Millions of families across America are struggling because of COVID-19. According to the Bureau of Labor Statistics, initial unemployment claims reached 38.6 million as of the week ending May 16. Putting that into perspective, Americans filed more unemployment claims in nine weeks than they did throughout the Great Recession, which lasted 18 months. As the pandemic strains budgets, disrupts supply chains, and stresses our nation’s health care systems, the credit union mission becomes more important than ever.

Every day brings the nation one more closer to the end of the pandemic; even so, COVID-19 will remain a challenge in the months and years ahead. Times like these provide the opportunity for credit unions to differentiate themselves from other financial institutions and showcase the vital role cooperatives play in the lives of their members and communities.

The Federal Credit Union Act established the U.S. credit union system in 1934, in the midst of the Great Depression. Today, credit unions are once again navigating a moment in history in which they can leave a lasting impression on the nation.

The financial crisis of 2008 provides the closest modern parallel to the magnitude of the Great Depression. Notably, the actions taken by credit unions during the late aughts laid the foundation for remarkable success throughout the 2010s. A look at the industry’s profile in December 2007 versus today shows the credit union industry is well positioned to provide value to members and consumers.

Saving Members Money

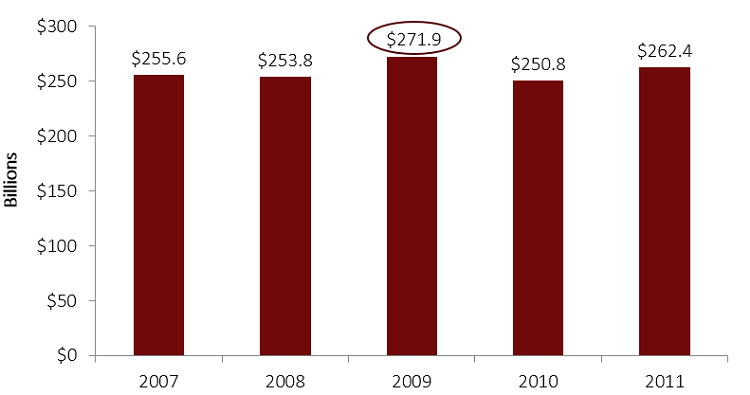

The first takeaway from the Great Recession that is applicable today is that credit unions continued to lend to members throughout the downturn. In fact, credit unions set a new loan origination record in 2009 despite the fact the U.S. economy hit its economic trough in June of that year.

ANNUAL LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.11

Callahan & Associates | CreditUnions.com

In 2009, credit unions originated the highest loan volume in their history at the time.

While headlines from 2009 highlighted the credit crisis impacting many sectors, credit unions performed the countercyclical role for which they are designed. Other financial institutions pulled back sharply reducing credit card lines by more than $1 trillion but credit unions stepped up and granted credit that helped households better manage their cash flow.

Much like today, interest rates had dropped to zero and many credit unions defined success not by how much they originated but by how much money they saved members when refinancing their loans. Today’s environment presents the opportunity to do the same.

Modifying Mortgages

Credit unions also worked to keep families in their homes. Millions of consumers lost their homes in foreclosure during the first two years of economic recovery from 2009 to 2011 and other financial institutions faced record civil fines for foreclosure fraud and other mortgage abuses during this period. Credit unions, by contrast, stuck with their communities and strived in good faith to work with borrowers.

QUARTERLY REAL ESTATE LOAN MODIFICATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.11

Callahan & Associates | CreditUnions.com

Credit unions helped nearly 65,000 members stay in their homes.

Today, the key question to ask is: What do you want members to say about your credit union once this is over?

While other institutions pursue profit, cooperatives have the opportunity to show consumers what makes them different during COVID-19 and beyond.

Best Years Ever

It’s striking how quickly the financial picture changed for credit unions in the years immediately following the Great Recession. Provision expenses more than doubled in 2008, growing 121.9% to $7.1 billion. In 2009, the provision for loan loss peaked as expenses grew 35.2% year-over-year to $9.6 billion.

PROVISION FOR LOAN LOSS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.11

Callahan & Associates | CreditUnions.com

Industry provisions for loan loss expense fell 50% from its 2009 peak.

However, this ramp-up was quickly followed by a steep decline as the economy began to recover. The Annual Net Income graph shown here illustrates how the rate of change in provisions correlated with credit union earnings.

ANNUAL NET INCOME

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.11

Callahan & Associates | CreditUnions.com

Industry net income in 2011 was a record for credit unions at the time.

Credit unions stuck with their members and continued to lend to them during the Great Recession. That was followed by the best years the credit union industry has ever seen. Today, the industry is well positioned to follow the same path with a larger balance sheet, more liquidity, and $1.42 reserved for every $1 of delinquent loans versus $0.82 at the end of 2007.

A Safety Cushion Of Capital

Finally, it’s worth taking a look at how capital performed through the financial crisis and the first few years of economic recovery. As shown on the Total Capital graph below, net worth ratios were effectively never lower than 10%.

TOTAL CAPITAL (INCLUDING ALL)

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.11

Callahan & Associates | CreditUnions.com

Industry capital, including the ALL, neared $109 billion in 2011.

As in past years, the credit union industry currently has a lot of capital on its balance sheet. Capital totaled $193.4 billion as of March 31, 2020, up 78.1% from 2011 levels. Industry net worth also stood at 11.0% in the first quarter of 2020. Given record levels of capital and net worth, credit unions will have the ability to innovate and extend lifelines to members and consumers in ways not yet considered.

Inevitably, every crisis comes to an end. These points of reference show credit unions can deliver tangible benefits in difficult times and overcome financially challenging years.

The most important takeaway, however, is that the credit union industry has the mission-driven foundation to help consumers weather this storm. With a clear strategy, this could be the opportunity of a lifetime for credit unions to be a part of the solution that helps members and communities get back on their feet.