Top-Level Takeaways

-

Membership increased 3.7% year-over-year to 119.7 million as of June 30.

-

Assets increased 6.4% annually to top $1.5 trillion.

-

Earnings pushed up ROA 6 basis points year-over-year to 0.96%.

The credit union business model which is purpose-driven and focused on the financial well-being of members is not like that of other financial institutions. That’s readily apparent during strategic planning season, when cooperatives discuss new methods to differentiate their products and services and enhance the member experience.

For example, this year, many credit unions are discussing how a deliberate, calculated expansion of credit risk could better serve members. They’re also considering how their local roots and member interactions can help them recognize product and service needs of members, thereby positioning the credit union for long-term success.

These are important considerations to keep in mind while analyzing the industry’s midyear financials.

Industry Performance

The number of credit unions in the country dropped from 5,596 in the second quarter of 2018 to 5,425 in the second quarter of 2019. There were 3,335 federally chartered credit unions and 2,090 state-chartered credit unions at midyear.

It is important to note, however, that credit union consolidation is slowing. The year-over-year difference in the number of institutions averaged 259 in the first half of the decade and 236 in the second half. Additionally, the percentage of the industry lost to a merger or liquidation has been less than 4.0% for the past three years.

Despite the drop in the number of credit unions, the industry’s assets at midyear topped $1.5 trillion. That’s an increase of 6.4% from the previous June. Loan growth slowed 3.2 percentage points year-over-year, from 9.7% as of June 30, 2018, to 6.5% at midyear 2019. Deposits, on the other hand, increased $73.0 billion, or 6.0%, year-over-year. That’s an acceleration of 57 basis points.

Credit unions also reported impressive gains in investment growth, which rose 4.5% year-over-year. In June 2018 investments had fallen 4.0% from the year prior as credit unions had been allowing investments to run off to fund loan demand; as such, this portion of the balance sheet had been contracting.

Elsewhere, capital growth surpassed double-digits it nearly doubled from 6.4% in 2018 to 11.3% in 2019 while membership growth held steady at 3.7%. The movement served more than 119.7 million members as of June 30, 2019.

INDUSTRY GROWTH OVERVIEW

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Strong earnings over the past year fueled double-digit capital growth in the second quarter.

Midyear results show that members continue to respond to credit union value, says Jay Johnson, chief collaboration officer at Callahan & Associates.Lending activity increased, and credit unions rewarded savers with higher rates. These results, combined with recent interest rate movements, indicate the industry is well-positioned to help members even more in the second half of 2019.

Members

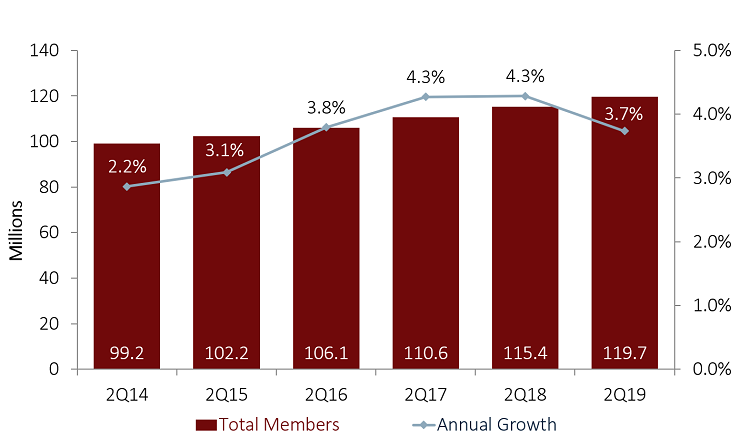

Credit union membership has grown 20.7% or, 20.5 million members since the second quarter of 2014. In the past year alone, 4.3 million members opened a new account. That’s an increase of 3.7% from June 30, 2018.

Whereas the U.S. population has grown less than 1.0% for the past five years, membership growth at credit unions has stayed above 3.5% since the fourth quarter of 2015. As of June 30, 2019, total credit union membership surpassed 119.7 million.

MEMBERSHIP AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Annual credit union membership growth fell to 3.7% by midyear 2019. The movement added 4.3 million new members in the past year.

Market Share And Member Impact

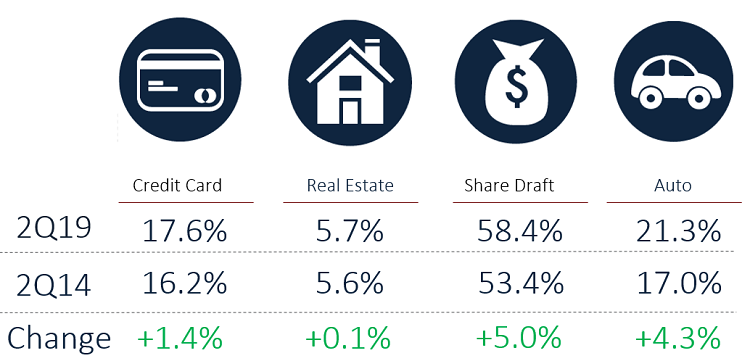

Credit unions aren’t just adding members; they’re engaging members, too.

The percentage of members that hold a credit union credit card 17.6% as June 30, 2019 has increased 1.4 percentage points in the past five years. Real estate penetration, which includes an estimated number of loans sold but serviced by credit unions, has increased 10 basis points in the past five years. It was 5.7% at midyear. Share draft penetration, an indicator that a credit union is a member’s primary financial institution, has increased 5.0 percentage points in the past five years. It was 58.4% at midyear. Finally, auto loans, too, have gained in popularity. In 2014, 17.0% of members held a credit union auto loan. That number was 21.3% as of June 30, 2019.

PENETRATION RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Credit unions are working to engage, not just add, members. Their efforts are evident in the number of members who are turning to cooperatives for their financial needs.

When it comes to market share, credit union performance remains strong in mortgages, credit cards, and auto. First mortgage market share was 8.1% as of June 30, 2019, which is down slightly from the year prior. Revolving consumer loan balances, mostly composed of credit cards, continued to trend upward and reached 6.2% in the second quarter. Auto market share was 18.4% at midyear. This is down 1.4 percentage points from one year ago.

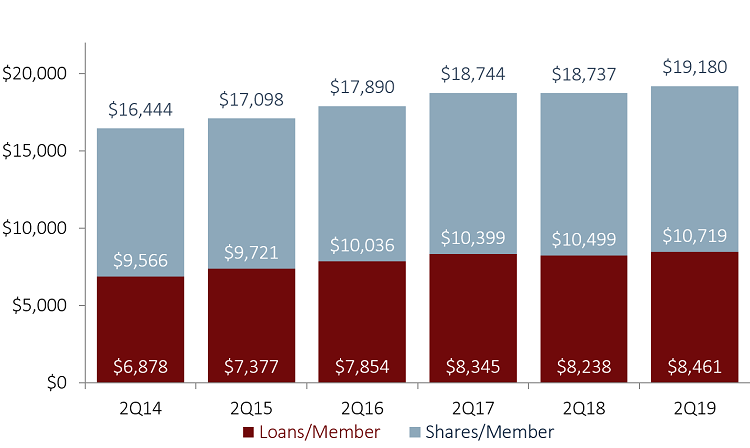

AVERAGE MEMBER RELATIONSHIP

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Average loan balances per member have increased 23.0% in the past 5 years.

The average member relationship for U.S. credit unions reached $19,180 at midyear. That’s an increase of $443 from the same time last year. Although loan growth is slowing, it remains the driving factor behind gains in the average member relationship. Loan balances per member were up 2.7% year-over-year to $8,461; share balances per member rose at more tempered 2.1% to $10,719.

Wait, There’s More!

This is just one section of the industry trends discussion that appears in Credit Union Strategy & Performance. Read the whole discussion today.

Read More

This article appeared originally in Credit Union Strategy & Performance. Read More Today.