Better Rates And Service Mean Extra Costs For Credit Unions

Credit unions leverage their member-first mission to better serve all members, even those of modest means, making cooperatives especially valuable in challenging economic times.

Credit unions leverage their member-first mission to better serve all members, even those of modest means, making cooperatives especially valuable in challenging economic times.

With “junk fees” in the crosshairs in Washington, Callahan takes a deep dive into how that revenue impacts the balance sheet and what the future could hold.

Rising interest rates helped credit unions boost margins in 2023; however, increased provisions ate into ROA.

Higher interest rates in 2023 underpinned an increase in total revenue, which hit a record high in the third quarter.

As credit unions repriced their asset portfolios, higher loan and investment yields bolstered margins and revenue. However, stiff competition for liquidity increased the cost of funds.

The Ohio cooperative has been working with vendors and testing new solutions to find the right fit for the new reporting standards.

Dive into the performance trends that shaped the final quarter of the year, and learn how those metrics could impact the months ahead.

A look back at the Great Recession and subsequent industry performance offers an understanding of risks and opportunities in the current economic climate.

NET LIQUIDITY CHANGE FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22 © Callahan & Associates | CreditUnions.com The federal government took a variety of steps to provide economic relief during the first year of the pandemic, including distributing trillions of dollars directly to consumers. As a result, credit union shares grew at record rates

Credit unions are hosting more FTEs and paying them more than they were one year ago, in large part driven by an extremely competitive hiring environment.

Fluctuating loan demand upset credit union lending pipelines and balance sheets in the first half of the year. How significant were these impacts?

Six data points showcase what’s happening in the U.S. economy that could direct credit union decision-making for the rest of the year.

Credit unions have made the choice to back away from indirect auto lending, but that has come with a substantial opportunity cost.

Credit unions leverage their member-first mission to better serve all members, even those of modest means, making cooperatives especially valuable in challenging economic times.

Credit unions are reigniting investment strategies amid rate shifts and slowing loan demand.

The need for responsible higher education financing continues to grow, and your credit union has an opportunity to provide affordable, flexible funding for college and technical careers.

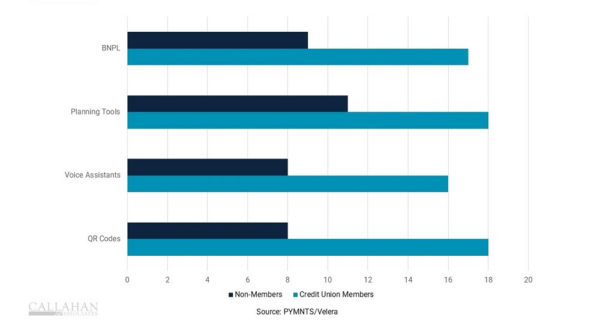

BNPL programs have become a key player in the financial landscape, with some credit unions adopting their own version for their members.

Market pressures and compliance challenges are just two variables pushing cooperatives to hand off their card operations.

How credit card reward programs drive business and loyalty at Alliant and Affinity credit unions.

A March 2024 study determined Buy Now, Pay Later tools are among the top features consumers want from their payments options.