The NCUA has set a new record for comment letters, but most weren’t from credit unions.

NCUA spokesman John Fairbanks told Credit Union Times the agency has received 3,094 comment letters on its proposed changes to member business lending rules, an all-time record.

That breaks the mark of nearly 2,200 received earlier this year about the regulator’s proposed new risk-based capital rules. One big difference this time? Most of the letters received by the end of August deadline were from bankers, who say credit unions are not qualified to do commercial lending, are guilty of mission creep, and are making an end-around of the 12.25% MBL cap.

Bills that would raise the cap have again been proposed in Congress, where they again may well languish in the face of withering bank opposition. The NCUA’s proposed MBL changes, which primarily replace prescriptive rules with an expectation for self-governing policies and enhanced examiner training, are getting a similarly chilly reception.

This response makes a powerful statement. It shows the NCUA has gone too far, and bankers won’t stand for it, says ABA President and CEO Frank Keating. We will make sure Congress is aware of this outpouring of opposition as we encourage lawmakers to exercise more oversight of an agency that seems to have lost sight of its mission.

While some industry advocates note that many of the comments appear to be repeated form letters, in all fairness the same could be said of the RBC mail campaign earlier this year. The agency said then it reads and considers it all.

The MBL rule would:

-

Give credit union loan officers the ability to waive a personal guarantee

-

Remove explicit loan-to-value limits and eliminate the need for a waiver process

-

Lift limits on construction and development loans

-

Clarify that non-member loan participations will not count against the statutory member business lending cap.

CUNA says the rule would remove almost all MBL requirements not specified in the Federal Credit Union Act, originally passed in 1934, and gave the proposal this qualified endorsement: CUNA supports the overhaul of NCUA’s current MBL regulation to the extent that it shifts from a prescriptive regulation that contains many detailed requirements to a principle-based regulation that gives more flexibility in the construction and operation of an MBL or commercial program. However, the rule can, and should, go further.

Bankers say it goes too far, violating the spirit of the 1998 Credit Union Membership Access Act, in which, the ABA’s comment letter says, Congress made it clear that credit unions should be focused on consumer lending, not commercial lending.

The credit union lobby is backing the changes with some reservations but the rank-and-file may or may not care, depending on their involvement. Credit unions that care, care very much. Those that don’t do a lot of that kind of lending really don’t, says Jay Johnson, a credit union strategy consultant and executive vice president at Callahan & Associates.

Credit unions have been doing business lending for a long time. It’s a small part of our industry but a growing part of the portfolio, Johnson says. Some say we should push for the new cap and any other relief, while others say, No, don’t, that it makes us look too much like a bank and tax exemption could become vulnerable as a result.’

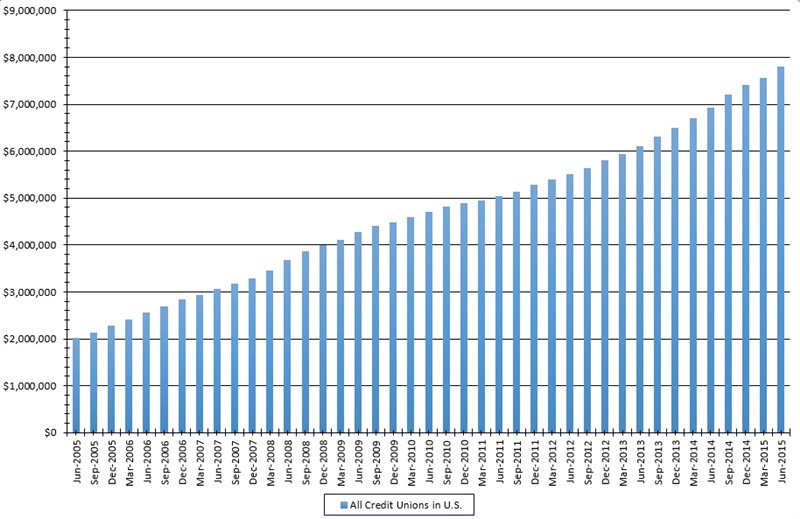

OUTSTANDING MEMBER BUSINESS LOANS

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

How they see it.Stephen Mackowitz says the new rules would allow Digital Federal Credit Union ($6.42B, Marlborough, MA) to boost its MBL activity by 5% to 10%. DCU currently has a $665.66 million MBL portfolio, the fourth-largest in the Callahan database and the second largest that is not tied to a specific industry.

(New York City’s Melrose Credit Unionat $1.80 billion specializes in taxi medallions while number 3 on the list church lender Evangelical Christian Credit Union in California had a $670.80 million portfolio as of 2Q2015. Bethpage Federal Credit Union on Long Island is second on the overall list at $673.07 million.)

Mackowitz, DCU’s senior vice president for commercial lending who launched the DCU program in 2002, says his operation would benefit from the relaxation of the waiver and collateral rules. Right now, we can’t provide financing for many franchises, because the rules only allow us to finance against hard collateral. Now, we’ll be able to make cash-flow loans, Mackowitz says.

We have other self-imposed caps that are more conservative than the NCUA’s. We feel it’s prudent to base our decisions on our organizational risk tolerance rather than what is allowed by a regulator.

An example would be if a Subway franchise was selling for $200,000, we could only loan against the hard collateral of basically restaurant equipment, thus our loan limit might be $40,000. Now we can loan maybe up to 70% of the franchise cost, the DCU lending executive says.

The new rules play well with the membership of a credit union like BECU ($13.60B, Tukwila, WA), says Dana Gray, the big credit union’s vice president of business services. Removing the arbitrary and prescriptive restraints on certain types of lending, Gray says, will allow BECU to expand its business lending portfolio with a membership base that is both entrepreneurial and looking for ways to fund sound small business ventures.

Meanwhile, here’s the perspective of one credit union for whom the changes may mean little change: We understand that 2,759 of the letters oppose the rule and 327 are in favor of it, so it seems like higher level of grassroots activity than in the past, and for that reason, I’m a little surprised, says Brandon Riechers, EVP and chief lending officer at Royal Credit Union ($1.62B, Eau Claire, WI).

Royal has $623.4 million in outstanding member business loans as of 2Q2015, the fifth most of the 2,143 credit unions reporting MBLs in that quarter, according to the Callahan & Associates database.

With a state charter and CDFI designation, Royal already is exempt from the MBL cap, and with 30 years of MBL experience, RCU expects to see little change if and when the NCUA board approves the new rules. We have other self-imposed caps that are more conservative than the NCUA’s, Riechers says. We feel it’s prudent to base our decisions on our organizational risk tolerance rather than what is allowed by a regulator.

Wouldn’t be prudent. Speaking of prudent, here’s what the ABA says in its Aug. 28 comment letter: The amendments set forth in this proposal will lead to safety and soundness concerns as business lending regulations become increasingly lax and increased commercial lending becomes more appealing to the credit union industry.

In his own comment letter, Harris Simmons, chairman and CEO of Zions Bancorp in Salt Lake City, UT, says, Credit unions generally lack the skills and controls necessary to safely engage in this business.

Another letter writer, Douglas Bruins, president of the $660 million Citizens Bank in Mukwonago, WI, blames unsafe commercial business lending practices for forcing many of the mergers and acquisitions that have shrunk the number of state-chartered credit unions there from 223 to 160 over the past five years. I believe the principal reason for the majority of this M&A activity was to avert credit union failure, he writes.

Examiner issue. Of course, the responsibility for ensuring the principles of soundness and safety are being adhered to under the new rules still greatly resides with the regulator. If the proposed rule is adopted, the NCUA says, it would conduct specialized training for examiners at a one-time cost of about $1.9 million before implementing the rule, and provide supervisory guidance to credit unions.

That regulatory uncertainty offsets the pleasure some may feel as they see an end to their MBL cap woes.

We are seeing strong interest from credit unions are at or approaching their MBL cap.Despite that readiness, the proposed changes are being met with some trepidation because the adjustments to the exam process are unknown at this time. Being used to the current exam process, credit unions are concerned that the proposed changes could lead to greater time requirements and additional personnel needs, says Tony Lillie, chief credit officer, CU Member Business Lending, at Minnesota-based CU Companies.

Comedy relief? The idea of not counting loan participations against the MBL cap, although it provides regulatory relief, is not universally popular in credit union land, either. I think it’s comical, says Mackowitz at DCU. A business loan is a business loan, and all business loans should count against the cap.

Riechers at RCU also objects to the loan participation change and places it in the overall context of lender experience at credit unions. By eliminating many of the experience requirements and not counting (loan participations) against the cap, it would seem the NCUA is taking unnecessary risks by allowing the potential for credit unions to rely solely on the originating credit union’s experience and not the risk tolerance of the purchasing credit union, he wrote in his comment letter.

Another MBL veteran, Credit Union Business Group president and CEO Larry Middleman, adds, The rationale is kind of funny. It’s kind of counterintuitive, especially if the credit union with little experience is doing the buying. You can do an unlimited amount of that, but you’re limited in your own home area.

However, one of the proposed rule changes that makes perfect sense to Middleman and other stakeholders is the personal waiver. To be able to lend to a variety of what I call A-grade borrowers would clearly benefit credit unions, he says. You have people with high net worth and long-established businesses who are asked to make personal guaranties that they’re not asked to anywhere else in town. Not having to get that waiver anymore will open up the opportunity for credit unions to serve more of these blue-chip borrowers.

And to serve others that banks eschew. It’s limiting the ability to serve the home area that sticks in Philip Love’s craw. It’s crazy to think there are institutions that have to deliberately ignore the needs of a vital segment of the community that create the majority of jobs small businesses, says the president and CEO of Midwest Business Solutions in Rapid City, SD. Business lending is a means of becoming relevant to the market while at the same time promoting social good in their community.

Of course, with great change comes great responsibility. The proposed regulations will open up more options for business lending with credit unions, Love says. but it also will require more responsibility on the part of credit unions to structure and manage their programs in a sound manner.

A final vote on the rule change could yet come this fall.

Read more:

-

Here is the NCUA’s MBL comment page.

-

Here is the American Bankers Association’s comment letter.

-

Here is Royal Credit Union’s comment letter.