In October 2014, Patelco Credit Union’s budget planning committee of C-level executives, senior vice presidents, and vice presidents faced a difficult question.

Are we using our resources correctly? asked Erin Mendez, CEO of Patelco ($4.1B, Pleasanton, CA). If not, how do we realign them?

Mendez set a goal for the 2015 budget: reduce controllable expenses by 10%.

CU QUICK FACTS

patelco Credit Union

data as of 12.31.14

- HQ: Pleasanton, CA

- ASSETS: $4.1B

- MEMBERS: 285,954

- BRANCHES: 40

- 12-MO SHARE GROWTH: 3.79%

- 12-MO LOAN GROWTH: 22.32%

The committee hit that goal by not only cutting controllable expenses excluding full-time employee salary and benefits as well as facilities costs but also reallocating funds to areas of greater need or higher priority. For example, the 2015 budget includes $1.8 million reallocated to education efforts and legislative and regulatory affairs, among others.

Patelco dug deep to reduce its controllable expenses, and its efforts provide three lessons all credit unions can follow.

Lesson No. 1 Know Your Endgame

Mendez is taking the credit union in a different direction than her predecessors. Patelco built its reputation on a member-centric approach to service, and Mendez, who has been CEO since 2013, wants to get back to that standard.

The first step in achieving that goal is for the credit union to use its expenses more efficiently. Even with its planned reduction and redistribution of past expenses, the credit union still plans to increase expenses by 5% in 2015.

Patelco is working to design processes, procedures, and systems around a hassle-free experience with the hopes that doing so will create financially stronger members. For example, in July 2014, the credit union cut 39 unnecessary fees because, as Mendez says, it’s our fiduciary responsibility to our membership.

So far, Patelco has saved members $800,000 annualized in fees, exactly what it had predicted. The move showed members the credit union was serious about its commitment to their finances, and Patelco expects members will likewise reaffirm their commitment to the credit union.

I’m a firm believer if you do what’s right for the member, then the member will participate in your products and services, she says.

The fee cut also has had an unintended consequence of reducing call center volume, as fewer members are calling to ask for a reduction in fees, Mendez says.

Want More Data?

Check out the CreditUnions.com GRAPHIC OF THE WEEK for a sampling of productivity and efficiency metrics.

Lesson No. 2 Rethink The Business

Teaching an old dog a new trick can be difficult, especially when that dog is a $4 billion financial institution with roots stretching back to the 1930s. But when Patelco brought on Mendez and CFO Susan Gruber, in September 2014, it found the leaders who would undertake that challenge.

To identify areas with unnecessary or inflated expenses, Mendez encouraged senior vice presidents and vice presidents to rethink the way they did their jobs. She asked them to examine where and why they spent money.

Of Patelco’s $1.8 million in savings, $345,000 came from salaries and benefit expenses, which were then reallocated to other areas of the credit union; $588,000 came from reducing temporary and contract staff; and $863,000 came from renegotiating and eliminating vendor contracts.

Anything was on the table that was in the controllable category, Mendez says.

The credit union didn’t reduce its headcount total staffing grew almost 5% year-over-year but it did move employees into different roles. Patelco revamped its branch structure and consolidated regions regional managers from five to three. It then absorbed the affected employees into different areas of the organization. In addition, the credit union turned its business development team intoa community outreach team that works to enrich the lives of members, employees, and the community through financial education.

The credit union also hired or released temporary employees, terminated consultant services it was not using, and renegotiated contracts with vendor partners. These changes ushered in a new era for the credit union where rethinking costs will become an ongoing process in a rapidly changing financial services marketplace.

It’s a perpetual investment to look at those mechanics of your business and see if they are still appropriate for today and also the foreseeable future, Mendez says. If not, you have to have the ability and the wherewithal to change those things.

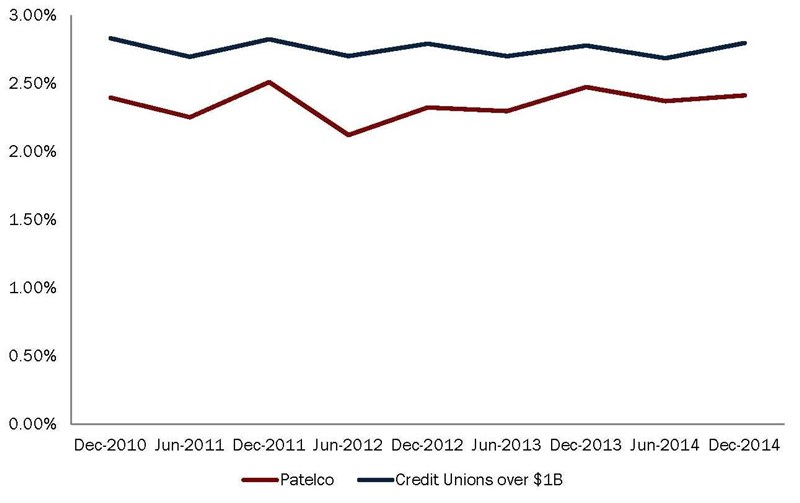

It will take time, but the credit union plans to hit an operating expense ratio of 2.0% or less, which is achievable as more members turn to online banking and lower the institution’s overall cost per transaction and ultimately its operating expense ratio.

Lesson No. 3 Force The Situation

According to Mendez, Patelco’s expense reduction and reallocation is nothing special. Where the credit union made notable strides was in forcing the situation to find the reductions, she says.

Patelco’s operating expense ratio (see chart below) is better than peer credit unions of $1 billion or more in assets. So why the pressing changes? Were they essential if Patelco was already more efficient than similarly sized peers?

There’s still a lot you can do even if you think your expense ratio is good, Mendez says. You just have to systematically go through things.

To her knowledge, the credit union had never undergone such an exercise. Yet simply combing through its expense report illuminated unnecessary expenses.

Operating Expense Ratio

For all U.S. credit unions | Data as of Dec. 31

Callahan Associates | www.creditunions.com

Source: Callahan Associates’ Peer-to-Peer Analytics

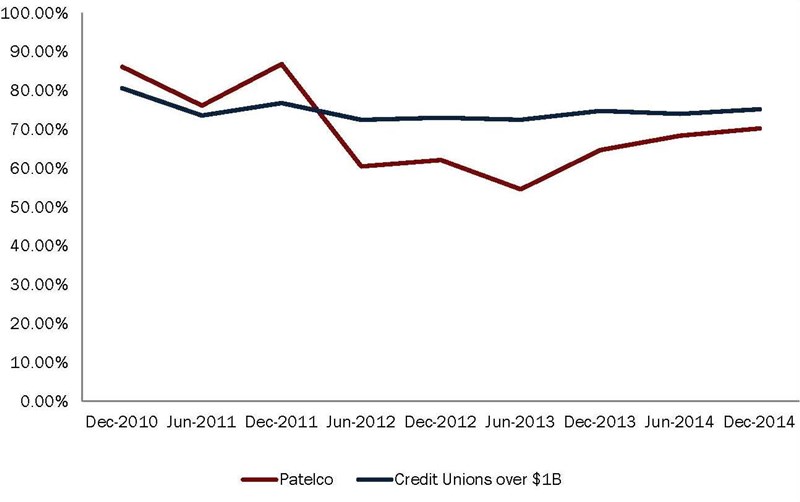

efficiency RATIO

For all U.S. credit unions | Data as of Dec. 31

Callahan Associates | www.creditunions.com

Source: Callahan Associates’ Peer-to-Peer Analytics

The bulk of the credit union’s expenses came from essential services such as vendor, legal, and consulting so Patelco took a hard line when it came to quality and price of these relationships. It eliminated all legal retainers and consolidated its legal partnerships. It also, by new policy, dumped its evergreen contracts.

What’s more, the due diligence helped the credit union discover it was paying two pricing vendors but using only one.

Why were we paying the second one? Mendez asks.

Patelco researched the market rates for the vendor services it retained. If the pricing was not appropriate for today’s market, the credit union asked those vendors to revisit the contract, even if it wasn’t up for negotiation. The strategy worked, and Patelcoshed expenses.

We were surprised with how quickly [vendors] were willing to negotiate when we said they might lose the business in the future, Mendez says.