12-MONTH COMPENSATION GROWTH VS. PRICE INFLATION

U.S. Workers| DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

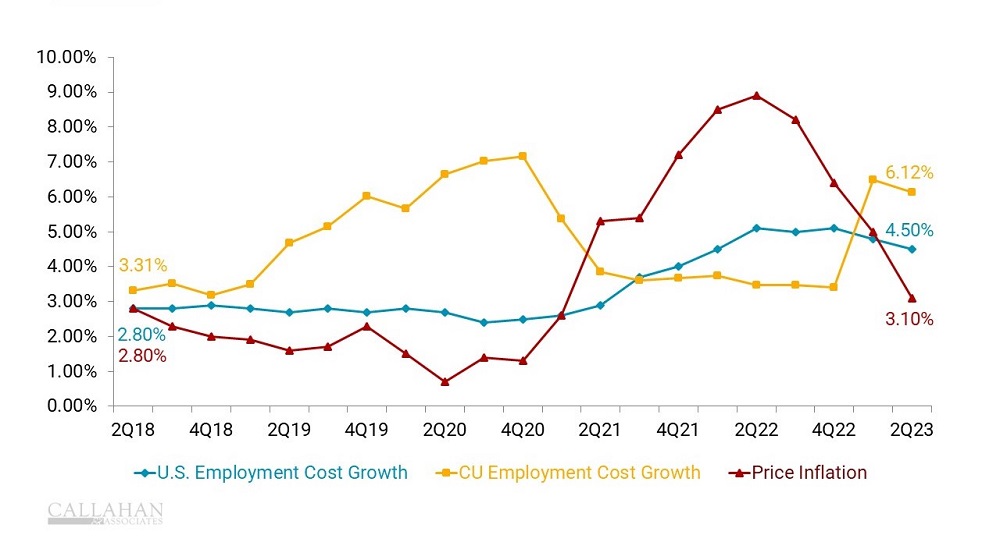

- In the United States, employee compensation growth — which includes wages and benefit costs — has generally surpassed the national inflation rate. In a competitive marketplace, staff members with increasing skills and efficiencies likewise expect increased compensation relative to cost of living.

- During the pandemic, trillions of dollars of federal relief combined with record-low interest rates that increased overall access to money padded consumers’ budgets, leading to an increase in demand for goods and services at the same time quarantines and manufacturing shutdowns constrained supply. Naturally, prices rose.

- Unfortunately, wages and compensation were slow to adjust. However, the availability of remote work increased demand for many white-collar jobs as workers traded salary growth for workplace flexibility.

- Still, price inflation surpassed wage growth for nearly two years, which had a compressing effect on American’s budgets. Despite near-record employment, the national savings rate is the lowest it’s been since the Great Recession.

- The Federal Reserve’s higher-for-longer policy has finally started to lower inflation rates. In the meantime, labor markets have settled into a hybrid remote work environment, and wages are readjusting to attract and retain talent. Even as August inflation numbers came in above expectation, salary growth remains ahead of the curve.

- All told, compensation has finally surpassed inflation, bringing some much-needed relief to consumer budgets and brightening the near-term outlook for savings — a welcome sign for depository institutions in search of liquidity.

How Does You Compensation Compare?

Use industry data to determine how your credit union performs against competitors, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?