An improving economy and favorable rate environment contributed to increased loan volumes at credit unions in 2014. Total loans outstanding increased 9.3% from the fourth quarter of 2013, nearly 1.5% greater than growth in the same period the year prior. A closer look at the individual components of the loan portfolio reveals credit card lending increased 7.1% from December 2013.

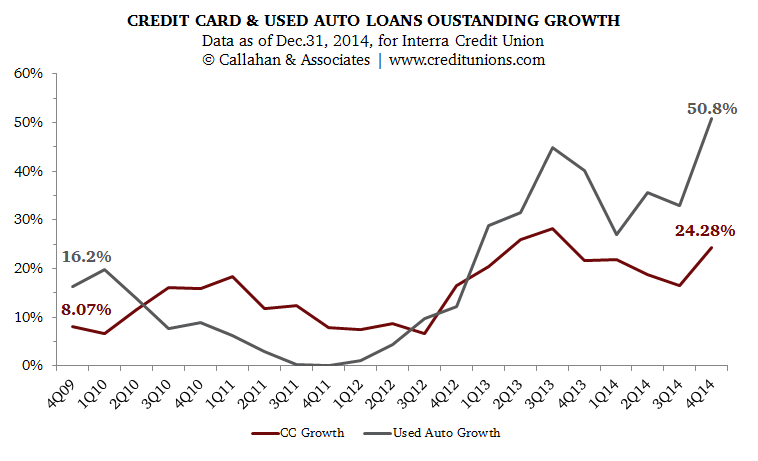

Interra Credit Union ($720.0M, Goshen, IN) outpaced both national and Indiana credit unions in all lending categories. Its total loans outstanding increased 19.6% in 2014, with non-real estate loans outstanding including credit card, auto, and other rising 36.6% in the same period. Credit card loans outstanding at Interra increased nearly 25% from 2013; the growth in the number of credit card loans outstanding topped 30%. Comparatively, credit card loans outstanding at Indiana credit unions increased 8.4% during the period.

In addition to impressive credit card growth, Interra posted above above-average automotive lending in 2014. Specifically, used auto loans, which account for nearly one-fifth of the loan portfolio, increased $31 million (50.8%) in 2014, contributing more than 40% of the year-over-year growth of the loan portfolio.