Distributed ledger technology, more commonly known as blockchain, is one of many trending topics in the credit union ecosystem. It has the potential to revolutionize many aspects of a credit union’s operations ― especially in the realm of transaction and record management.

What exactly is a distributed ledger?

A distributed ledger is a shared platform where credit unions can store copies of each record or transaction on multiple computers, with data sliced up, encrypted, and duplicated multiple times across the network. This means that there is no central server that could be hacked or corrupted because so many copies exist. The ledger utilizes a consensus mechanism to verify transactions and prevent fraud. And lastly, their records are immutable ― every transaction is recorded in order, so you can add a new transaction to the chain, but if you attempt to alter the ledger, the chain can reference the other copies to identify and exclude corrupted transactions.

How will this impact the technology investments I make today?

One of the most exciting opportunities for credit unions is how distributed ledgers can integrate with current technologies to enhance the services that credit unions provide to their members.

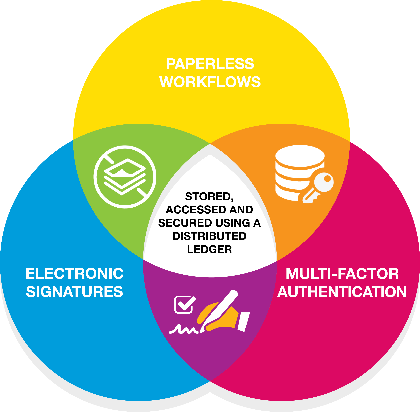

For the last several years, credit unions have been making significant investments in going paperless, integrating electronic signatures, and introducing multi-factor authentication protocols. Each of these technologies requires credit unions to create, store, and access a wide range of member data, from biometric identifiers to loan documents.

By storing this data on a distributed ledger, credit unions will be able to improve efficiency, enhance security and deepen their members’ experiences, thereby generating additional ROI tomorrow from the investments they make today.

How would this work in practice?

For an example of how this could operate in practice, a credit union could utilize a distributed ledger for loan management. In this scenario:

- A member completes a digital loan application that would be reviewed and approved using an established document management workflow.

- The credit union would provide digital loan documents to the member who would need to verify his/her identity when signing. This identity verification could incorporate multiple validators such as fingerprints, retina scans, and dynamic signature verification.

- Once the member has electronically signed the agreement, the loan document and any accompanying documentation can be executed as a smart contract.

- The smart contract tracks each transaction made as part of the loan agreement and upon completion of the loan repayment can automatically transfer the title to the member.

This set up allows credit unions to reduce processing time and costs for loans. Adding multi-factor authentication to the process can help reduce the risk of fraud and identity theft. In addition, the distributed ledger would provide an immutable record of transactions. This could allow credit unions to decrease the time and resources spent auditing and maintaining disparate records systems. Streamlining document storage and enhancing accessibility could also provide members with easier access to their financial records and faster transaction times as well as enhancing their personal data security.

Taken together, paperless workflows, electronic signatures, and multi-factor authentication can work together to reduce the time a credit union spends on high-volume, low-value transactions, allowing staff to can devote more time to deepening their interactions with members and providing personalized services. Each of these investments can generate immediate ROI when implemented but could also compound your ROI when implemented alongside blockchain.

To learn more, download this whitepaper which covers:

- What is blockchain or distributed ledger technology?

- Ways that credit unions can use distributed ledgers to manage member identity, transaction records, and documents.

- How this approach can enhance efficiency, security, and member experiences for credit unions.

- Use cases for blockchain in credit unions.

Author: Mike Dana, Business Development Manager, Financial Services, Wacom Technology. Mike is responsible for managing the development and implementation of eSignature solutions for credit unions and across the U.S. and Canada. Contact Mike at mike.dana@wacom.com or visit Wacom online at http://esignature.wacom.com/credit-unions

About Wacom: Wacom’s vision to bring people and technology closer together through natural interface technologies has made it the world’s leading manufacturer of interactive pen display solutions for electronic signatures. Wacom´s patented technology is perfect for capturing handwritten signatures thanks to high resolution and accuracy. With a Wacom signature device, members can secure and efficiently process their workflows wherever documents are filled out, signed, and verified.