The operational strategy of a credit union has a direct impact on its productivity and efficiency metrics. It’s important for credit unions to strike the right balance for all stakeholders taking care of members and employees while ensuring the overall health of the organization.

The efficiency ratio helps credit unions monitor the relationship between operating revenue and overhead expenses by providing a measure of how much an institution spends to earn $1 of revenue.

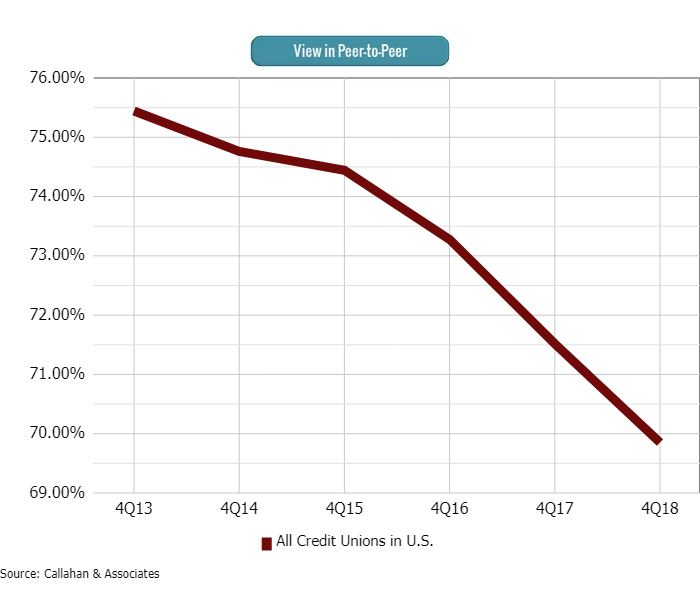

As of Dec. 31, 2018, U.S. credit unions reported an average efficiency ratio (excluding provision for loan losses) of 69.9%. That’s down 169 basis points from one year prior.

EFFICIENCY RATIO (EXCLUDING PROVISION FOR LOAN LOSSES)

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

© Callahan & Associates | CreditUnions.com

The 2018 year-end efficiency ratio of 69.9% is the lowest fourth quarter level credit unions have reported since 2009, when it was 69.7%.

Total income (less interest expense) increased 10.1% year-over-year, outpacing the 8.1% growth in operating expenses credit unions reported at year-end. Underlying the double-digit growth in income is a strong annual growth in net interest income, other operating income, and fee income which increased 12.0%, 13.5%, and 4.9%, respectively.

ContentMiddleAd

A lower efficiency ratio indicates a credit union is dedicating a smaller percentage of income to overhead expenses, whereas a higher efficiency ratio suggests the opposite. There are many factors that contribute to a declining efficiency ratio, the first of which is operating expense management.

The efficiency ratio divides operating expenses by total income and subtracts interest expense. Long-term expenses, such as office rental and loan servicing fees, can negatively impact the efficiency ratio. Short-term expenses, such as travel and conference expenses and miscellaneous operating expenses, can also skew the ratio. The efficiency ratio extends its usefulness beyond what is typically measured in the standard operating expense ratio by taking into account a credit union’s primary non-interest income components fee and other operating income. The result is a metric that provides insight into an institution’s operational income and expense structure.