OPERATING EXPENSE GROWTH VS. REVENUE GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

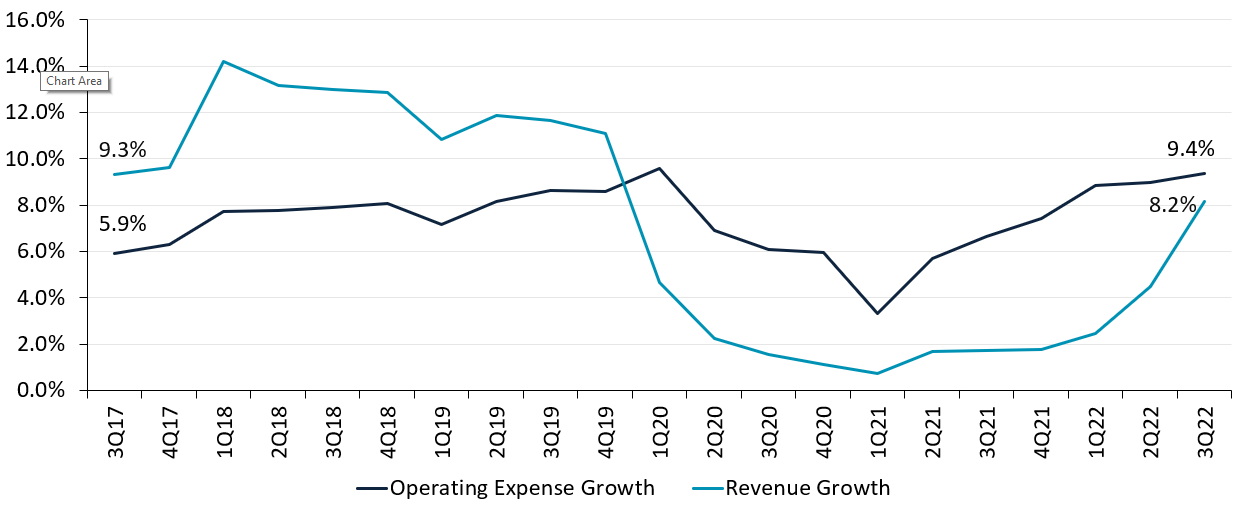

- Operating expenses have outpaced revenues since the start of the pandemic, but that is changing thanks to surging loan demand and tightening liquidity.

- The gap between revenue and expenses was as wide as 6 percentage points as recently as the first quarter of 2022; however, by Sept. 30, it had shrunk to just 1.2 points.

- Fueled in part by a hot labor market, employee compensation accounted for slightly more than half —51.9% — of all operating expenses. The average annual growth rate for operating expenses was 8.15% through the first three quarters of 2022.

- Looking forward, growth in employee benefits and compensation expenses could slow along with other non-farm payrolls, which were down from one year ago. Interest income is also likely to rise as loan demand increases and cooperatives allocate more funds to lending versus to cash or investments.