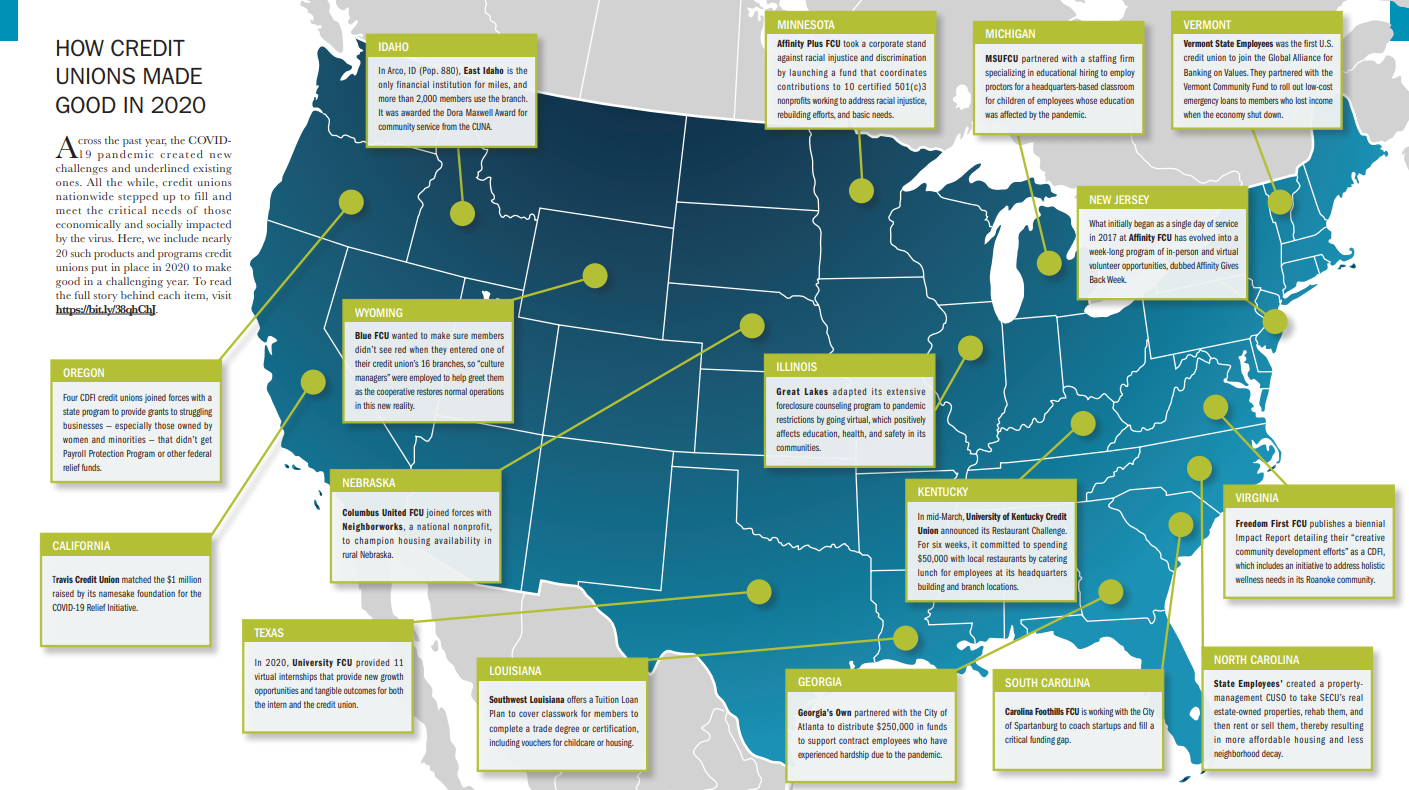

Across the past year, the COVID-19 pandemic created new challenges and underlined existing ones. All the while, credit unions nationwide stepped up to fill and meet the critical needs of those economically and socially impacted by the virus and its affects. Here, we include nearly 20 such products and programs credit unions put in place in 2020 to make good in a challenging year.

Click to enlarge.

It’s A Beautiful Day In The Neighborhood

Columbus United FCU joins forces with a national nonprofit to champion housing availability in rural Nebraska.

Read Now

Small-Dollar Loans Boast Big Career Potential

A Louisiana credit union brings technical education within reach by removing two major barriers to attaining it.

Read Now

Oregon Credit Unions Step Up To Distribute Relief

A group of member-owned cooperatives and their league helped strapped residents and businesses through state programs.

Read Now

A Strategy To Express Social Values. Every Day. All The Time.

Even the most basic principles of a credit union’s work are worth celebrating. This credit union tells its story while engaging its community.

Read Now

On-site Learning Lab Supports School Children At MSUFCU

Employees can bring their kindergarten through eighth grade students to work at the credit union’s headquarters.

Read Now

Student Internships In The Age Of Virtual Staffing

After adopting a virtual model for its college internship program, UFCU continued to build out financial wellness counseling, networking, and scholarship components.

Read Now

Rebuild, Repair, Recover: Affinity Plus Helps The Twin Cities Heal

Listening, then acting, has helped the big Minnesota credit union respond to the protests in its hometown.

Read Now

A Major Metro Partnership Provides Grants To City Workers

When the coronavirus pandemic created economic hardship for Atlanta contract workers, the city turned to a local credit union to disburse tax-free funds and bridge the income gap.

Read Now

Operation Takeout: Supporting Restaurants In Their Time Of Need

The Restaurant Challenge from the University of Kentucky FCU guarantees revenue for local businesses and a paycheck for their workers.

Read Now

Great Lakes Credit Union Forges Into The Forefront Of Foreclosure Counseling

Counselors adapt to pandemic restrictions as the Chicago credit union expands its HUD-funded housing counseling program.

Read Now

Support For Small Businesses During The COVID-19 Crisis

Carolina Foothills FCU is working with the City of Spartanburg to coach startups and fill a critical funding gap. That’s important because small-business support is now more important than ever.

Read Now

A Small-Town Branch Strategy For Dispersed Members

East Idaho Credit Union calls the state’s second-largest city home but also has branches in communities with fewer than 1,000 residents, where members are known to drive 30 miles or more to conduct their financial business.

Read Now

Culture Managers And Heart Taps Mark Lobby Reopening At Blue FCU

The Wyoming-Colorado credit union is striving to maintain safety and culture as it works to restore operations.

Read Now

A Day Of Service During A Challenging Year

Five credit unions share how they volunteer when in-person gatherings are more difficult than ever.

Read Now

What’s In A Name: Community Impact Officer

Simeon Chapin plays an integral role in communicating and executing Vermont State Employees Credit Union’s goals to make a local and global difference.

Read Now

Rehab, Rent, Sell: A 3-Part Strategy To Fight Foreclosures

SECU rethinks REOs to create quality, affordable housing across the Tarheel State.

Read Now

Travis Credit Union Offers $1M In Donations In Support Of Community Partners Amid COVID-19

In addition, the credit union will match up to $4M for donations made to the Travis Credit Union Foundation.

Read Now

This piece initially ran in the 3Q20 issue of Credit Union Strategy & Performance. Click here to download the full issue.