According to Callahan & Associates FirstLook estimates of 5,367 credit unions, representing 94.1% of the industry’s assets, credit unions expanded total loan balances 10.6% as of the fourth quarter 2015, a 21 basis point increase year-over-year. Much of this growth was driven by auto loans, which soared 14.0% year-over-year to an all-time high of $264.7 billion. Here are 4 key takeaways from auto lending in 2015.

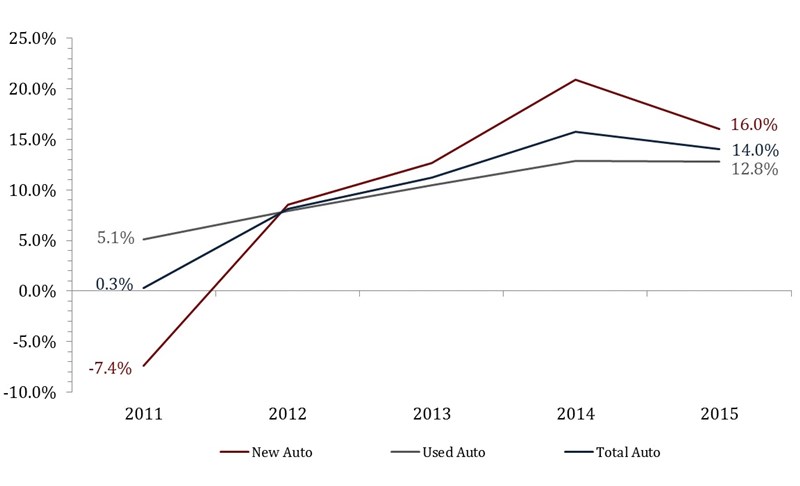

No. 1: While still posting double-digit growth, auto loan growth slowed 1.7 percentage points annually.

As of December 2015, auto loan growth slowed across new and used auto loans causing total auto loan growth to slow to 14.0% from 15.7% in December 2014.

AUTO LOAN GROWTH

For all FirstLook credit unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

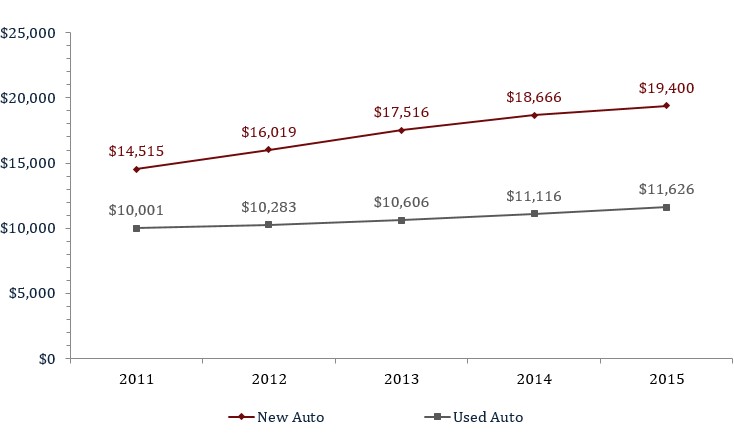

No. 2: Average new and used loan balances reach a record high!

Average new and used auto loan balances continue to rise, with average new auto loan balances expanding 3.9% annually. Average used auto balances posted 4.6% growth, adding $510 year-over-year.

AVERAGE AUTO LOAN BALANCES

For all FirstLook credit unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

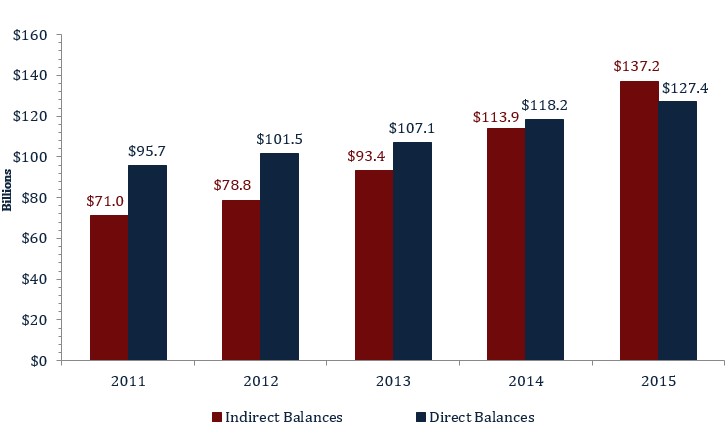

No. 3: Indirect lending surpassed direct lending in 2015.

In June 2015 indirect loan balances surpassed direct lending for the first time in history. From December 2014 to December 2015 indirect balances grew 20.5% while direct grew 7.8%.

INDIRECT VS DIRECT BALANCES

For all FirstLook credit unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

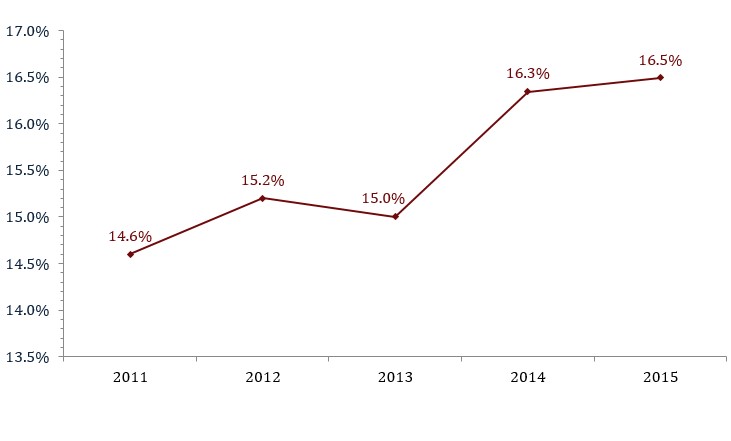

No. 4: Credit union’s year-to-date auto market share rose 20 basis points annually.

Credit unions captured 16.5% of the auto market as of December 2015, its highest year-end rate since December 2009, when it was 19.9%.

CREDIT UNION AUTO MARKET SHARE

For all FirstLook credit unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates