Diversity, Equity, and Inclusion — advises framing the conversation around the business case behind those efforts.

“When I talk to a leadership team, I start with the rate of growth, the percentage of growth increase that I can help with, the amount of return, the cost savings,” she said. “I’m going to situate it in a language they can understand.”

No. 2: Financial wellbeing makes an encore.

Not surprisingly, financial wellbeing remained a dominant topic on Day Two, and Gigi Hyland, executive director of the National Credit Union Foundation, noted during a panel discussion that all credit unions are working toward that goal, even if they don’t use that same terminology.

Bjorn Larson, financial wellbeing strategist at BCU ($5.7B, Vernon Hills, IL), said although his credit union has worked in this space for years, it realized a decade ago many of the corporate SEG partners it was adding wanted to add financial health as a benefit for employees. That prompted the credit union to work more in the financial literacy space, hosting lunch and learns and eventually standing up a financial counseling program. That latter effort grew dramatically, to the point the credit union now has more than 120 certified financial counselors on staff — many of whom are branch employees who say the counseling is their favorite part of their job.

Taking a different tack, Washington State’s BECU ($29.2B, Tukwila, WA) modified its savings account offerings to make it easier for members to save. The credit union implemented “envelopes” that allow members to save for different things — emergency funds, vacations, holiday spending, and more —within the same account. No more forcing members to open multiple accounts to save for different purposes.

Jill Vicente, vice president of social impact and financial health programs at BECU, noted that when it comes to financial wellbeing for all, the last two words are the most important, and it takes a commitment across the organization to see that through. The credit union is currently working with Hyland and the Foundation to build out its training around purpose to advance financial wellbeing.

That can be especially helpful when it comes to those staffers who work in back-office positions and might not interact with members every day. It’s important to remind them what it means to work at a credit union and the impact their work has.

How To Lead With Purpose

LEARN MORE TODAY

No. 3: “The civil rights issue of our time.”

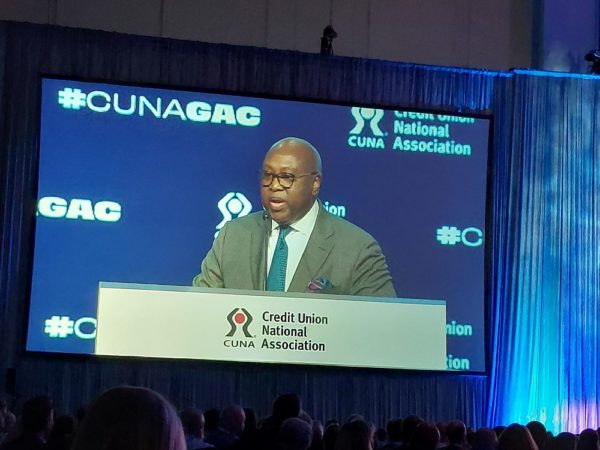

All three members of the NCUA board addressed the crowd during the conference, with Todd Harper, chair, taking to the microphone on Monday. Rodney Hood, board member, and Kyle Hauptman, vice chair, spoke on Tuesday.

For his part, Hood reiterated his belief that financial inclusion remains “the civil rights issue of our time.”

That’s particularly important at a time when inflation is running rampant and interest rates are on the rise, but Hood — who also served on the board in the mid-2000s — offered some context that might provide relief for those worrying about the economic picture.

“Up to this point, this is not a repeat of the last crisis,” he said, although he also added that a recession might be in the cards. “The advice I give the credit union industry is don’t be alarmed, but be alert, and be prepared.”

Hauptman — who, somewhat bizarrely, entered and exited the stage accompanied by Guns n’ Roses’ “Welcome To The Jungle” — called the current economic picture “the strangest in my lifetime,” and suggested aggressive action from the Fed has done little to cure the inflation.

If there is a recession in the next two years, he said, the credit union system is in good shape, although he encouraged credit unions to ensure they have access to the regulator’s Central Liquidity Facility. He also advised keeping a close eye on auto loan portfolios, which comprise nearly one-third of all credit union loans.

“We know the next economic battle won’t look like the last one,” he said, pointing out that subprime auto loans are already showing signs of stress and could worsen if job losses increase.

He also encouraged credit unions to continue to promote savings.

“Our society is not the best at getting people to save money,” he said. “That’s where credit unions come in.”

Stop By To Say Hi