Equity markets strengthened across 2019, with the Dow Jones Industrial Average up 1,801 points from September 2018 to September 2019. To stabilize growth in the face of swirling domestic and global economic headwinds, the Federal Reserve cut its benchmark interest rate twice in the third quarter and finished September with a target rate of 1.75%-2.00%.

In the broader financial services industry, banks and credit unions have reported improved earnings following the 2018 rate cuts; however, increases in interest expenses have accelerated in recent quarters, putting downward pressure on margins.

Key Points

- Investment income increased 23.2% year-over-year, pushing yield on investments up 42 basis points.

- At $4.7 billion, interest income from loans contributed 73.1% of the total year-over-year increase in revenue.

- Total revenue grew 11.79% year-over-year to $61.4 billion at the end of the third quarter, driving ROA to 0.98%.

- The industry’s average net worth ratio was 11.4% as of Sept. 30. More than 98% of credit unions reported a well-capitalized net worth ratio of 7% or higher.

Click the tabs below to view graphs.

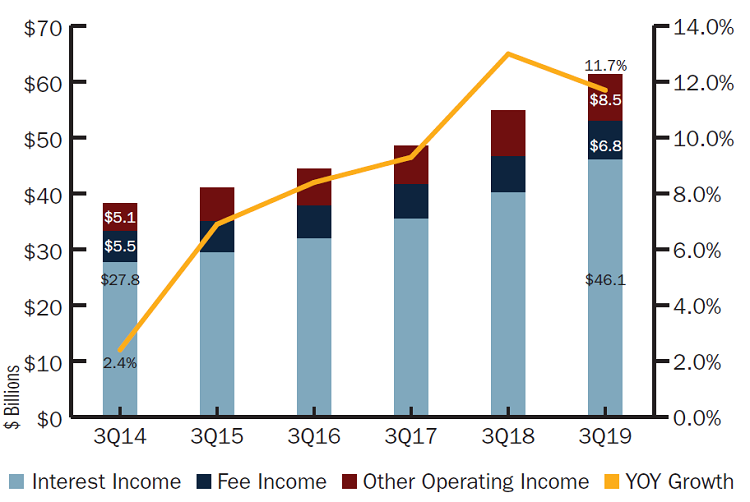

TOTAL REVENUE AND ANNUAL GROWTH

TOTAL REVENUE AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

A 14.7% annual gain in interest income largely drove revenue growth in the third quarter.

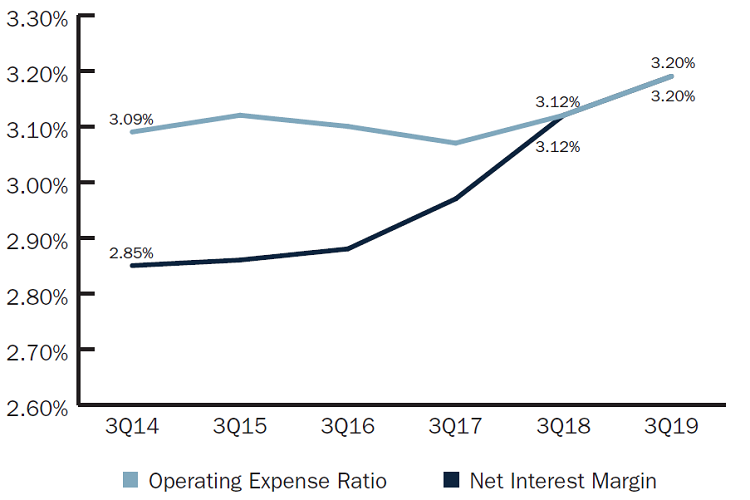

NET INTEREST MARGIN VS. OPEX

NET INTEREST MARGIN VS. OPEX

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

The net interest margin and the operating expense ratio increased 7 basis points each in the last 12 months, reaching 3.20% as of Sept. 30.

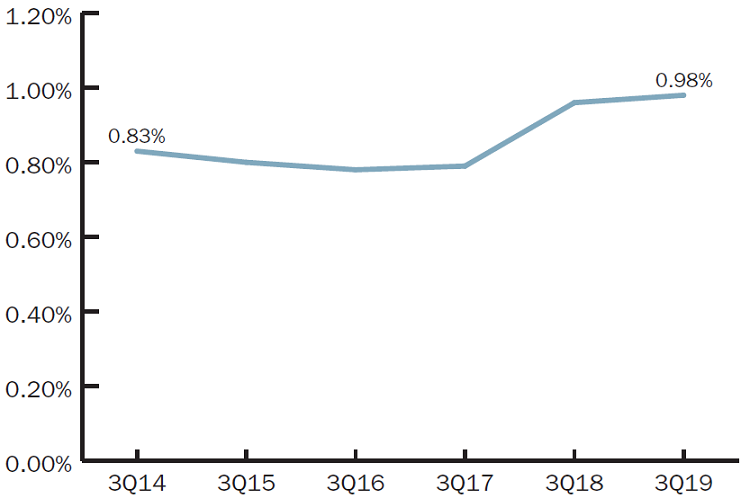

RETURN ON ASSETS

RETURN ON ASSETS

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

ROA approached 1% in the third quarter of 2019. In the past five years, ROA has increased 15 basis points to 0.98%.

The Bottom Line

The 2018 rate hikes presented latent benefits to credit union earnings in 2019. As loan yields moved modestly higher, year-to-date net income at U.S. credit unions reached $11.1 billion as of Sept. 30, 2019. That’s 7.9% more than the same time last year. Interest income increased 14.7% annually to $46.1 billion as credit unions took advantage of the growing mortgage refinance market that declining interest rates brought on. Strong earnings in the past 12 months pushed up ROA by 2 basis points annually. That reached 0.98% in the third quarter of the year. And, at 11.5%, the annual growth in capital was the highest since 1999. With rising earnings and capital, credit unions are well positioned to make member value investments in 2020.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.