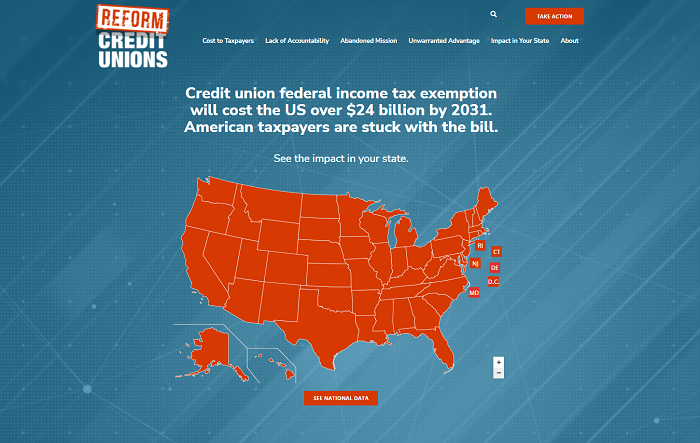

Every fall the bank lobby groups ramp up their PR fight against credit unions. This year’s attack by the American Bankers Association is called Reform Credit Unions and even includes a cute website to make the case.

Ok, I admit it. I am biased and (slightly) jaded about attacks from the banks. That aside, I do believe credit unions need to do more to show members and potential members that such smooth messaging is the result of fancy lobbyists trying to earn their money. Perhaps that’s why this year’s attack makes me particularly angry.

The ABA claims the credit union federal tax exemption is a detriment to taxpayers, but I see an emerging trend in which credit unions across the country are steadfastly working to improve the lives of their members and communities. Movement leaders are embracing even tighter the founding virtues of member-owned nonprofit financial cooperatives.

The ABA is calling to Reform Credit Unions. If the credit union movement was to counter that argument, we could call the website Rekindle Credit Unions.

In the beginning of the credit union movement, groups of people came to together to address a need. They had the drive and a shoebox, there is almost always a shoebox to create something new, something different to serve the needs of their community. As one group proved the model a success, others formed to address the needs of their community, and the movement exploded as the flame sparked a fire.

Today, a new generation of cooperative leaders are doubling down on purpose. They believe their credit union can be the catalyst for improving the lives of the members and communities they serve. These sparks are popping up all over the country in the largest and smallest credit unions, and although having a shared purpose isn’t new, using it as a competitive advantage might be.

How can shared purpose be a competitive advantage? Well, most credit unions don’t have the scale to compete solely on price, convenience, or technology big banks and fintechs generally win here. But when it comes to showing members and communities that their financial institution cares? That it is looking out for them? That their interests align? Well, credit unions can win that game.

Unfortunately, this value proposition won’t resonate with everyone. Some consumers will want only the best rate or the shiniest technology. That’s OK. Likewise, credit unions need to be OK with telling those consumers they would be better served somewhere else. This won’t be easy, but it’s easier and ultimately better than trying to be all things to all members.

So, what’s next?

First, leaders need to clarify the purpose of the credit union. That purpose should be something that inspires employees to come to work, something that employees are proud of and strive to live.

As you frame the credit union and all it does around that purpose, new people with whom that purpose resonates will join and participate, thus transforming the organization from one that competes on price and product into one that competes on emotion and connection.

This might be a lofty, abstract concept, but it is critical for the sustainability of credit unions. You are playing a game you are uniquely positioned to win. The markets need cooperatives, credit unions need to connect the dots.

Don’t believe me that credit unions need to do more? Nearly every credit union leader I talk with says, If our members would call us, we can help them navigate almost anything. This might be true, but how often do members call? Why don’t they call? Do they know calling is an option? If they did call, would the credit union be able to help them? Would they feel judged or shamed?

During the pandemic, several credit unions told Callahan they started reaching out to members proactively, checking in on them, identifying their fears, offering empathy, and explaining what tools and programs were available to help. These efforts paid off through higher ratings on trust, pride, and loyalty.

So, members know their credit union cared about them during the pandemic. Now how can the movement take that further?

Every year around Thanksgiving, Butterball sets up a hotline for baking questions. It’s designed for people who mess up their turkey, even if they didn’t buy a Butterball. Has your credit union thought about establishing a Butterball helpline for members who are in a financial jam?

The ABA is calling to reform credit unions. If our movement was to counter that argument, we could call our website Rekindle Credit Unions. That rekindling lies in asking questions such as, Should we host a holiday hotline? or Do members feel judged? and sharing what they’ve learned with other leaders on a similar journey. How did they make a hotline work? How do they encourage members to reach out?

Different credit unions might have distinct purposes and diverging goals, but the more they can connect and share with one another, the better their chances of turning small sparks of greatness into a firestorm for positive change.

Reform Credit Unions? No, Rekindle Them!

Every fall the bank lobby groups ramp up their PR fight against credit unions. This year’s attack by the American Bankers Association is called Reform Credit Unions and even includes a cute website to make the case.

Ok, I admit it. I am biased and (slightly) jaded about attacks from the banks. That aside, I do believe credit unions need to do more to show members and potential members that such smooth messaging is the result of fancy lobbyists trying to earn their money. Perhaps that’s why this year’s attack makes me particularly angry.

The ABA claims the credit union federal tax exemption is a detriment to taxpayers, but I see an emerging trend in which credit unions across the country are steadfastly working to improve the lives of their members and communities. Movement leaders are embracing even tighter the founding virtues of member-owned nonprofit financial cooperatives.

The ABA is calling to Reform Credit Unions. If the credit union movement was to counter that argument, we could call the website Rekindle Credit Unions.

In the beginning of the credit union movement, groups of people came to together to address a need. They had the drive and a shoebox, there is almost always a shoebox to create something new, something different to serve the needs of their community. As one group proved the model a success, others formed to address the needs of their community, and the movement exploded as the flame sparked a fire.

Today, a new generation of cooperative leaders are doubling down on purpose. They believe their credit union can be the catalyst for improving the lives of the members and communities they serve. These sparks are popping up all over the country in the largest and smallest credit unions, and although having a shared purpose isn’t new, using it as a competitive advantage might be.

How can shared purpose be a competitive advantage? Well, most credit unions don’t have the scale to compete solely on price, convenience, or technology big banks and fintechs generally win here. But when it comes to showing members and communities that their financial institution cares? That it is looking out for them? That their interests align? Well, credit unions can win that game.

Unfortunately, this value proposition won’t resonate with everyone. Some consumers will want only the best rate or the shiniest technology. That’s OK. Likewise, credit unions need to be OK with telling those consumers they would be better served somewhere else. This won’t be easy, but it’s easier and ultimately better than trying to be all things to all members.

So, what’s next?

First, leaders need to clarify the purpose of the credit union. That purpose should be something that inspires employees to come to work, something that employees are proud of and strive to live.

As you frame the credit union and all it does around that purpose, new people with whom that purpose resonates will join and participate, thus transforming the organization from one that competes on price and product into one that competes on emotion and connection.

This might be a lofty, abstract concept, but it is critical for the sustainability of credit unions. You are playing a game you are uniquely positioned to win. The markets need cooperatives, credit unions need to connect the dots.

Don’t believe me that credit unions need to do more? Nearly every credit union leader I talk with says, If our members would call us, we can help them navigate almost anything. This might be true, but how often do members call? Why don’t they call? Do they know calling is an option? If they did call, would the credit union be able to help them? Would they feel judged or shamed?

During the pandemic, several credit unions told Callahan they started reaching out to members proactively, checking in on them, identifying their fears, offering empathy, and explaining what tools and programs were available to help. These efforts paid off through higher ratings on trust, pride, and loyalty.

So, members know their credit union cared about them during the pandemic. Now how can the movement take that further?

Every year around Thanksgiving, Butterball sets up a hotline for baking questions. It’s designed for people who mess up their turkey, even if they didn’t buy a Butterball. Has your credit union thought about establishing a Butterball helpline for members who are in a financial jam?

The ABA is calling to reform credit unions. If our movement was to counter that argument, we could call our website Rekindle Credit Unions. That rekindling lies in asking questions such as, Should we host a holiday hotline? or Do members feel judged? and sharing what they’ve learned with other leaders on a similar journey. How did they make a hotline work? How do they encourage members to reach out?

Different credit unions might have distinct purposes and diverging goals, but the more they can connect and share with one another, the better their chances of turning small sparks of greatness into a firestorm for positive change.

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Takeaways From Day 2 Of GAC

Takeaways From Day 1 Of GAC

Credit Union Storytelling With A Mission Focus

Keep Reading

Related Posts

Takeaways From Day 2 Of GAC

Takeaways From Day 1 Of GAC

What’s Job No. 2?

Takeaways From Day 2 Of GAC

Aaron PassmanTakeaways From Day 1 Of GAC

Aaron PassmanCredit Union Storytelling With A Mission Focus

Marc RapportView all posts in:

More on: