What credit union members want more than anything else is for their credit union to look out for their financial wellbeing. That’s the core finding of more than a decade of Gallup research into consumer financial services. Your members are your mission. Now, maybe more than ever before, your members need you and they need to know you care.

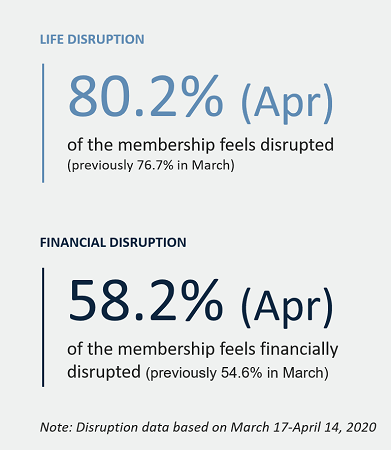

The COVID-19 pandemic has disrupted the lives of four out of five credit union members either a great deal or a fair amount. Nearly three-quarters of these folks are feeling that disruption in their pocketbook.

These numbers are higher than they were just a few weeks ago. Notably, they are also several points higher for credit union members than for the public at large. That’s a key finding from preliminary research conducted by Gallup as part of the collaborative member engagement and financial wellbeing program it is offering with Callahan & Associates.

Credit unions across the country are providing tangible help for members suffering economic setbacks due to COVID-19. Waived fees, lower rates, skip-a-pays, unsecured loans, better remote services, protection for government payments, and myriad other material support are making life measurably better for credit union members. But, research shows members need and want emotional support, too.

Feelings Are Facts

Behavioral science the psychology of decision-making that has earned several Nobel Memorial Prizes in Economic Sciences in recent decades shows that approximately 70% of human decision-making is driven by emotion-based perceptions and not perfectly rational assessment of facts. As such, you need to show your members the credit union cares.

People who don’t think their credit union cares about them are less likely to take advantage of available resources, less likely to employ those resources in an optimal way, and less likely to reach out for help before things become desperate.

Members who perceive their credit union cares about their financial wellbeing have more confidence in its motives and greater trust in the value of its guidance. In the near term, that means using the tools and support you provide more effectively and sustainably, creating better outcomes for members and for the credit union. Longer term, it means greater loyalty, higher NPS and satisfaction scores, and deeper share of wallet.

Gallup surveys illustrate how engaging with empathy differentiates credit unions from banks and builds a reservoir of goodwill that will pay dividends in the future.

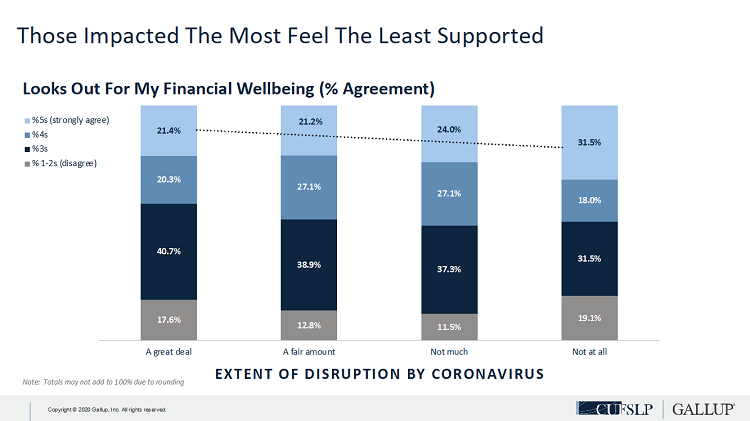

This brings another finding from Gallup surveys into sharp focus: Credit union members feeling the greatest impact from the pandemic those in greatest need of both practical and emotional support from their credit union are the members least likely to feel supported as measured by their agreement with the statement, My credit union looks out for my Financial Wellbeing.

People who don’t think their credit union cares about them are less likely to take advantage of available resources, less likely to employ those resources in an optimal way, and less likely to reach out for help before things become desperate. Those outcomes are bad for everyone, but changing the pattern that produces them is hard, especially in the midst of a crisis.

Many in the credit union industry were trained as bankers. We’re here because we care about people, but our understanding of the business is deeply rooted in rational analysis, not emotional engagement. Especially in a crisis, we default to what we know. That’s normal, and we should feel good about what the industry is doing. But, our members need more.

Emotional engagement supports members and animates the credit union mission. There are a number of things we can and should be doing right now to build it.

- Employ the ACT with Empathy framework across your member-contact infrastructure:

- Acknowledge your member’s emotional state; validate their feelings.

- Confirm your member’s needs; reassure them through engagement.

- Take action by communicating next steps and a timeline; this will build hope and reduce stress.

- Use people available from closed lobbies to proactively reach out to members. Several credit unions involved in the collaborative member engagement program are doing that with great results. Engaging with members before they have a problem positions the credit union as a resource rather than a threat and lays the foundation for better outcomes no matter what the future brings.

- Start thinking strategically:

- What are we learning from this crisis?

- What changes should we be making in the future to apply these lessons?

- What changes could we start to make right now without compromising our crisis response?

- Think collaboratively:

- What would you like to know from other credit unions about their response efforts and plans? What would you be willing to share about your own?

- How can you work collaboratively with other credit unions across the country and within your market to better serve members?

- What can Callahan & Associates do to support you in these efforts? Please, reach out and tell us!

Gallup researchers and consultants contributed to this article. Data is drawn from an ongoing Gallup study among Credit Union Consortium participants representing more than 3.2 million credit union members across the nation.