TOTAL REVENUE

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.23

© Callahan & Associates | CreditUnions.com

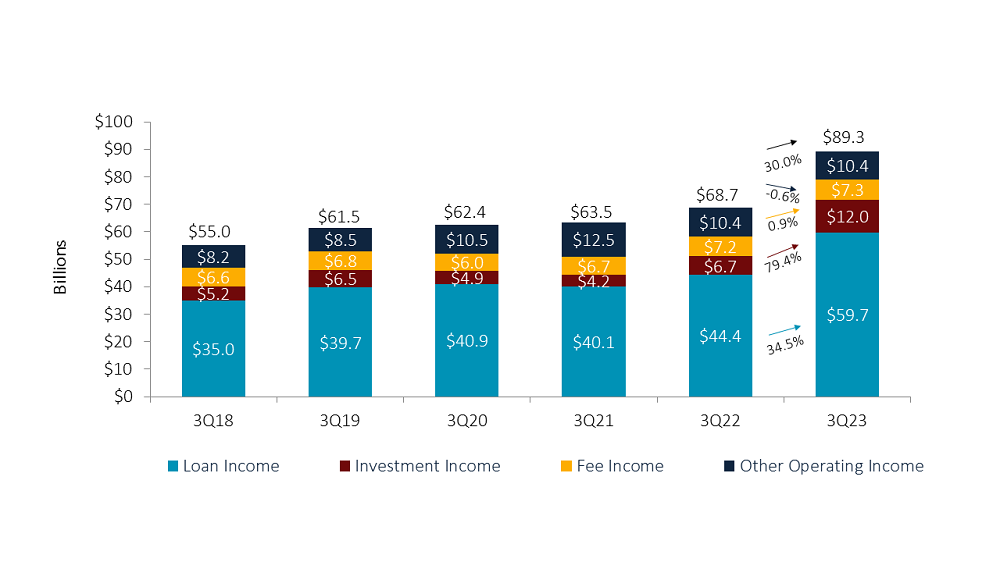

- Total revenue at U.S. credit unions has consistently grown year-over-year. This year, annual revenue growth surged 30.0%, smashing previous industry records.

- Substantial increases in both loan and investment incomes — which posted growth of 34.5% and 79.4%, respectively, thanks to interest rate hikes and repricing portfolios — underpinned this surge.

- Higher interest rates are generally a boon for credit union revenues, but they also drive greater interest expense costs. Year-to-date interest expenses for the industry reached $17,594,675,707 as of Sept. 30, 2023. That’s up 223.2% from one year ago. Accordingly, the industry net interest margin grew 25 basis points year-over-year to 3.03%, despite the significant rise in interest revenue.

- Although interest expenses are suppressing margins, the surge in gross revenue surpassed the growth in total operating expenses. Annual operating expenses rose by 9.4% in the third quarter, which is historically substantial but only one-third of revenue growth.

- With this upswing in revenue, credit unions can reinvest earnings to better serve members or improve operations.

Benchmark Your Financial Performance With Ease

Learn how your institution’s financial performance stacks up against peers and the industry. Callahan’s Peer Benchmarking Suite makes it easy for credit union leaders in any role to measure performance, identify new opportunities, and support strategic plans.

REQUEST A DEMO