Employee compensation is typically one of the largest expenses in a credit union’s budget. But adequately staffing a credit union requires considerations beyond simply finding the right balance between paying employees too much or too little.

Expenses On The Rise

Credit union expenses, specifically employee salaries and benefits, as a share of total revenue have increased over the past 10 years.

In the first quarter of 2007, employee compensation at credit unions accounted for 24.2% of total revenue, according to data from Callahan & Associates. Fast forward to first quarter 2017, and employee compensation accounted for 33.9% of total revenue.Conversely, only 26.9% of revenue at banks went to employee salaries in the first quarter of this year.

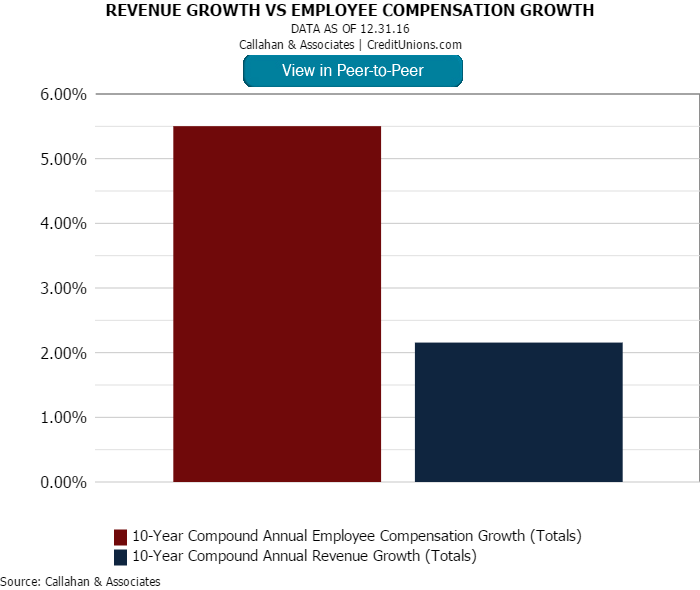

Credit unions generally do have larger workforces today than they did 10 years ago; however, overall employee compensation has grown at a faster rate than the number of employees over the same period. Compound annual employee compensationgrowthfor the past 10 years is 6.4%, compared with compound annual revenue growth of 2.8%.

Smaller institutions typically devote a larger share of revenue to salaries than their larger counterparts, and the negative correlation between salaries and benefits as a percent of revenue exists in the credit union space, too. Credit unions with more than $1 billion in assets devote 31.1% of their revenue to employee pay, whereas credit unions with less than $20 million spend 42.6% of revenue on compensation.

Revenue Growth Versus Compensation Growth

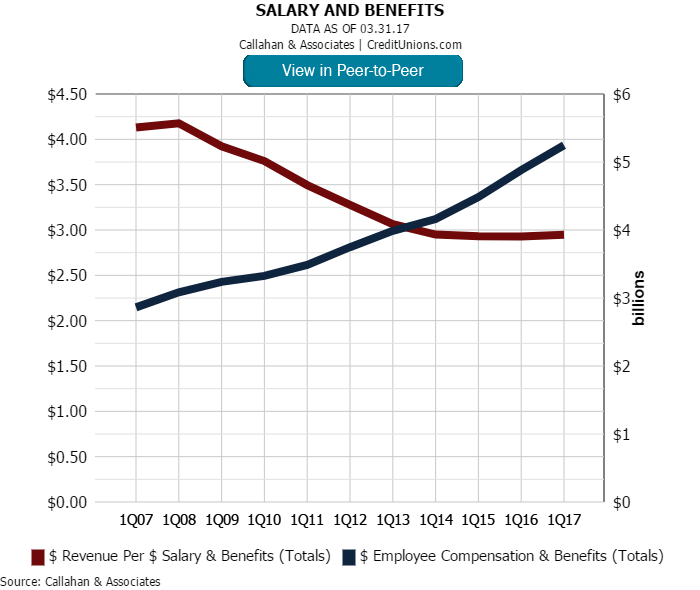

Despite credit unions spending more on salaries and benefits, the revenue they are earning per money spent on salaries and benefits is declining.

Luckily for credit unions, the gap between revenue growth and salary growth has tightened during the past two years. After increasing its share from 2008 to 2016, employee compensation accounted for a smaller share in revenue in the first quarter of 2017than it did in the fourth quarter of 2016.

Changes In Operating Expenses

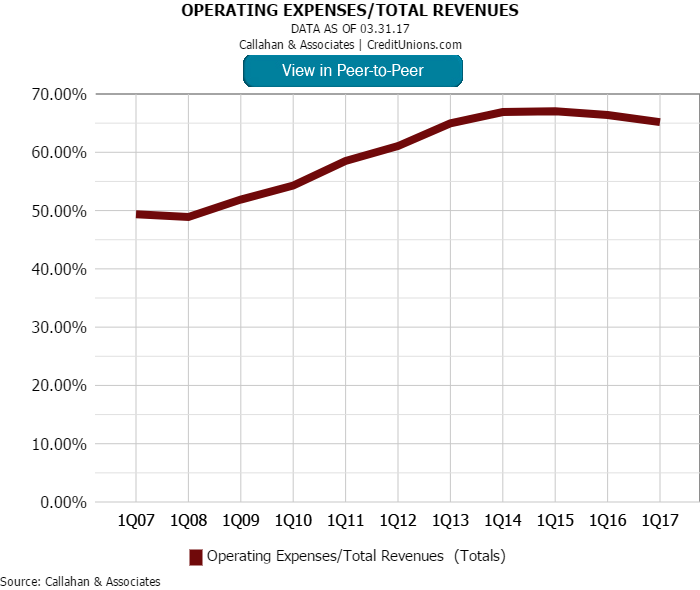

Total operating expenses as a share of total revenue has also risen over the past 10 years and accounted for 65.2% of total revenue in the first quarter of 2017. However, according to performance data from Callahan & Associates, the ratio has followeda similar trajectory to salaries and benefits and decreased during the past two years.

How does your credit union compare against peers in operating expenses, salary and benefits, employee compensation growth, and more? Find out with Peer-to-Peer. Learn more here.