The National Credit Union Administration approved major revisions to Call Reports starting in the first quarter of 2022. This process took six years and involved substantial reorganization and restructuring of most sections of the Call Report, including the removal, addition, and modification of over 1,000 combined account codes.

With all those changes, some credit union leaders may still be struggling to articulate the differences to board members and auditors, but Callahan Associates is here to help.

Let’s go step by step through some of the biggest questions:

What Is The Call Report Modernization Process?

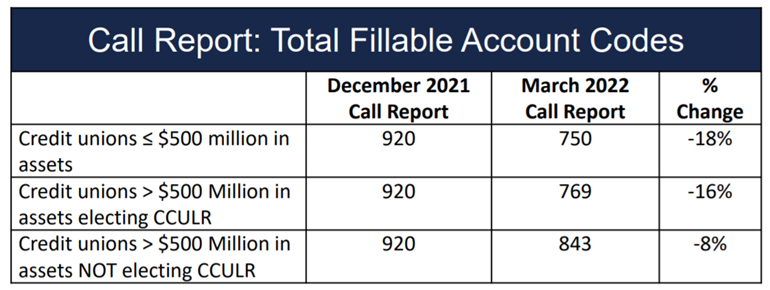

Back in 2016, the NCUA established its Call Report Modernization Process, which was intended to streamline reporting, reorganize and improve data collection, and accommodate the agency’s risk-based capital schedule. That initiative is now nearly complete, and all those goals were addressed in the first-quarter Call Report update. These changes led to a reduction in the number of codes credit unions are required to report though the scope of those changes depends on which capitalization ratio the credit union is required to complete.

The goals listed above put in place to accommodate the new capitalization schedules were the main driver of the 1Q22 changes. The NCUA hopes to protect the financial security of the industry in the event of economic downturn and has built out complex new risk-based reporting to do so.

Want to know more about the new Call Report changes? Just looking for the basics? More information is available here

Is My Credit Union Complex’?

Credit unions below $500M in assets are considered non-complexand still held under the same 7% capitalization requirement that was in place before these changes. However, credit unions above $500M in assets are held to one of two new capitalization ratios. If the institution’s capitalization is above 9%and they meet a few other risk-based balance sheet criteria they will qualify for the more simplistic complex credit union leverage ratio (CCULR). However, if they don’t qualify for CCULR, the credit union must complete the much more detailed risk-based capital (RBC) calculation. This latter formula is the impetus for most of the Call Report changes in 1Q22, as new investment and loan information is required to quantify the risk requirements.

As shown in the chart above, even if an institution uses the RBC calculation, there are fewer codes to compile than in previous quarters. This leaves a potentially lighter burden from a finance, accounting, and compliance standpoint (once credit unions reset their core processors to process these updates), but it negatively impacts analytical and business intelligence teams. Less data usually offers fewer opportunities for analytical insights.

What Has Changed?

It is undeniable that the 5300 is more cleanly organized than before, and categories now align across multiple sections of the Call Report more exactly than in the past. Delinquency and charge-off information is broken down to match the lien type categories in the loan and commercial loan sections. Investment categories on the balance sheet now align to better match the investment detail sections in the Call Report appendices.

All of this will allow for more detailed and helpful analytical insight over time. However, data between 2022 and prior years will not align cleanly for many metrics, preventing effective performance analysis. For some data, trend timelines have been reset to zero. The key financial categories most affected by inconsistent changes include:

- Investment portfolios

- Mortgages (both originations and balances outstanding)

- Asset quality

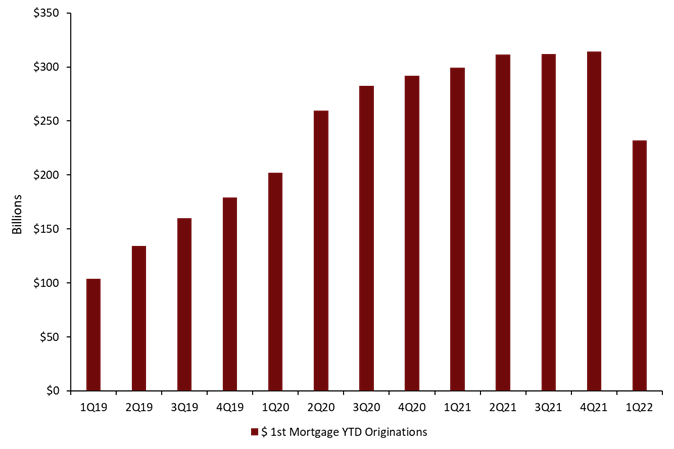

An example of this is shown below, for credit union first mortgage originations:

Annualized First Mortgage Originations

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

At first glance, it looks like the credit union mortgage origination business declined by over 20% between 4Q21 and 1Q22. While the mortgage business is starting to hit some headwinds following two consecutive years of record lending, we know from market news that lending is not dropping off as significantly as it appears above. The reduction shown is the result of reporting changes by the NCUA.

Previously, the Call Report included commercial loans lumped in with first mortgage origination totals. As of 1Q22, this is no longer the case. Only 1-4 family residential property liens are included in the totals. Prior to 1Q22, we were unable to purely isolate residential mortgages commercial was inseparably included. Now, however, examining long-term first-mortgage trends will show totals for residential and commercial for all quarters up through 4Q21, following which only residential will be visible. As a result, it may appear as though mortgage originations fell off a cliff, when the true story is that commercial mortgages simply aren’t included in that reporting anymore.

Long-term, this is arguably a good change. Residential and commercial loan businesses are very different, and the risk profiles and business models behind these two loan types are distinct. They really shouldn’t be lumped together. However, the sudden removal of commercial data makes it more difficult to paint an accurate picture of the mortgage business over the course of 2022.

How Can Callahan Help?

The first mortgage example seen above is not the only case of inconsistent data following the changes. Many commonly used financial metrics have been affected by the reorganized Call Report. Sometimes, the new account codes can be MacGyver-edtogether to create some type of consistency over the periods. Callahan Associates has built a list of common formula updates in our 1Q22 Call Report change resources.

Other changes, like first mortgages, will be impossible to trend. As analysts, we can address these changes by understanding where they happened, and why.

The first step is to learn how the 5300 has changed. Old and new Call Reports as well as instruction guides and change resources from Callahan can be found at the link above and on the NCUA website.

What Else Do I Need To Know?

When analyzing data between 4Q21 and 1Q22, any visualizations that look strange should immediately be taken with a grain of salt. Keep your data BS metersset to high. If graphed data looks like an aberration, it is far more likely to be the result of reporting changes than any type of actual industry trend. Use the resources above to learn why these metrics have changed. Once you understand the change, you can explain it to your leadership team or board.

In some cases, common performance metrics may need to be retired for a few quarters until a new, consistent trendline has accumulated. Alternatively, you can continue to use these metrics if you understand the reporting caveats. This decision is up to you and your team, and the key to making it is knowledge of the data. In order to use any data to make informed strategic decisions, you must understand the source. The NCUA’s 1Q22 changes are sizable and there will be a learning curve for everyone, but the fundamental need to understand the source remains.

Take it upon yourself to become your internal expert on the new Call Report. This knowledge will be invaluable to your credit union’s analytical team in 2022 and beyond.

If all else fails, hang your hat on the fact that in three to five years, the credit union industry’s Call Report data should trend in a much cleaner and more organized fashion than ever before.