On Wednesday, Callahan & Associates hosted its quarterly Trendwatch webinar, an event that recaps the industry’s performance trends over the past three months as well as highlights industry success stories and other areas of opportunity.

Callahan bases its analysis on data gathered through its FirstLook program. Trendwatch attendees have access to insight they won’t find anywhere else weeks before the official NCUA data release. This quarter’s Trendwatch highlighted several areas in which credit unions are turning out impressive performance. Here are three takeaways from the first day of Trendwatch 2Q 2015:

No. 1: It Was A Milestone Year

In 2015, credit unions set all-time highs in membership, loan, and share balances.

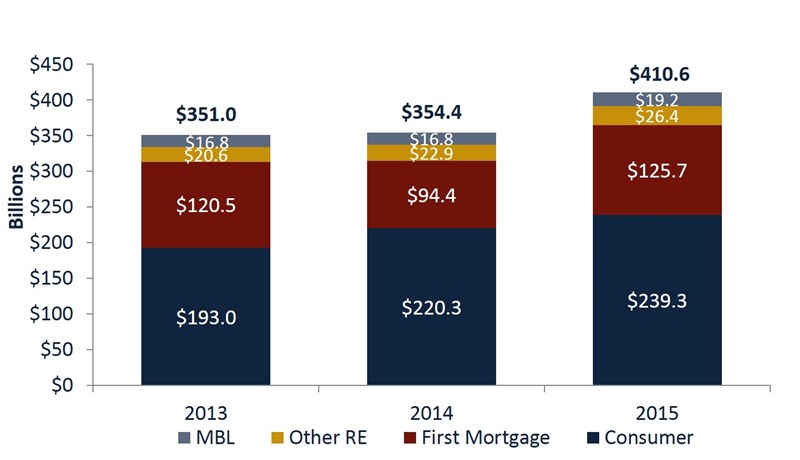

Due to an annual growth rate of 3.7%, as of fourth quarter, total credit union membership now exceeds 104 million, a net gain of approximately 3.7 million members. In addition, credit unions lent a record of $410 billion to members, a year-over-year growth of 15.9% influenced in part by a 33.2% year-over-year growth in first-mortgage originations. Share balances also topped $1 trillion.

YEAR-TO-DATE LOAN ORIGINATIONS

For all FirstLook credit unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

No. 2: Momentum Exists Across Many Measures

Core deposits and auto and mortgage loans were major drivers of credit union balance sheet growth in the fourth quarter.

Total shares outstanding grew 7% year-over-year; this performance was primarily driven by share drafts, which grew 14.3% year-over-year, and regular shares, which grew 10.1% year-over-year.

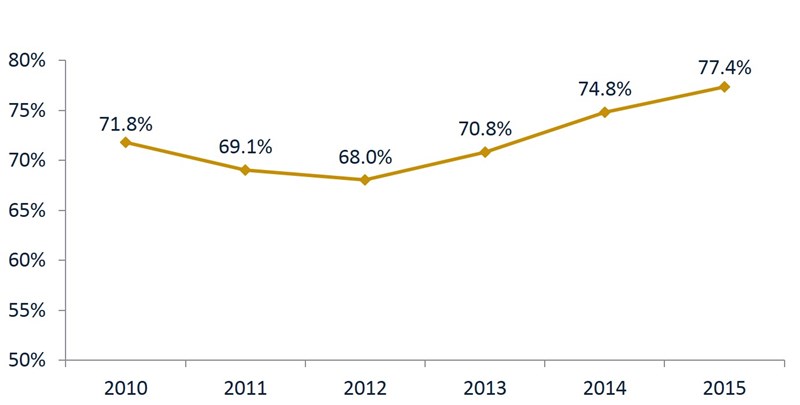

Total loans grew 10.6% year-over-year in the fourth quarter, raising the industry’s loan-to-share ratio to 77.4%, the highest since 2008. Loan growth was achieved largely through the 10.3% year-over-year growth in first mortgages outstanding, and 16% and 12.8% growth in new and used auto loans, respectively.

Meanwhile, the credit union auto finance market share increased from 16.3% at year-end 2014 to 16.5%, and the industry’s share of first-mortgage originations increased from 8.4% in 2014 to 8.5%. The growth in loans, shares, and market share reinforces credit unions’ position as trusted sources of financial services and preferred financial institutions.

LOAN-TO-SHARE RATIO

For all FirstLook credit unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

No. 3: Credit Unions Continue To Drive Member Value

As credit unions continue to grow members, loans, and deposits, the question then becomes: what will sustain this success? The answer lies in member value.

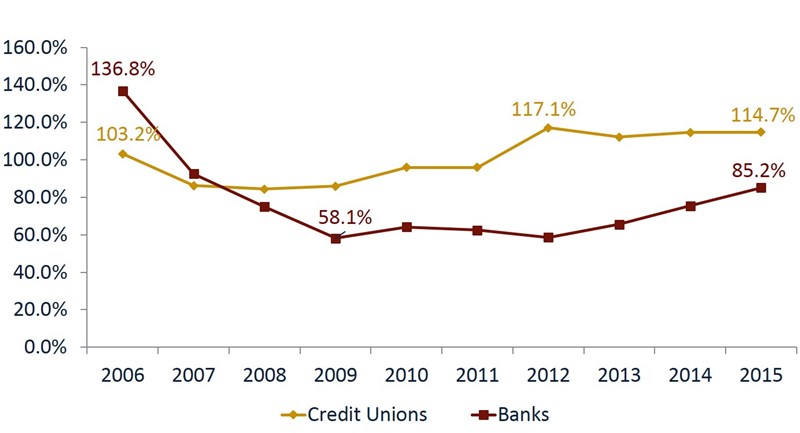

Credit unions continue to drive value to members through lower fees, which have steadily declined over the past five years. And in response to safety and soundness requirements, net worth and total capital balances are rising, and a consistent coverage ratio (allowance for loan losses/ delinquent loans) postition of 114.7% shows that balance sheets are well positioned for potential losses and reinforces the credit union difference.

COVERAGE RATIO

For all FirstLook credit unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Trendwatch, Day 2

If you missed today’s Trendwatch, you still have a chance to catch it tomorrow. Click now to register for the 11:30 a.m. broadcast on February 18.