Not long ago, the nation was in economic turmoil. In response to COVID-19, businesses shut down and laid off workers in droves, pushing the unemployment rate to 14.8% in April 2020. Unemployment dropped to 4.8% by the end of September 2021, according to the Bureau of Labor Statistics, and extended unemployment benefits expired earlier that month; however, it is too early to tell whether this cessation will push Americans to return to work.

Job openings reached 10.4 million at the end of the third quarter of 2021. That’s an increase of 5.0 million from one year ago. It was a V-shaped recovery for the labor market, and credit unions are struggling to hire enough front-line staff to keep operating at full capacity in the wake of such dramatic swings.

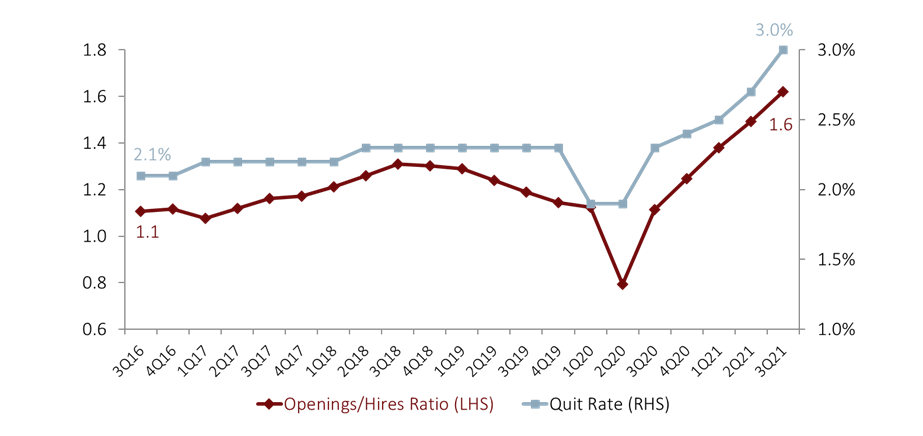

JOB OPENINGS AND LABOR TURNOVER SURVEY (JOLTS)

UNITED STATES | DATA AS OF 09.30.21

The openings/hires ratio and the quit rate increased consistently after bottoming at the beginning of the pandemic. As of Sept. 30, 2021, there were 1.6 job openings for every person hired.

Source: Bureau of Labor Statistics

Employees

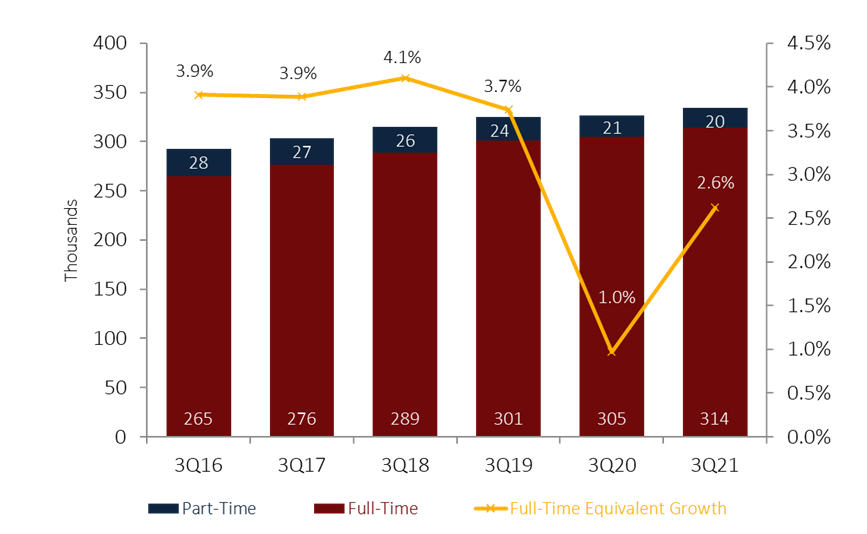

Employee totals across the U.S. credit union industry increased 2.6% year-over-year to 324,198 but lagged strong member growth, which surged 4.0% over the same period. As a result, members per employee averages increased to 401 as of Sept. 30, a five-member increase during the past year. Employees are now serving more members than at any prior point this millennium.

This staffing ratio has risen steadily since March of 2020 clearly correlated with pandemic effects. In fact, it hovered around 385 for all of the past decade, pre-pandemic, never straying more than a few in either direction. This relatively sudden increase in responsibility for employees might make it challenging to maintain the exceptional member service quality in which credit unions take pride.

Today’s new members are not low maintenance, either. The annualized number of loans originated per employee increased by 15 from the third quarter of 2020 to reach 127 as of the third quarter of 2021 . Granted, this is down from a peak of 182 (annualized) in the record-setting first quarter of 2021, but credit union staff members are busier than ever.

EMPLOYEE TOTALS

U.S. CREDIT UNIONS | DATA AS OF 09.30.21

Employee growth increased 2.6% annually in the third quarter amid strong member growth.

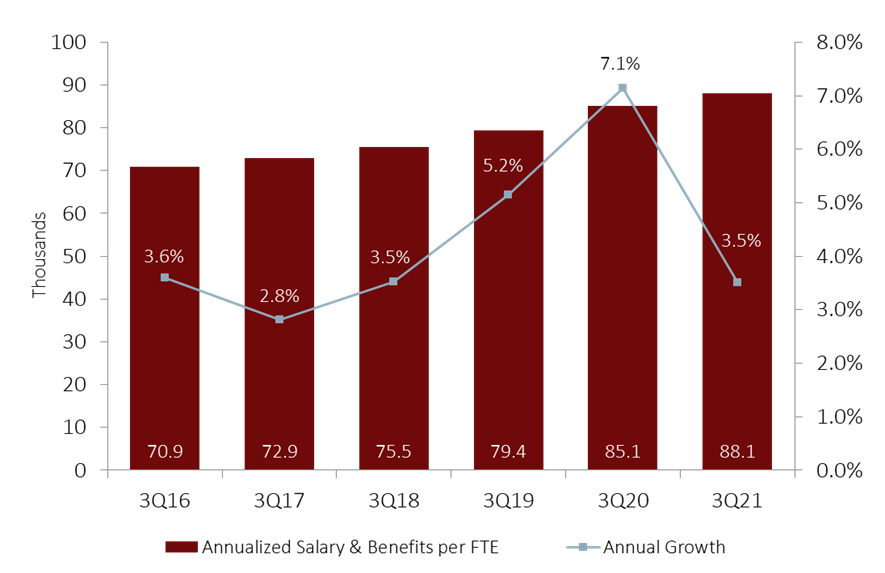

To compensate for this increase in workload and to attract new staff, credit unions have increased wages. The industry reported an average spend of $88,069 on salary and benefits per employee per year as of the third quarter of 2021. That’s an annual increase of $3,005. Since the start of 2020, credit unions have increased how much they spend on compensation per employee by $8,395, or 10.5%.

The competitive labor market pushed up salaries, and credit unions were obliged to keep up to hire and retain talent. For each $1 spent on salary and benefits, credit unions across the country earned $2.96 in revenue as of Sept. 30. This represented an annual decrease of 14 cents as income growth struggled to maintain the same pace as compensation. Still, even these wage increases might not be enough as potential employees look to other industries for work-from-home opportunities and higher compensation.

SALARY AND BENEFIT EXPENSE PER FTE AND ANNUAL GROWTH

U.S. CREDIT UNIONS | DATA AS OF 09.30.21

Credit unions spend an average of $88,069 per year on salary and benefits per employee.

Efficiency

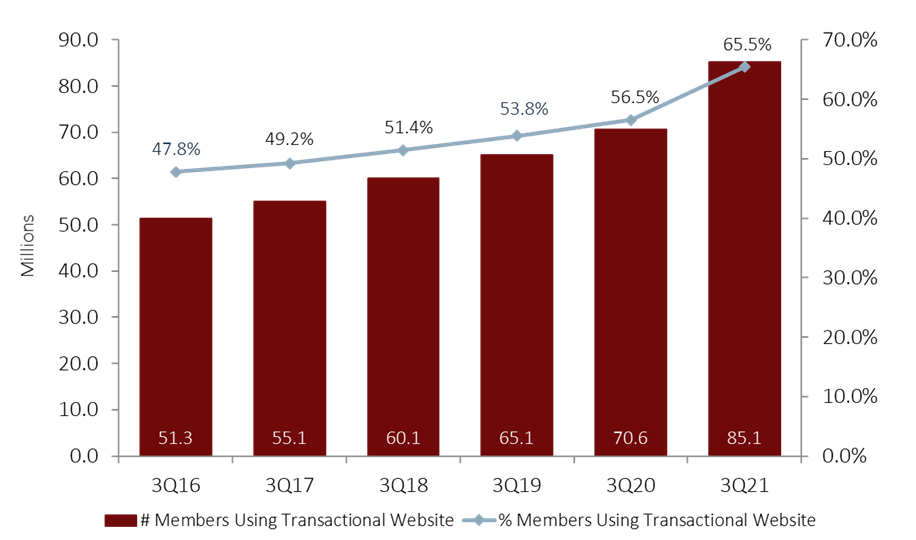

To counteract the tight labor market and some of the negative earnings effects of the pandemic, credit unions have increased efficiency. The pandemic compelled businesses to use technology and increase online products and services in the absence of traditional face-to-face customer interaction. Credit unions were no exception. The percentage of members using a credit union’s transactional website jumped 9.0 percentage points year-over-year to 65.5% as of Sept. 30, 2021.

Credit unions are investing in transactional websites and members are using them, reducing branch staff workload and improving operations for everyone involved. Relatedly, the number of employees per branch ticked up to 15.4 as of Sept. 30, 2021, from 14.9 one year earlier. Although employee totals grew slightly to meet high borrowing demand, physical branch totals have declined as credit unions focus on technological channels rather than brick-and-mortar expansion to reach new members.

TRANSACTIONAL WEBSITE USAGE

U.S. CREDIT UNIONS | DATA AS OF 09.30.21

Usage of credit unions transactional websites accelerated over the past year, showing members are willing to move their transactions online.

The operating expense ratio, which measures how much a credit union spends on operating expenses for each dollar of assets under management, declined 23 basis points year-over-year to 2.80%. This year is the first time on record the industry’s ratio has dropped below 3.0%, highlighting how credit unions are stretching each dollar.

The efficiency ratio defined as the amount of operational expense needed to generate one dollar of revenue decreased in a similar manner, falling 69 basis points year-over-year to 71.9%. Put differently, this means credit unions paid 71.9 cents to generate one dollar of revenue, the most efficient value since 2018. What’s more, recent wage hikes imply credit unions are controlling operational costs in areas besides staffing.

Credit unions in the United States have generated healthy asset and earnings growth during the past few quarters; however, they should be wary of lagging behind their bank competition in developing operational improvements. The pandemic shifted the labor market, and credit unions are struggling to respond. Perks such as sign-on bonuses and hefty salaries might not be enough to maintain an effective staff when other industries are doing the same or better.

With remote work options now available at most companies, credit unions are competing with every company across the nation for talent. If the labor shortage persists, credit unions might have to further invest in technology and digital offerings to effectively reach members. Thankfully, record industry earnings have left credit unions with some capital to put toward these channels; however, the addition of more and different technology could require revisiting conventional efficiency metric ranges.

Whatever happens, credit unions must find ways to deal with labor shortages without hindering their institution’s positive community impact. Generally speaking, research shows employees are driven by purpose more than compensation. Credit unions have a clear purpose. Make sure it’s known!

William Hunt contributed to this reporting.