What Is Cost Of Funds?

(dividends paid to members)

+ (interest paid on borrowed money)

average outstanding shares and borrowings

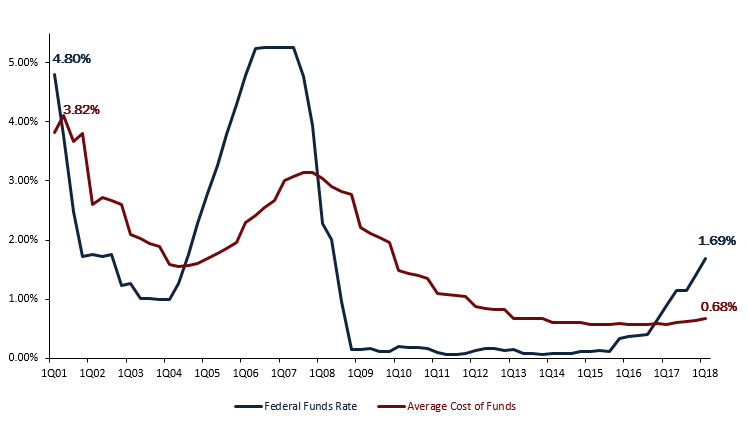

The credit union cost of funds correlates directly with the federal funds rate. The federal funds rate is expected to increase throughout 2018 and has increased six times since December 2015.

As the fed fund rate increases, the cost of fund ratio increases for credit unions. A lower cost of funds allows credit union borrowers to take out loans with lower interest rates. With every rate hike, the interest rates on loan products increase; however, members also have access to deposit accounts that offer higher interest rates.

Cost of funds is an important metric in daily credit union operations answer the questions below to test your knowledge.

ContentMiddleAd

Click on the question to view the answer.

Question 1: (True or False) The cost of funds for credit unions will hit a record high in the first quarter of 2018?

False. Based on early performance data released by the NCUA and available in Peer-to-Peer, Callahan predicts the cost of funds for credit unions will be 0.68%. This is 10 basis points higher than one year ago, but it is still lower than the all-time high of 4.03% from December 2000.

Question 2: What and when were the smallest and largest spreads between the fed fund rate and credit union industry cost of funds?

At 0.65% and 0.59%, respectively, the federal funds rate and the credit union cost of funds were closest in December 2016.

The largest spread observed occurred in the second quarter of 2006, when the federal funds rate was at 5.24% and the industry cost of funds was 2.42%.

Question 3: In what year was the highest federal funds rate ever recorded?

The Federal Reserve recorded an all-time high federal funds rate of 19.10% on June 1, 1981.

On the opposite end of the spectrum, the Fed recorded an all-time low rate of 0.07% on July 1, 2011. The rate has increased gradually since then.

COST OF FUNDS VERSUS FED FUNDS RATE

FOR U.S. CREDIT UNIONS AND BANKS | DATA AS OF 03.31.18

Although the credit union cost of funds rate is not in lockstep with the federal funds rate, the changes in the fed funds rate dictate the directionality of the credit union cost of funds.

Source: Callahan & Associates.

The data in this posting is from Callahan’s Peer-to-Peer. Want to analyze your first quarter performance against relevant peers in the industry? Learn more about Peer-to-Peer today.

Based on early performance data released by the NCUA and available in Peer-to-Peer, Callahan projects the spread between the federal funds rate and the industry cost of funds will be 1.01%. Credit unions likely will trail the increases in the federal funds rate. How much higher the cost of funds will be depends on the rate of increases from the Fed. Faster increases from the Fed will widen the spread between cost of funds and the federal funds rate, whereas slower increases will allow time for the cost of funds to adjust and tighten the spread.

Credit unions in the United States will likely continue to see their cost of funds rise if the Fed continues to raise rates in 2018.