I’ve spent a lot of time on social media lately, scrolling through feeds to pass the time and distract my mind from the uncertainty of daily life in the time of the coronavirus.

I know I’m not alone. As more and more people hunker down at home, more conversations are moving online. Is your credit union ready for that new reality? Here are six tips to keep in mind during the next several weeks.

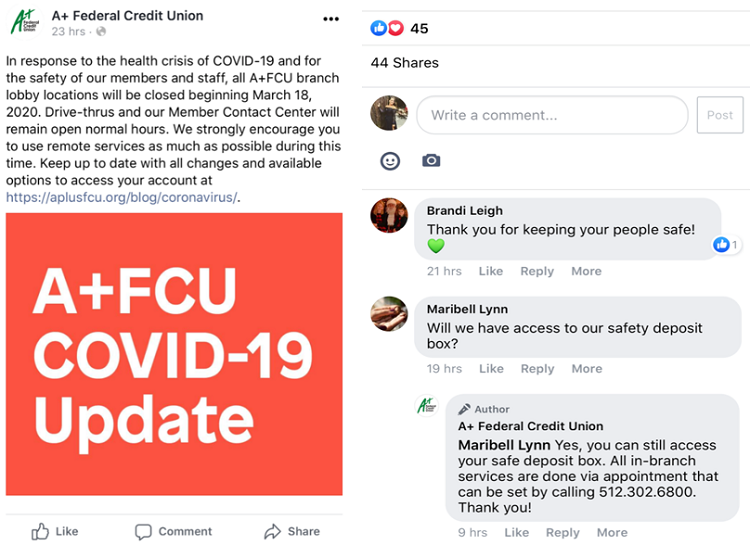

DO update followers regarding the credit union’s service plan.

Social media is one of the first places members turn to for operating hours. Make sure to update your Google listing hours and let followers know your retail and service plan during this time. Check out this helpful document on how to update your hours.

Keep an eye out for repetitive member questions, then proactively push out those answers to members.

As credit unions alter operating hours to adhere to government recommendations and ensure member safety, it’s important to post and promote retail and service plans.

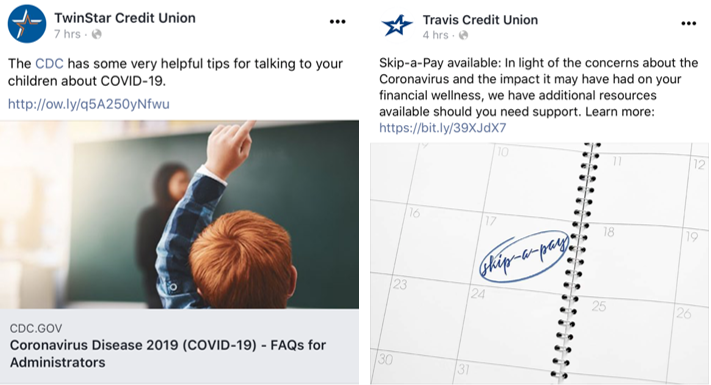

DON’T sell. DO show members the credit union is a trusted partner.

People want to feel supported, not sold to; they want to know someone has their back. This is especially true during a crisis. If the credit union offers benefits or free services that seem particularly relevant in today’s environment for example, remote deposit capability share this with your members. If you find resources from a trusted source about how to cope during a crisis, share them with followers. In the future, members will remember your calm presence during this storm.

Tell followers about the credit union’s benefits and free services that will help them successfully navigate this unfamiliar environment.

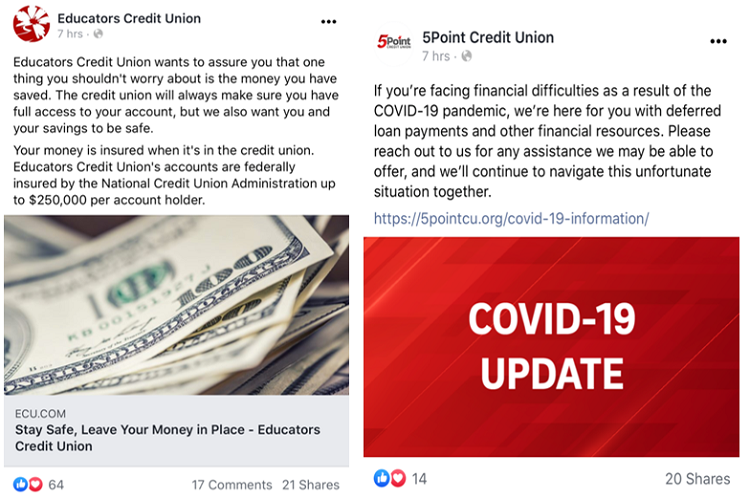

DO ease the minds of members.

Credit unions offer all kinds of programs that would ease the minds of worried members, so, tell them about it. Some offers might not feel extraordinary, but when life is far from ordinary, even small assurances such as the availability and safety of savings can go a long way. Money can be a major stressor for families even during normal times. In today’s unprecedented economic and social environment, credit union support can make all the difference for vulnerable members.

Take a fresh look at products and services to determine which ones might be especially comforting to worried members.

DON’T overpost.

Everyone is spending more time online, but that doesn’t mean the credit union needs to post more. Be authentic and post only what you feel your members need to see. Too much posting can run counter to the credit union’s goals, especially at a time like this.

DO turn off automated posts and be cautious of retargeted and sponsored posts.

Many credit unions schedule posts using automation sites. When reality is changing by the day even by the hour it’s best to push irrelevant posts into the (far) future or cancel them altogether lest news breaks and a scheduled post comes across as insensitive or offensive. Take a look at sponsored campaigns as well. It’s often difficult for members to discern between sponsored posts and credit union messaging, so you might want to consider pausing product- or sales-heavy campaigns for now.

We’re in unprecedented territory. Markets are in a flux, jobs are in jeopardy, and people are nervous. But for members, credit unions are serving and supporting today like they have every day for the past 110 years. And with a few tweaks to online strategy, everyone will know it.