Interest in secondary capital is growing, and new strategies, larger loans, and NCUA decisions are changing the way credit unions deploy it.

Since the 1990s, the federal government has allowed low-income credit unions (LICUs) to accept non-member deposits and secondary capital, which gives credit unions a shot to their net worth and makes available new avenues to expand loan portfolios, assets, and services.

More than 40% of all credit unions held a low-income designation at midyear; however, only 70 reported using secondary capital. Even fewer institutions in credit union land have made secondary capital a foundational element in their mission to help members and stimulate the economies of the low-income communities in which they operate.

The following nine metrics draw from more than a decade of data from the 5300 Call Report as well as Callahan’s own Peer-to-Peer analysis tool. They highlight the impact secondary capital has on cooperatives and the members they serve.

The NCUA has pushed back against new ways to wield secondary capital, bringing to light a debate about the role of secondary capital in the credit union industry. Read more in What Is The State Of Secondary Capital At U.S. Credit Unions?

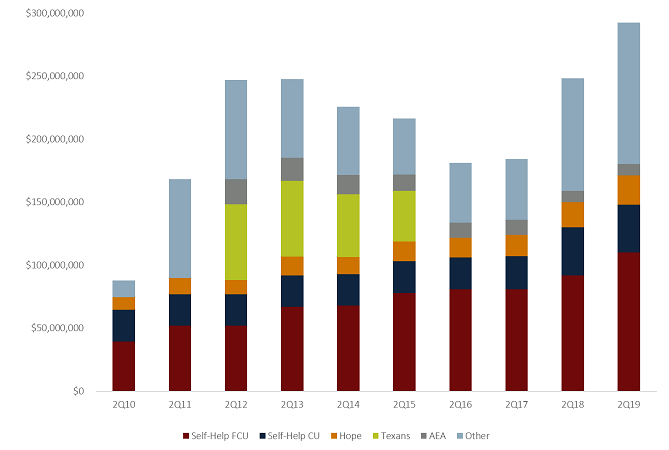

TOTAL SECONDARY CAPITAL BALANCE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Secondary capital balances at U.S. credit unions have fluctuated throughout the decade, but both Self-Help cooperatives and Hope Credit Union consistently held 40% of the industry total.

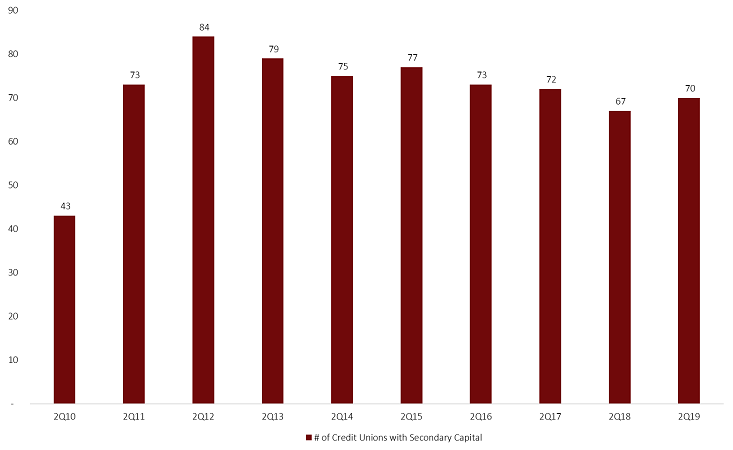

NUMBER OF CREDIT UNIONS THAT HOLD SECONDARY CAPITAL

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

The number of credit unions using secondary capital nearly doubled in 2011 during the Treasury Department’s Community Development Capital Initiative (a subcomponent of TARP and an effort to assist institutions that support underserved populations). Since CDCI’s completion in September 2010, the number of credit unions holding secondary capital has stabilized in the mid-to-low 70s.

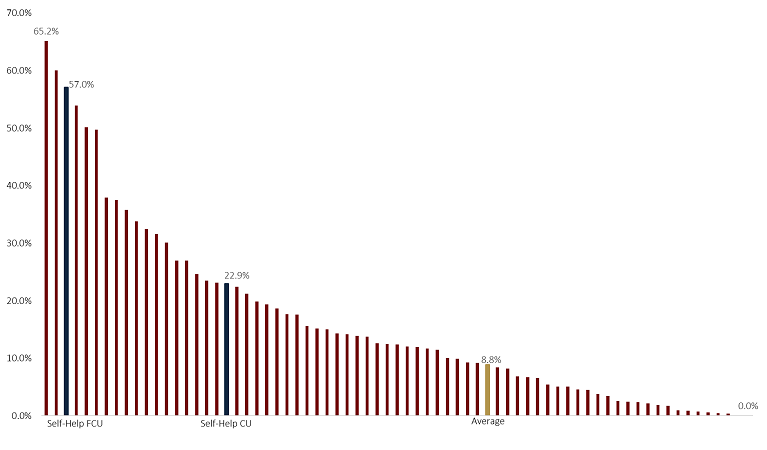

SECONDARY CAPITAL DEPENDENCY RATIO

FOR U.S. CREDIT UNIONS WITH SECONDARY CAPITAL | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

This ratio shows how dependent a credit union is on capital infusions by looking at secondary capital as a percentage of total capital. In 2019, cooperatives that deployed these funds exhibited a wide range of dependency.

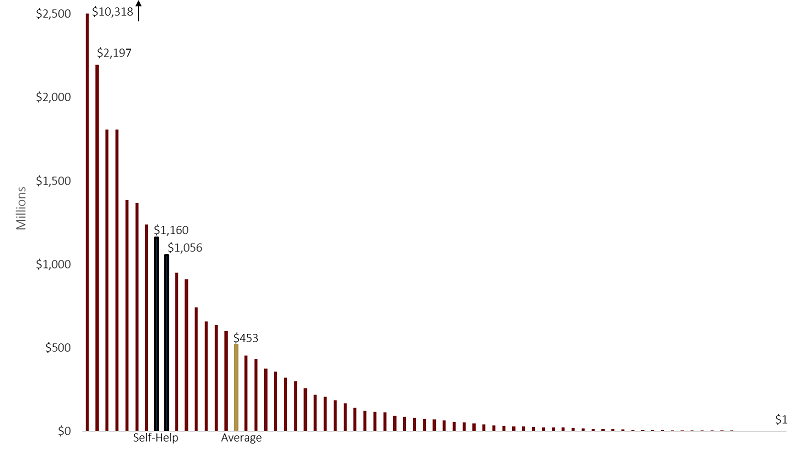

ASSET SIZE

FOR U.S. CREDIT UNIONS WITH SECONDARY CAPITAL | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Of the 70 credit unions that hold secondary capital at midyear 2019, 40 are under $100M in total assets. Size does not preclude the need for outside funding, however, as credit unions of all asset classes are represented in the group. As of midyear, the largest credit union that held secondary capital was Suncoast Credit Union ($10.3B, Tampa, FL); coming in second was Local Government FCU ($2.2B, Raleigh, NC). Self-Help Federal Credit Union ($1.2B, Durham, NC) and Self-Help Credit Union ($1.1B, Durham, NC) together held $148 million in secondary capital, nearly half of all secondary capital in the market, and ranked in the top quadrant of the group by asset size.

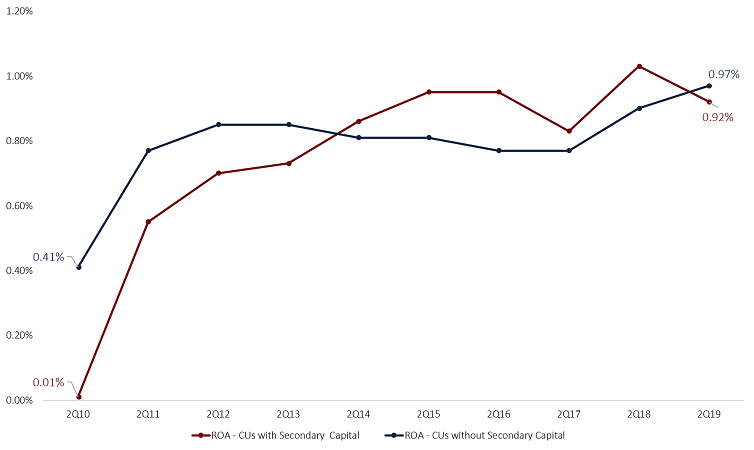

RETURN ON ASSETS

FOR U.S. CREDIT UNIONS| DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Although the return on assets at credit unions that hold secondary capital versus those that do not was comparable in the second quarter of 2019, the secondary capital boom in the early 2010s correlates with a substantial ROA increase for participating cooperatives.

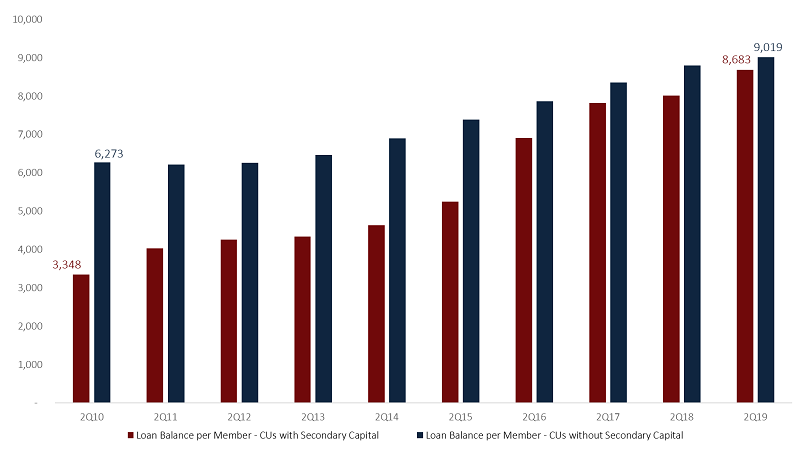

LOAN BALANCE PER MEMBER

FOR U.S. CREDIT UNIONS| DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Similar to ROA, the gap in loan balance per member between credit unions that use secondary capital versus those that do not has steadily, dramatically closed during the past decade.

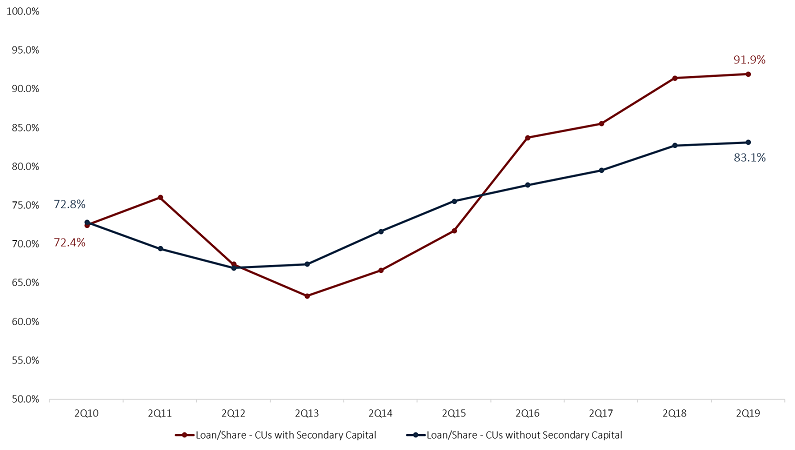

LOAN TO SHARE RATIO

FOR U.S. CREDIT UNIONS| DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

he loan-to-share ratio at credit unions with secondary capital dipped in the early 2010s, but newcomers to the secondary capital field have helped the ratio rebound.

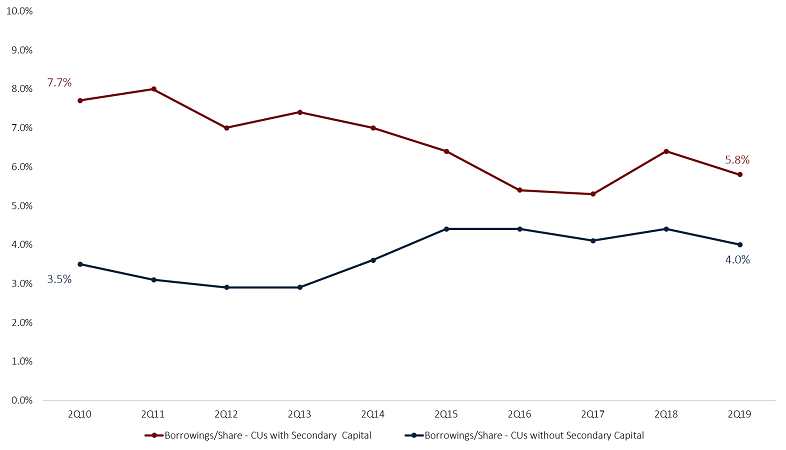

BORROWING TO SHARE RATIO

FOR U.S. CREDIT UNIONS| DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Perhaps not surprisingly, cooperatives that use secondary capital borrow more money, on average, than those that do not use secondary capital.

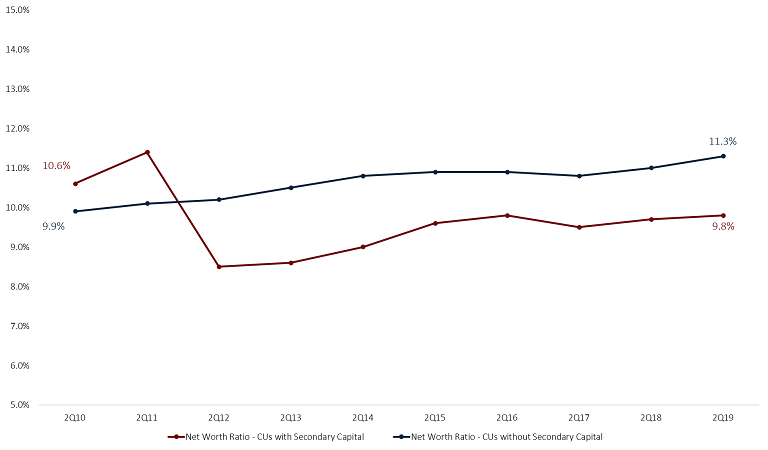

NET WORTH RATIO

FOR U.S. CREDIT UNIONS| DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

The net worth ratio for credit unions with secondary capital tends to lag behind the average for U.S. credit unions. Many credit unions that deploy secondary capital do so to boost their net worth and gain flexibility to lend and operate deeper within their membership base.

The CEO of the Self-Help credit unions uses secondary capital to fight predatory lending and protect financially vulnerable consumers. Learn more in How Martin Eakes Became The Most Hated Man In America (By Payday Lenders)