The data in this blog has been updated since its initial publication.

The average member relationship for U.S credit union offers a look at the depth of the relationship members have with their credit union. The metric combines the average loan and share balances for all members, minus commercial balances. A credit union’s pricing strategy, product offerings, and underwriting policies all contribute to the depth of its member relationships, and the industry’s overall increasing average member relationship suggests members are banking more with their credit union.

Click on the question to view the answer.

Question 1: (True/False) The average member relationship at U.S. credit unions has increased approximtely $5,000 in the past 10 years.

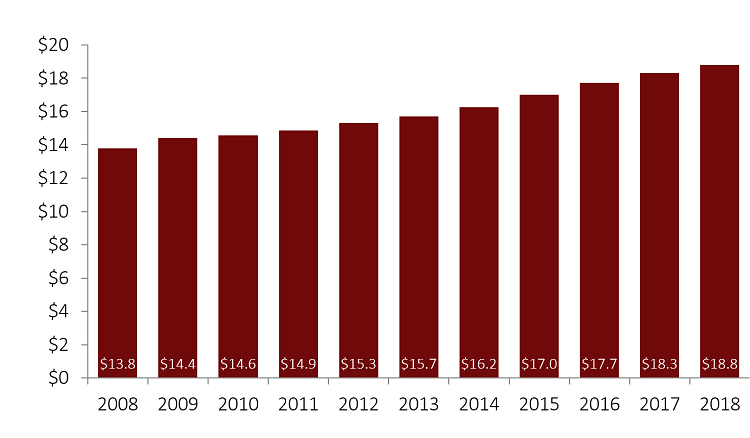

True. At year-end 2008, the average member relationship at U.S. credit unions was $13,777. This value has increased every year for the past decade, and analysts at Callahan & Associates are projecting it reached $18,775 at year-end 2018. Callahan also projects membership rose 4.6% annually to 117.8 million, showing how credit unions are deepening relationships with new and existing members alike.

AVERAGE MEMBER RELATIONSHIP

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Average member relationship has increased approximately $5,000 in the past 10 years at U.S. credit unions.

Source: Callahan & Associates.

Question 2: (True/False) One in every four members has an auto loan with their credit union.

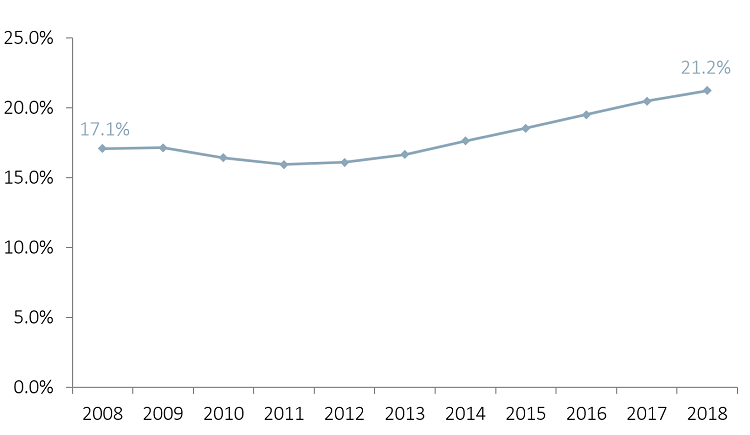

False. Analysts at Callahan & Associates are projecting that auto loan penetration at U.S. credit unions reached 21.2% in the fourth quarter of 2018. That’s up 73 basis points year-over-year. More than one-in-five members currently hold an auto loan with their credit union the highest penetration of any loan product.

Auto lending once considered the bread and butter of cooperative lending continues to be a point of strength for credit unions. Callahan projects total auto loan balances expanded 10.3% in 2018 to $370.5 billion at year-end, with used auto loans compromising 59.8% of the auto portfolio and new autos making up the remaining 40.2%.

AUTO LOAN PENETRATION

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

More than one-in-five members has an auto loan with their credit union.

Source: Callahan & Associates.

Question 3: (True/False) Share draft penetration has increased year-over-year every quarter since 2007.

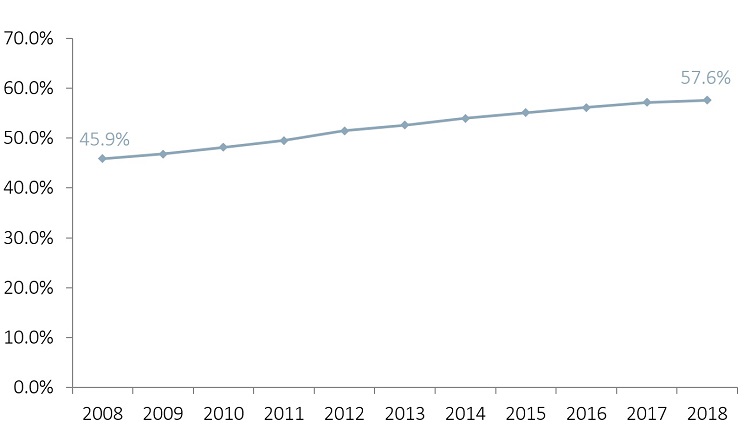

True. Analysts at Callahan & Associates project share draft penetration a relative measure for the percentage of members who use the credit union as their primary institution increased 41 basis points year-over-year to 57.6%. The last time this metric decreased on an annual basis was the second quarter of 2003. As credit unions position themselves as choice financial institutions, members continue to choose cooperatives for everyday financial needs.

SHARE DRAFT PENETRATION

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Credit unions have continually expanded their share draft penetration, a sign that more members are turning to the cooperatives for their every day financial needs.

Source: Callahan & Associates.

Discover The Latest Credit Union Trends

Join us for Trendwatch, February 14 at 2:00 p.m. ET to learn about 4Q 2018 credit union performance trends.

How Do You Compare?

Go beyond the national averages and dive deeper into individual credit unions, peer groups, state, and more using Peer-to-Peer. Let us walk you through your numbers with a custom performance audit.