Credit union membership is growing at its fastest rate since 2000, core deposits are leading an accelerating share growth, and lending is growing at a double-digit pace, according to third quarter data from Callahan Associates.

This week, Callahan hosted its quarterly Trendwatch webinar, an event that recaps the industry’s performance trends over the past three months while highlighting credit union success stories and other areas of opportunity.

Here are three Trendwatch takeaways:

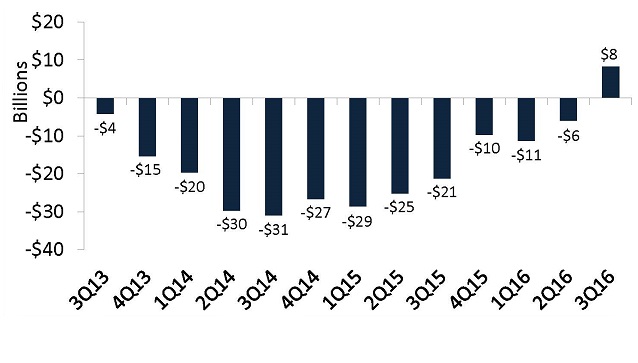

No. 1: Accelerating Share Growth Helps Shrink Gap In Quarterly Net Liquidity Change

At third quarter, share balances at credit unions grew 8.7% year-over-year to reach a record high of nearly $1.1 trillion. This growth was primarily driven by core deposits, including share drafts and regular shares.

Year-over-year, third quarter share draft growth of 17.1% is an increase of more than 7 percentage points over the 10% growth posted in the second quarter, and third quarter regular share growth of 9.8% bests the second quarter’s 9.3%.

This growth has contributed to an increase in credit union share draft penetration, which now sits at 55.9%, compared with the 55.1% posted in second quarter, as well as a shrinking gap in net liquidity change. At third quarter, the difference between year-over-year share growth and loan growth was positive for the first time for at least three years.

ANNUAL NET LIQUIDITY CHANGE*

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.16

Callahan Associates | www.creditunions.com

*Net liquidity from shares = $share growth – $ loan growth

Source: Peer-to-Peer Analytics by Callahan Associates.

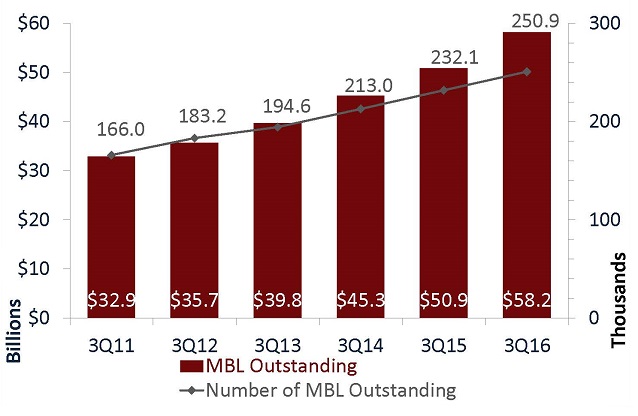

No. 2: Member Business Lending Continues To Grow

In the first nine months of 2016, credit unions originated more than $343 billion in loans, driven by double-digit growth in consumer, other real estate, and member business loans.

New, friendly member business lending regulations, growing member demand, and increased credit union proficiency have led to record MBL balances and total number of loans. Balances now total $58.2 billion, an increase from the $50.9 billion on the books in third quarter 2015. All told, 250,900 member business loans are outstanding at third quarter 2016, an increase of approximately 18,000 year-over-year.

Read more about this portfolio in,Member Business Lending Grows In Third Quarter.

MBL BALANCES AND NUMBER OF MBL OUTSTANDING

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.16

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates.

No. 3: Organic Growth Continues, But What Will The Fallout From Wells Fargo Bring?

Annual credit union member growth rate has increased at its fastest third quarter rate since 2000, at 4%. All told, credit unions now serve more than 107.6 million members, up from 103.4 million at third quarter 2015.

In addition, credit union member usage of products is on the rise. At third quarter 2016, 17.2% of members use credit union credit cards, a 2.5% increase from third quarter 2011. In the same period, share draft and auto usage increased as well, up 2.6% to 51.7% for share drafts and up 3.2% to 19.2% for autos. The average member relationship expanded as well, up 4.8% to reach the highest level ever, $17,502. It was $16,696 at third quarter 2015.

In September, it was revealed that Wells Fargo employees had setup fake customer bank accounts to reach sales quotas. Because third quarter data encompasses the period ending Sept, 30, 2016, it’s likely that credit unions have yet to see any material changes in market share directly resulting from the Wells Fargo fallout. Fourth quarter data will provide greater clarity in this regard.