Growing deposits, affordably, to meet loan demand was easily the leading challenge credit union leaders identified in Callahan’s 2019 Executive Outlook Survey. The respondents also generally reported stable to strong economies in their local markets, with some exceptions in rural areas dependent on a single industry, such as mining.

A few respondents also expressed fears of a coming recession in the eighth annual year-end survey, and a couple cited growing delinquencies as an area of concern. Local challenges included high housing costs and home affordability, and across the country, many leaders noted it was only getting tougher to find good help.

In the nearly 250 responses, competition from credit unions, banks, and non-banks frequently appeared, as was the need to grow membership and provide a better digital and branch experience.

Callahan’s 2019 Executive Outlook Survey asked respondents to consider their local market, challenges, and investments to address those challenges. The following pages contain a selection of excerpted answers. The home state and asset class of the respondent’s credit union follow the responses.

These replies are organized by U.S. Census region and are representative of the larger survey. To review the entire survey, visit CreditUnions.com and type economic outlook into the search bar.

South

Alabama, Arkansas, Delaware, District of Columbia, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia, West Virginia

Deposit growth is a challenge for 2019. Competitive pressures are making growing the liability side of the balance sheet a concern.

Florida, $1B-$10B

[We’re investing in] ITM self-service with biometric capability for future expansion into new markets.

Texas, $100M-$250M

[We’re investing in] improvements in quality member services in all touchpoints and technologies.

Georgia, $20M

The credit union is experiencing greater than expected charge-offs on the indirect auto loan portfolio. We’re adding to the collections staff.

Maryland, $1B-$10B

Our biggest challenge will be to manage loan losses. This is particularly true this year, given that we had 18% loan growth last year and we do a significant amount of lending in the lower credit score range. If the economy hits any speed bumps this year, those borrowers will likely be the first impacted.

Maryland, $20M-$50M

Unemployment is very low. It’s a very competitive market. Almost a zero sum game must steal business. Most people belong to two or three credit unions.

Washington, DC, $20M-$50M

We are a smaller credit union that has never been challenged to have high expectations. A new board came in two years ago and decided to change things up. I was brought in six months ago to drive change and growth. The challenge is to change learned bad habits.

North Carolina, $50M-$100M

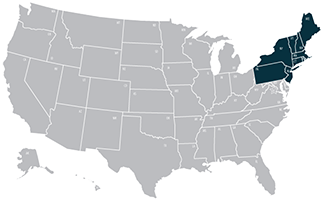

Northeast

Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont

We’ve committed our NCUA rebate from 2018 to determine a deposit strategy for 2019: $330K.

Massachusetts, $250M-$500M

We’re concerned about housing bubble 2.0 and a recession in a couple of years, so we're not going to grow loans for sake of growing loans with low margins.

Maine, $100M-$250M

Residential mortgage loan origination. Heavy competition, fewer sale transactions, little or no refinancing. Non-conventional products are back.

Rhode Island, $500M-$1B

Loan demand is a little weaker than last year.

Massachusetts, $1B-$10B

Deposit growth to match loan growth.

Massachusetts, $250M-$500M

Membership growth. SEG base is consolidating, providing for less opportunity for growth. We might need to look for other SEGs.

Pennsylvania, $1B-$10B

Online account opening improvements. Upgrading in branch staffing model and installation of ITMs.

Massachusetts, $1B-$10B

We’re adding a branch in a very competitive market at year-end as well as streamlining our processes — i.e., automation — to compete.

Maine, $250M-$500M

Lowering COF to improve NIM. Many organizations are vying for deposits.

Pennsylvania, $1B-$10B

We are in a somewhat depressed market. Not a lot of business coming into our area. We now have a lot of businesses looking for (labor) employees, and the biggest issue seems to be the inability to pass a drug test.

Pennsylvania, $50M-$100M

Midwest

Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, Wisconsin

[We’ve] launched money market accounts and [are] keeping rates very high along with CD and share rates. Digital advertising will switch to deposits for first time ever.

Michigan, $250M-$500M

[We’re] sacrificing fee revenue from our checking account product to encourage members to give us greater share of wallet and more direct deposit growth.

Ohio, $50M-$100M

Unemployment is very low, below national averages. War on talent. High loan demand, competitive deposit issues, robust economy. We're controlling our growth through loan sales and participations. Extremely competitive on all fronts. Pent-up car demand.

Iowa, $1B-$10B

Culture transformation will occur driven by a new VP of HR and an investment in a partner that will retrain the entire organization.

Illinois, $500M-$1B

Our local economy is strong. Unemployment remains around 4%, which is causing some hiring/retention challenges. We recently performed a compensation analysis for all employees and increased pay when appropriate. Housing demand is strong in our area. Loan demand is strong but has begun slowing over the past four months.

Michigan, $1B-$10B

[We’re] preparing for the new accounting standard CECL. We have to build a database and change how we account for loan losses. We’ve purchased software to help with this database.

Kansas, $20M

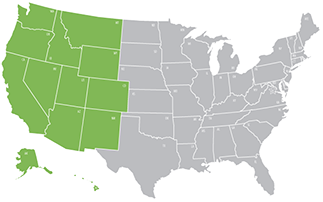

West

Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming

Deposit growth. We experienced 7% and above in previous years; it dropped to just 2% in 2018. We have set a target of 5% for 2019. Competing in this market with so many options and prices is challenging and promoting other values members care about is critical.

California, $250M-$500M

Compensation! We recently moved our starting wage for tellers to $15/hour and restructured all of our pay grades to reflect this increased minimum starting wage.

Oregon, $1B-$10B

[We’re] converting to a new loan origination system to streamline the entire mortgage process. We also have a related focus of improving our remote and mobile onboarding process to better compete and gain market share against the other online originators (namely Quicken Mortgage). Our product is far superior, but we need to make sure the process is at least equal or better.

Nevada, $500M-$1B

[We’re] creating a data analytics team to produce information faster to make decisions.

California, $250M-$500M

Operational effectiveness. We have many vital legacy systems hampering our ability to create a seamless member and employee experience. Every new system must support an open API/web services architecture to allow real-time data movement.

Oregon, $500M-$1B

Membership growth (non-indirect). Lack of awareness is the biggest challenge. Our size limits our resources.

California, $250M-$500M

The local market is stagnating. Real estate prices are slipping, consumer delinquencies are rising, and consumer confidence is falling.

California, $250M-$500M