Credit unions are financial institutions of the people, by the people, and for the people; so when it comes to making an impact, members are a top priority. Because they are meant to be more people-focused rather than profit-driven, a successful credit union can look very different from a successful bank.

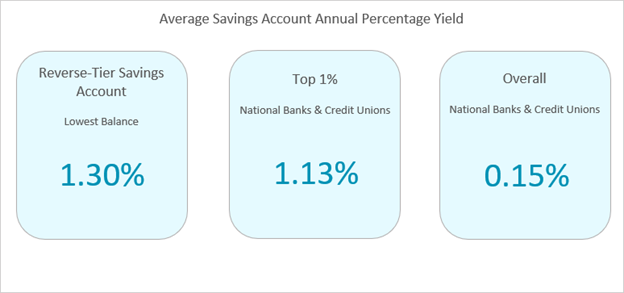

In pursuing this people-focused success, credit unions build member-supportive services that may not fare as well in a banker mindset. Based on data from Callahan’s 2021 Impact Survey, an average of 32.5% of members who are 18 years or older held at least $400 in checking and savings deposits by year-end at their credit union. The importance of saving was made especially clear after the mental, physical, and economic difficulties brought on by the pandemic and subsequent economic turmoil. Credit unions are looking for other ways to aid members in saving long-term, as well as being able to cover unforeseen emergencies. A relatively new product is the reverse-tier savings account (RTSA), which 14.7% of participating credit unions offer to their members. RTSAs are primarily offered by credit unions and offer higher interest rates on lower balances. The average yield on the lowest balance tier among credit unions in the Impact Survey was 1.30%, up to an average maximum balance of $3,500. According to DepositAccounts.com, a banking account comparison website, the average APY for the top 1% of savings accounts is 1.13%, while the overall national average is 0.15%. RTSAs are intended to promote saving for those with no or very little savings by incentivizing them to take advantage of the high rate to funnel even a few dollars extra into a rainy-day fund.

Supporting members means more than serving high-income city-dwellers it means serving members of all circumstances, and making services accessible and affordable to all consumers, regardless of membership status. Half of participating credit unions provide members free access to their credit score, which can help members take steps to improving it, should it be necessary. Additionally, 17.7% of credit unions offer credit-builder loans, small loans intended to do just that. The 2021 Credit Union National Association Membership Benefits Report found that, on average, credit unions charge lower interest rates for loans, offer higher interest rates for shares and deposits, and charge fewer and lower fees compared to banks. This equates to an estimated $98 in savings per member and $206 in savings per member household just by choosing to do business with a credit union over a traditional bank. This is especially helpful in underserved areas, where less access to financial institutions can translate to higher fees and loan rates.

Serving the underserved is a key component of the credit union philosophy, and that includes serving the community where a credit union is based. Credit unions participating in Callahan’s Impact Survey funded more than $169.4 million in commercial loans in underserved areas last year. Businesses are an integral part of local economies and communities, and commercial loans can act as a powerful tool to stimulate business growth and job creation.

Though members sometimes make up just a small fraction of the community a credit union serves, many credit unions still step up to the plate to aid entire communities, regardless of the size of their membership. According to a 2021 report from the Filene Research Institute’s Center for Consumer Financial Lives in Transition, unbanked consumers reported the nation’s lowest median income at just $18,395. Although the median income for the overall population remained largely unchanged from 2001 to 2019, credit union-only households reported a decline in median income over the same period from approximately $50,000 to $41,946. This means that credit unions are now serving more members with lower incomes those who are traditionally underserved. Unbanked households also have the largest proportion of heads of household without a completed high school education, as well as heads of household with just a high school diploma or GED as their highest education level.

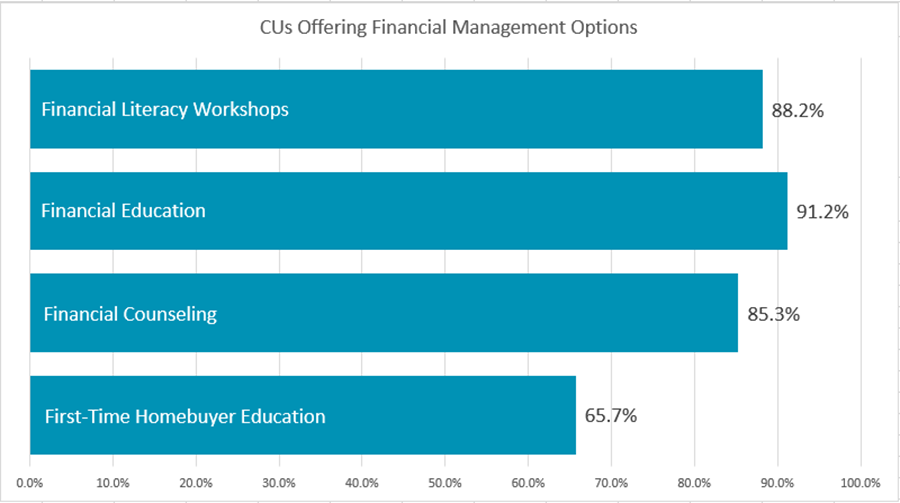

When it comes to addressing community needs, credit unions dream big but not unattainably. Of the institutions that participated in Callahan’s 2021 Impact Survey, 61.5% said their key community needs include some form of education. Credit unions are uniquely positioned to address some aspects of this; as financial institutions, they have a wealth of knowledge and experience when it comes to money management, which they can then pass on to their members and communities. In fact, most participating credit unions offer at least one financial management option to their members 91.2% offer financial education, 88.2% offer financial literacy workshops, 85.3% offer financial counseling, and 65.7% offer first-time homebuyer education. These options impart essential knowledge to members, from understanding financial terms to managing household debt. According to the FINRA Foundation’s 2021 National Financial Capability Study, consumers with lower levels of financial literacy are more likely than those with higher financial-literacy rates to engage in costly credit card behaviors and rely on borrowing methods outside of mainstream financial services, such as pawn shops, title loans, tax refund advances, or payday lenders. Only 35% of lower financial literacy respondents spent less than their income. Credit unions’ financial literacy initiatives can help bridge the gap for their members.

Credit unions participating in Callahan’s 2021 Impact Survey identified the terms above as community needs.

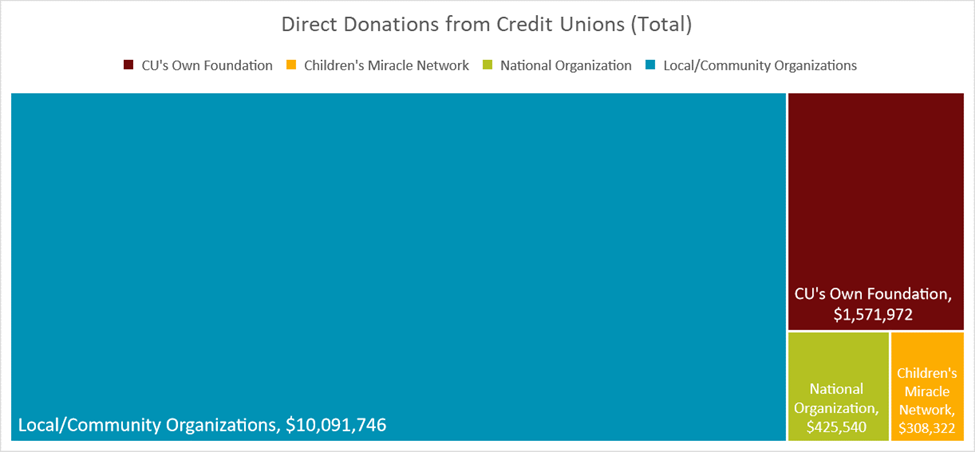

While credit unions have a mandate to serve their members, that doesn’t stop them from making an impact on the entire community. Credit unions in our 2021 Impact Survey reported over $12.5 million worth of scholarships, grants, and other charitable gifts and donations given in 2021 to their respective communities. This money is overwhelmingly donated to local and community organizations, with over 80%, or $10.1 million, donated to these types of organizations. Donations to local and community organizations allow credit unions to aid their communities by funding specific needs via those who know how to support these initiatives best. They also allow credit unions to impact more than just their members.

The information in this article looks at the past as is the nature of market research. That said, I encourage you to use this information as a springboard for thinking differently about your business going forward. Ask yourself how you can rethink activities to support an even bigger impact and imagine what your community could look like if you reoriented your mindset as a community resource provider and not simply a cooperative financial institution?