Membership at credit unions nationwide is growing, reaching 101.3 million members in June 2015, up 2.19 percentage points from June 2014. What’s more, lending activity suggests members are making credit unions their financial institution of choice.

1. Loan originations reached an all-time high for second quarter;

Total Loan Originations

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

2. Auto loan and credit card penetration both posted their highest second quarter penetration rate in five years.

Loan Penetration

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Peer-to-Peer Analytics by Callahan & Associates

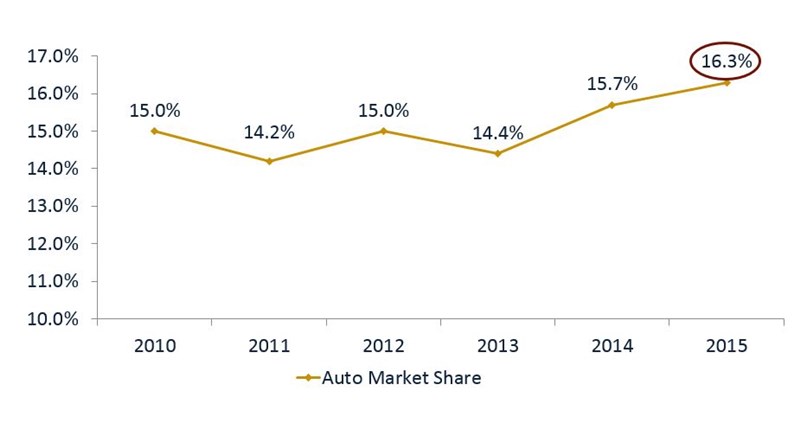

3. Credit unions captured their largest share of the auto market in the second quarter since 2009, when it was 20.9%.

Auto Market Share

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: AutoCount Data from Experian Automotive; Callahan & Associates

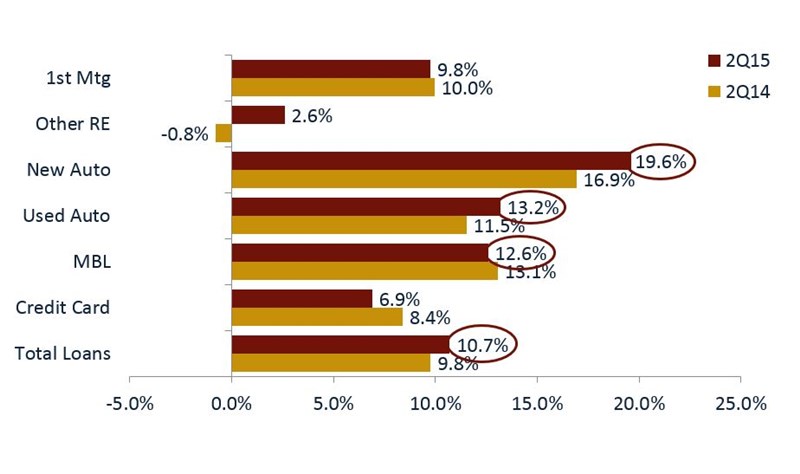

4. New and used auto loans now comprise 32.94% of the industry’s loan portfolio.

Auto lending posted the largest year-over-year growth of any loan component and hit outstanding balances of $93.7 billion in new auto loans and $154.6 billion in used auto loans.

Growth In Loans Outstanding

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

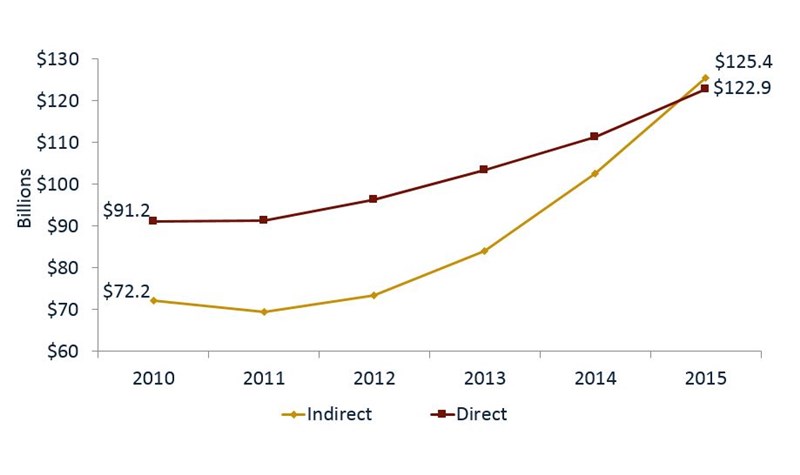

5. Indirect auto loan balances surpassed direct auto loan balances for the first time ever during the second quarter.

Both loan products posted notable year-over year gains, however 10.3% for direct and 22.2% for indirect.

Indirect Vs. Direct Auto Loans

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Visit CreditUnions.com for quarterly performance analysis not available anywhere else.