Every year, credit union leaders spend hours of preparation and discussion crafting strategic plans. In 2020, all that planning was sidelined as businesses, industries, and economies defended themselves against the disruption caused by the novel coronavirus pandemic.

Now, with four quarters of financials in the books and the end of the calendar year in the rear-view mirror, the industry can say it survived one of the most consequential years in the history of the financial markets.

Governments across the globe have adopted significant monetary and fiscal policy measures. Still, prolonged shutdowns and spiking unemployment have created grim economic situations for many people.

For leaders trying to keep their financial institutions, members, and communities afloat, COVID-19 poses a particularly confounding challenge in that large-scale financial data sets lag present day reality by approximately six weeks. In mid-February 2020, reports of COVID-19 in the United Sates began to appear, yet newly released fourth quarter financial data was favorable by most accounts. Fast forward one quarter and the situation had turned. Loan demand was sinking, the probability of large-scale defaults was increasing, and balances sheets were expanding at record rates.

When the economic environment is as fluid as it’s been during the past 10 months, executives and analysts alike must make tough calls about where to focus their efforts. There are hundreds of ratios and indicators that can be isolated and deconstructed to extrapolate what is happening as well as predict what the future might hold. But before diving into the minutiae, it’s helpful to understand the big picture.

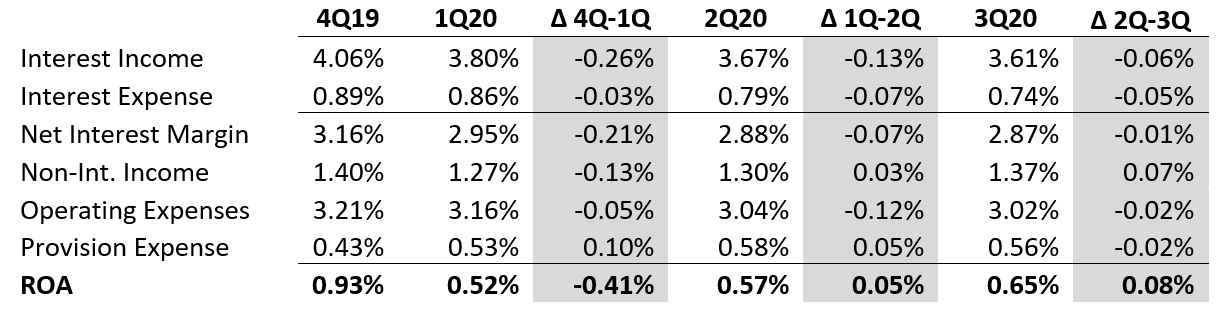

Analyzing performance through the lens of an earnings model summary often referred to as a spread analysis is helpful in understanding the impact COVID-19 has had on credit union performance. The analysis uses six key revenue and expense drivers on the income statement presented as a percentage of average assets to deconstruct credit union earnings. When examined over time, these ratios and the way they are interrelated offer insights into the health of an institution and its broader industry.

Spread analysis is a good place to uncover areas of success and underperformance that warrant further investigation. However, like any financial tool, spread analysis is not sufficient in and of itself but instead should complement other forms of analysis.

EARNINGS MODEL*

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.20

*As a percentage of average assets.

Source: Callahan & Associates.

The summary above shows nearly every ratio suffered a quarter-over-quarter decline in the early months of the pandemic. Given that shares flooded in at unprecedented levels during the first quarter, this is not entirely surprising. Total industry assets increased 4.6% from year-end 2019, a rate second only to that reported in the first quarter of 2009. Provision expenses were the only category in which credit unions reported an increase; again, not entirely surprising as credit unions were quick to fund this account in the face of domestic as well as global uncertainty.

As the year progressed, balance sheets continued to expand, and quarterly asset growth hit 6.8% at midyear. Share deposits alone surged 8.3%, with elevated member savings, aid checks, member relief initiatives that paused loan payments, and a government-deferred tax deadline all contributing to the jump. Unsurprisingly, ratios continued to suffer relative to prior periods, but the rate of decline was markedly less steep for income and expense accounts.

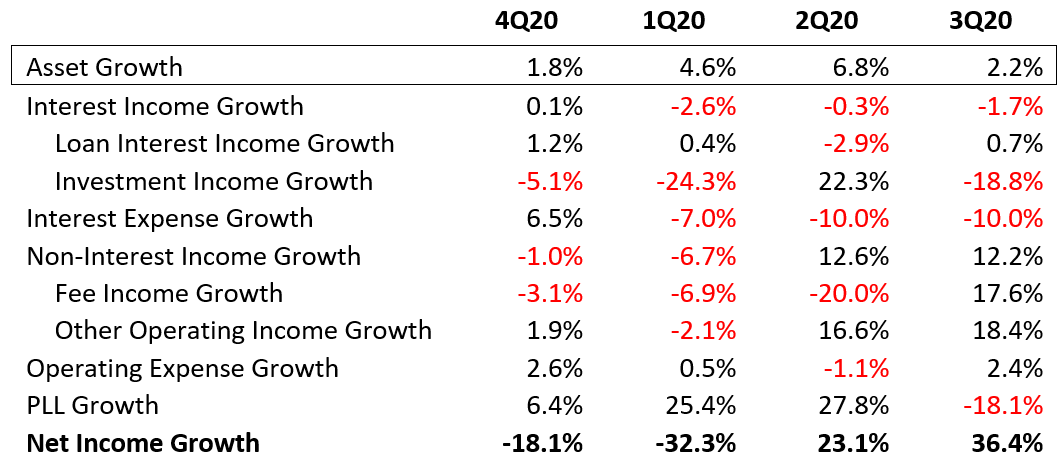

QUARTERLY GROWTH OF INCOME EXPENSE DRIVERS

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.20

Source: Callahan & Associates.

Notably, non-interest income (NII) increased between the first and second quarters. NII consists primarily of interchange income from debit and credit cards and gains on mortgage sales, and a modest uptick in spending coupled with a booming mortgage market injected a much-needed source of income as loan and investment portfolios bore the brunt of record-low interest rates.

Looking ahead, credit unions must find ways to serve members needs and perform the essential the duties of a financial institution. Many of the challenges the industry presently faces are unlikely to dissipate quickly. As as credit unions navigate 2021, executives will need to closely monitor income sources recurring as well as one-time loan and deposit pricing strategies, and, importantly, the financial health of members.

How Healthy Is Your Credit Union?

Analyzing performance through the lens of an earnings model summary often referred to as a spread analysis can help a credit union understand the impact COVID-19 has had on its performance.

Request a custom scorecard to see your credit union’s successes and opportunities.

Request Now