$104 billion. That’s the agreed price in the merger of the world’s two largest brewers, Anheuser-Busch InBev (ABI) and SABMiller. If regulators approve the deal, it will be one of the five largest mergers in history. The merged company will hold 30% of worldwide beer production, including eight of America’s top 10 brands.

It’s with this scale that the company plans to revive flat sales and fend off competition from American craft breweries.

In 2014, American beer sales totaled $101.5 billion. Craft beer accounted for $19.6 billion a 22% year-over-year increase in sales. The United States produced nearly 200 million barrels of beer in 2014. Eleven percent of that was craft beer a 17.6% gain over 2013. By contrast, craft beer production accounted for just 5% of the total market in 2011.

The ABI and SABMiller merger will shift the marketplace and cause further consolidation as Big Beer expands.

The relationship between Big Beer and craft breweries is not unlike that between banks and credit unions. On the face of it, both provide a similar service or product; however, differences in model and scale create dissimilar models of operation. And as credit unions continue to gain market share, the current shifts in the beer market could potentially mimic a marketplace shift between banks and credit unions in the financial services space.

The Sincerest Form Of Flattery

What makes a craft beer a craft beer? The Brewers Association defines these companies as small, independent, and traditional. These breweries produce 6 million or fewer barrels of beer per year.

Perhaps surprisingly, Blue Moon and Shock Top are not craft beers. They are crafty offshoots of SABMiller and ABI, respectively. They can leverage the production and marketing heft of their parent company while competing in the marketplace with the faux-authenticity of a craft beer. These are imitations of true craft beer because they are neither small nor independently owned. But by positioning Blue Moon and Shock Top as such, SABMiller and ABI hope to (perhaps wrongly) obtain the business of beer drinkers looking for crafty suds.

Likewise, the banking industry is looking for ways to appear more service-oriented and community-focused.

Mergers And Acquisition

A merger, in and of itself, should not be a strategy for growth, says Callahan founder and chairman Chip Filson. In the case of SABMiller and ABI, it appears to be a way to please shareholders who are underwhelmed by sales of the corporation’s flagship products. That said, there are some ways this merger can benefit each going forward.

A Marketplace report shows SABMiller and ABI each spend $500 billion annually on sports sponsorships. Once merged, the companies will no longer compete with each other for airtime, and with decreased competition for these advertisements, the price will likely drop, saving the corporation hundreds of millions if not billions in costs.

ABI has also made a point to buy popular, and firmly established, craft labels such as Goose Island, Elysian, and Blue Point. There are now more than 4,000 breweries in the United States, more than double the amount that existed in 2011. A market that fragmented makes it difficult for breweries with tighter margins to remain solvent.

Own The System

Breweries use distributors to get their products into stores and restaurants. It’s the distributors that take new breweries to market and ensure a diverse selection of beer. However, not all distributors are independent. ABI owns a number of them across the country, a fact that hinders craft brewers’ ability to distribute their wares.

According to a Reuters report, the U.S. Justice Department is investigating allegations that ABI is violating antitrust regulations by purchasing distributors and pressuring independent distributors to stay away from craft labels. True or not, the distribution system will continue to prove challenging to craft breweries with few resources.

Mock The Crafts

Budweiser aired an ad during the 2015 Super Bowl called Proudly a Macro Beer, which made fun of drinkers who enjoy nontraditional beer flavors such as pumpkin peach ale (Elysian, it should be noted, makes just such a beer).

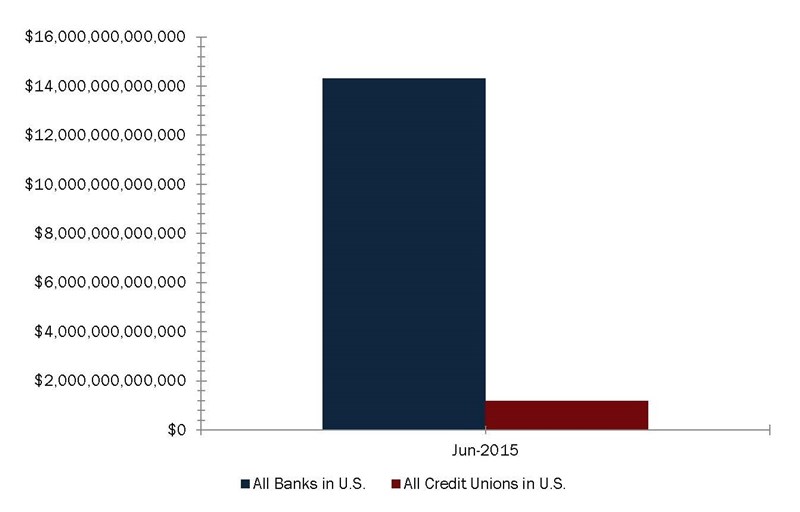

Although the ad is a bit myopic for a company that owns a number of craft breweries, it’s emblematic of the current beer climate. Budweiser, owned by ABI and the self-ascribed King of Beers, is the third highest-selling beer in the United States. It is taking shots at a craft beer industry that, in total, produces just about the same amount of beer as Budweiser. It’s akin to the banking industry, which manages assets of more than $14 trillion, attacking a credit union industry that manages less than $2 trillion.

Total Assets

For all U.S. credit unions and banks | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

So is the kingdom of Big Beer crumbling? Well if it is, they’ve got just the thing to wash away the pain.