The “K-shaped economy” is a buzzword that has defined the post-COVID economic landscape. The term describes an environment where those who are high earners and own assets continue to do very well, whereas those on the lower rungs of the economy do worse and worse. In this way, their diverging paths create a “K shape.”

The K-shape is symbolized by different socioeconomic classes’ ability to withstand the headwinds facing the U.S. economy. For example, with inflation, higher income households tend to own assets that are inflation-resistant. Meanwhile, for lower income Americans, inflation in the cost of everyday items eats up more of their budget. According to a 2023 report from the Federal Reserve, the more money a consumer has, the less stress they are likely to experience as a result of inflation. These diverging impacts and stress levels are present throughout the economy.

A History Of The K-Shaped Economy

For many decades following World War II, economic growth increased at roughly parallel rates for wealthy Americans and lower-income Americans. However, during the 1980s, the haves began to outpace the have-nots. Following the COVID-19 pandemic and the subsequent surge in inflation, the two halves of America began to uncouple further.

The pandemic disproportionately impacted service-oriented workers who could not work remotely, resulting in furloughs and layoffs shortly after the onset of COVID-19. Federal economic relief checks temporarily abated this impact, but then inflation disproportionately ate away at the budgets of lower-income Americans. Although the economy on average has caught up, many Americans have been left behind, living paycheck to paycheck and relying on credit cards to make ends meet.

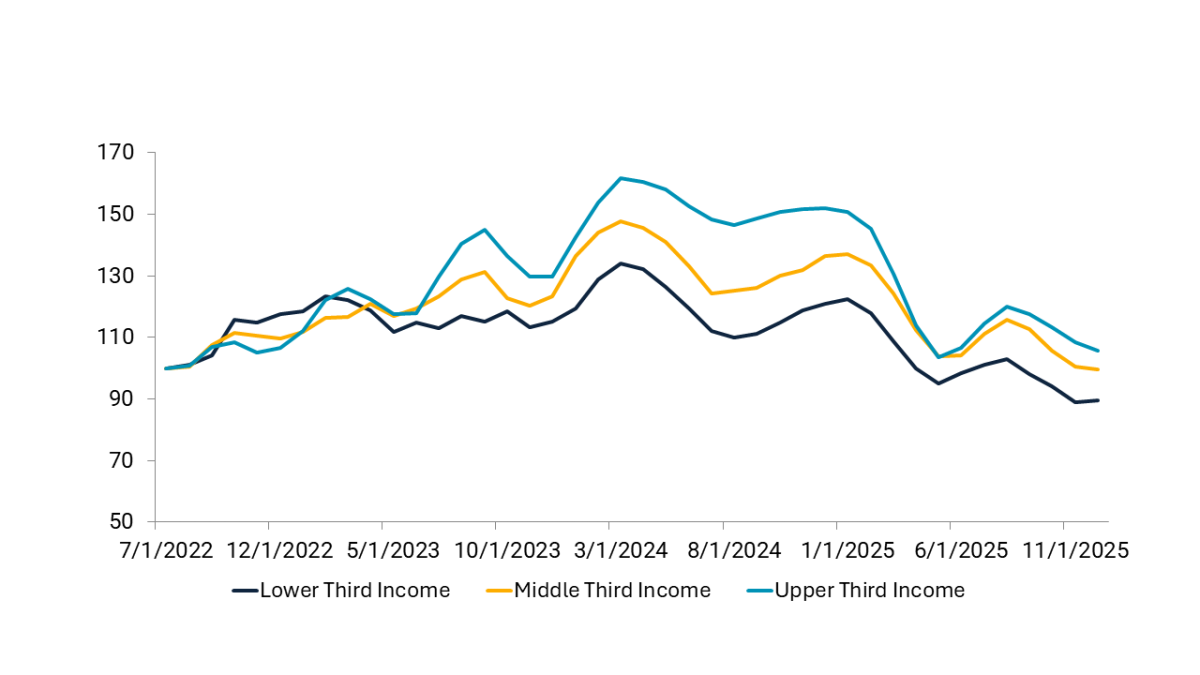

CONSUMER SENTIMENT, INDEXED TO 100

FOR U.S. HOUSEHOLDS

SOURCE: UNIVERSITY OF MICHIGAN

Why Is This A Problem?

Besides the obvious problems of the less wealthy falling further behind, there are a few ways these diverging paths disrupt the U.S. economy.

When it comes to national economic statistics, struggling households are often left out of the picture. Gross Domestic Product figures don’t necessarily represent how everyone is doing. Specifically, when the poor and wealthy diverge, GDP calculations overlook the median, so it’s important when assessing economic data to consider not only the average or mean but also the median.

This divergence also manifests itself in consumer sentiment. It’s often thought that consumer attitudes diverge from nationwide economic statistics because of widespread pessimism. However, it’s possible that consumer sentiment has diverged so significantly because impressive top-line numbers don’t encapsulate the lived, very real and common experiences of struggling individuals.

The K-Shaped Recovery And An Economy Divided. Inflation, debt, and income inequality are fueling a K-shaped, post-pandemic recovery, widening the gap between different economic segments and challenging lower-income households. Read more today.

What Can Credit Unions Do?

Credit unions should be intimately familiar with the financial wellbeing of everyday Americans. Considering many credit unions — particularly CDFIs and low-income designated ones — are equipped and mandated to help the lowest on the economic ladder, this is a crucial dynamic to understand. Credit unions looking to make a difference can practice the following:

- Financial Education — Having an understanding of finance can give members the tools needed to get their financial house in order. Vantage West leveraged its financial wellness coaching program to help nearly 700 people in its local community build the tools they need to move up the ladder.

- Wealth Building — Financial education is a great first step, but there’s only so much budgeting one can do. At the end of the day, the biggest differentiator between the two sides of the K is the ability to build wealth. Creating opportunities for credit union members to own their own home, deposit into high-yield savings products, or even invest in the stock market can go a long way to helping members catch up.

- Flexibility When Things Go Wrong — Times are tough. Credit unions can make members’ lives easier, and help them avoid falling further behind, by being flexible. Late payment options, reduced fees, and emergency loans all can help prevent members from falling through the income cracks. During times of chaos, these credit unions have built a blueprint for stepping up.