The U.S. economy is suffering under the burden of a worldwide health pandemic, and consumers are responding by moving additional savings into their deposit accounts. According to the Federal Reserve Bank of St. Louis, the nationwide personal savings rate was 14.3% as of September 30. This is down from the 33.6% record high reported in April; however, excluding the last quarter, it remains the highest rate reported since 1975. The Federal Reserve has kept interest rates low to incentivize consumer spending and borrowing and spur economic activity. Despite this, reduced day-to-day spending and sustained high deposit balances remain the norm through the third quarter.

Key Points

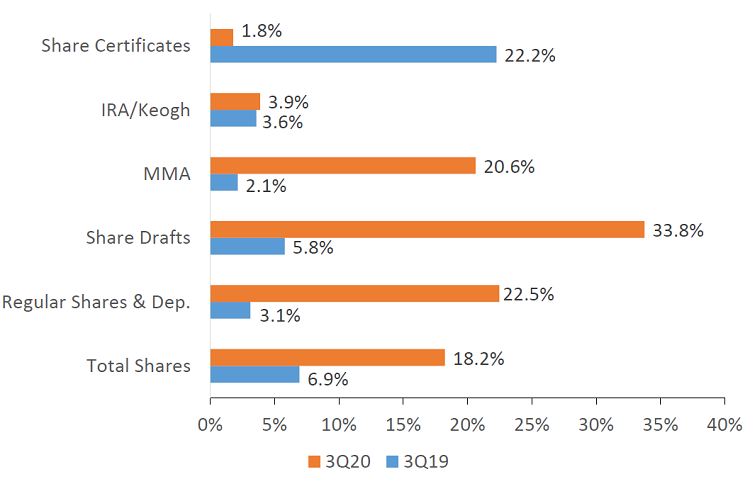

- Total share balances increased 18.2% annually, adding $238.5 billion to balance sheets and reaching $1.5 trillion as of the third quarter.

- Share draft balances increased 33.8% annually to $271.5 billion. Regular share balances increased 22.5% over the past 12 months to $580.0 billion. Sustained low interest rates make these accounts a source of low-cost liquidity at credit unions nationwide.

- Share certificates increased 1.8% year-over-year to $285.2 billion. This is a 20.5-percentage-point deceleration in growth in the past 12-months. Low interest rates give members an incentive to embrace the flexibility of core deposits in lieu of these restrictive accounts.

- Average share balance per member increased $1,558 year-over-year. This is the highest increase on record. As of the third quarter, credit union members held an average of $12,268 in share accounts.

SHARE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

Regular shares and share drafts accounted for 73.3% of total deposit gains at credit unions nationwide over the past year.

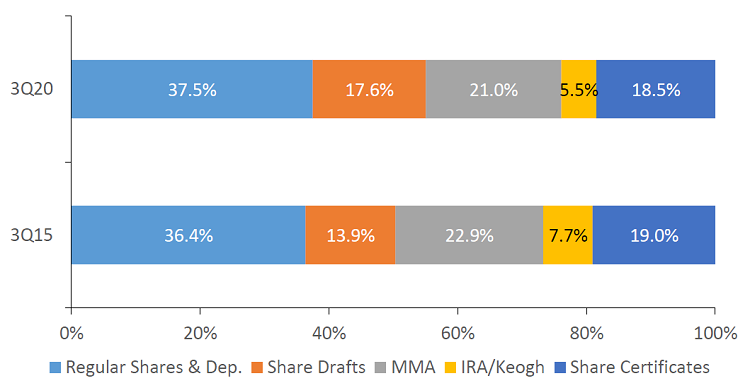

DEPOSIT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

Regular share balances neared $580.0 billion and accounted for 37.5% of the total credit union deposit portfolio.

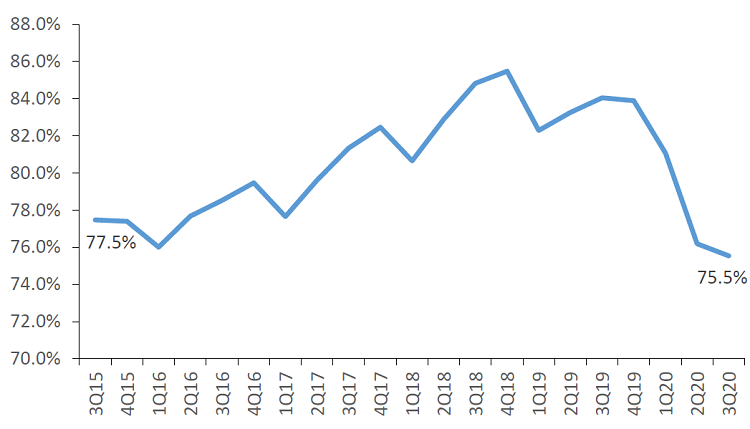

LOAN-TO-SHARE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

The loan-to-share ratio decreased 8.5 percentage points over the past year to the lowest reported rate since June 2015.

The Bottom Line

The Federal Reserve has indicated it will not raise rates from their current all-time low for the foreseeable future. Despite this incentive to spend, credit union members overwhelmingly seek the safety of deposit accounts, resulting in larger personal savings balances. Regular share and checking accounts alone have accounted for 73.3% of total deposit gains at credit unions over the past year, alleviating liquidity shortfalls. Certificate growth has slowed, too, as the pressure to offer higher rates lessens.