Rates might have stopped rising, but the pace of change inside credit unions has not slowed. The economy continues to defy predictions of an impending recession, and the next wave of innovation is no longer theory — it’s showing up in daily operations. Artificial intelligence has moved from experimentation to execution, finding its way into lending, underwriting, and member engagement.

At the center of that shift is the core system. It is where data, delivery, and decision-making all connect. Choosing a provider today is no longer a purely technological choice; it is a strategic one that shapes how credit unions serve members, manage growth, and adapt to what comes next.

And as the market continues to consolidate, knowing who leads, who’s gaining ground, and who’s standing firm has never been more important.

Fewer Players, Bigger Plays

Consolidation continued through the first half of 2025, as the number of active credit unions fell by 171 in the past 12 months, from 4,631 to 4,460. Three new institutions entered the field, but mergers and closures once again outpaced new formations — a reminder that although the industry continues to evolve, scale and efficiency are increasingly driving its structure.

Even as the number of players shrinks, credit unions are serving more members than ever before. Total membership climbed by 2.7 million, or 1.9%, reaching a record 145 million by mid-2025. That steady growth reflects the continued appeal of cooperative banking, especially in an environment where consumers are seeking value, stability, and trust.

Financially, the movement remains strong. Shares increased 4.9%, or $95.1 billion, to reach $2.042 trillion. Loan balances grew 3.9%, or $63.2 billion, to $1.7 trillion, signaling ongoing confidence from both lenders and borrowers.

Competition for deposits remains intense, but credit unions continue to prove that loyalty and relationship-based service can drive growth even when pricing power is limited. There might be fewer players on the field, but they are making bigger plays.

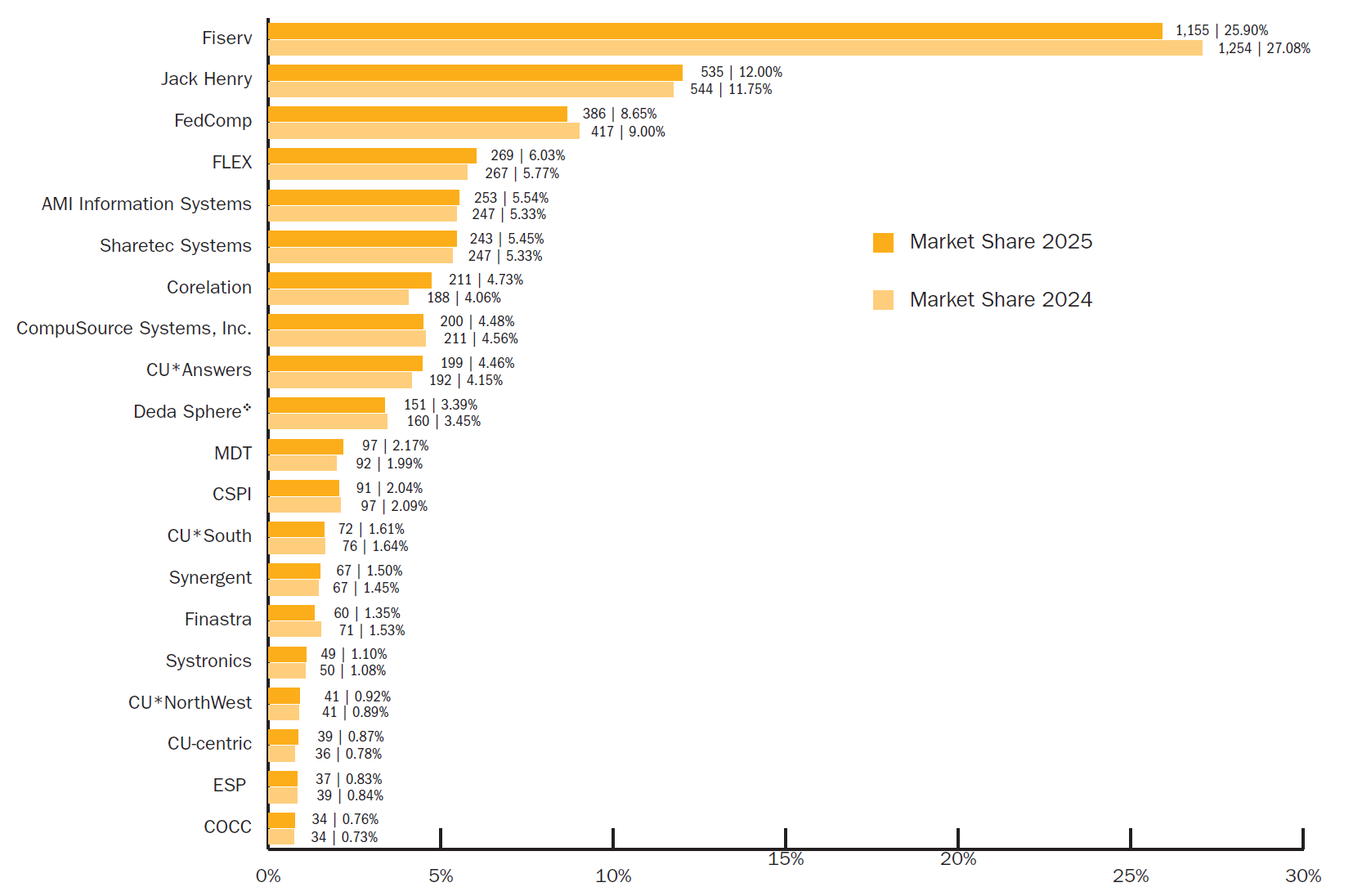

MARKET SHARE FOR TOP 20 CORE PROVIDERS BY NUMBER OF CREDIT UNION CLIENTS

# REPRESENTS TOTAL CREDIT UNION CLIENTS | % REPRESENTS TOTAL MARKET SHARE*

SOURCE: Callahan & Associates

The Giants Reposition

The same names continue to anchor the core processing landscape, but their footing looks a little different this year. Fiserv remains the market leader with 1,155 credit union clients, representing 25.9% of the industry, although its share slipped 118 basis points from the year prior. Jack Henry follows with 535 clients, 12.0% of the market, after gaining 25 basis points over the same period.

Together, the two serve 37.9% of all credit unions by client count. Their combined presence shapes much of the industry’s technological direction, but the dynamics between them tell a story of slow, deliberate repositioning rather than disruption.

Jack Henry continues to strengthen its grip among the largest institutions, serving 214 credit unions with more than $1 billion in assets, two more than last year. Fiserv has 153 in that group, up by one. In the $250 million to $1 billion range, the momentum swung in Jack Henry’s favor, which now leads with 211 clients compared to Fiserv’s 172, a decline of 21 for the long-time leader.

Fiserv still dominates the smaller asset tiers, where legacy relationships and multi-platform flexibility keep it deeply embedded in community institutions. But the market share data suggests that some of that loyalty is being tested, as credit unions weigh the value of scale and support against modernization and adaptability.

The hierarchy remains — but the ground beneath it is moving.

The Current Beneath The Core

The core market keeps evolving, even when the surface looks still. Credit unions continue to merge, modernize, and migrate, and those quiet shifts reveal where the current is heading.

Of the 174 credit unions that closed their doors in the past 12 months, 36 were Fiserv clients, representing 22.4% of all closures. Including those that switched providers, Fiserv ended the year down 99 total clients, the largest decline of any vendor. Still, it remains the market leader, serving more than a quarter of all credit unions nationwide.

Corelation again stood out on the growth side, adding 23 new credit unions to its KeyStone platform. The company now serves 211 institutions, lifting its market share by 67 basis points to 4.7%.

Across the broader market, of the 27 core processors with at least $400 million in combined client assets, seven gained clients, 16 lost clients, and four held steady. The rankings barely moved, but the direction of change is clear. Fewer providers are winning a greater share of relationships, and the middle of the market continues to thin.

Mind The Platform

Symitar remains the industry’s most widely used platform, serving 699 credit unions across three providers: Jack Henry with 535, Member Driven Technologies (MDT) with 97, and Synergent with 67. Altogether, 15.7% of credit unions nationwide operate on a Symitar-based core.

The overall count of credit unions fell by four this year, but the shifts within that total reveal ongoing motion. Jack Henry lost nine clients, whereas Member Driven Technologies added five and Synergent held steady. The adjustments might seem minor, but they highlight how scale and service models continue to reshape vendor relationships beneath the surface.

Fiserv’s Portico platform moved in the opposite direction, adding 84 new credit unions in the past year for a total of 613 clients, or 13.7% of the market. The growth reflects Fiserv’s continued effort to migrate credit unions from older systems to a smaller number of modernized, integrated cores.

That migration came at the expense of several legacy platforms. Fiserv’s CUSA lost 38 clients, FedComp’s Platinum platform dropped 31, and Galaxy declined by 26. The trend points in a clear direction: fewer platforms, deeper functionalities, and closer alignment with credit union strategy.

The pattern is not about who is new or who is fading. It is about how the infrastructure of the industry continues to tighten — fewer systems supporting a larger share of members, and each playing a more strategic role than ever before.

The Human Connection

Technology continues to evolve, but the human element behind every core decision remains unchanged. Every line of code, every systems upgrade, every migration still comes down to people. The teams that run the operations, the vendors that build the tools, and the members they serve.

Core systems remain the foundation of that connection. They enable every interaction, every transaction, and every moment when a member chooses a credit union over another option. Even as artificial intelligence reshapes processes and automation expands capacity, success still depends on human judgment, collaboration, and trust.

Credit unions balance progress with purpose. They don’t chase the newest tool; they use the right ones to serve members better. The system powers the work, but people define its purpose. That is what keeps the movement human.

This page is updated annually with market share figures available at midyear. For a look at last year and how things have shifted, click here. Note: The market share data presented reflects the information submitted by participating companies.

Evaluating Core Processors? Peer Suite Has You Covered. Whether you’re a credit union evaluating core processing solutions or a supplier evaluating market share, Peer Suite is loaded with technology partner data that makes it easy to uncover deeper insights to fuel your strategies. Curious to learn more? Schedule a conversation with Callahan & Associates today. Learn more today.