Top-Level Takeaways

- The marketing team at BCU shares slightly different messages with various teams.

- At Spero Financial, marketing focuses squarely on ROI.

- AmeriCU closely tracks, and shares, its Net Promoter Score to identify and rectify “silent killers.”

With looming economic uncertainty, ongoing talent shortages, and increasingly expensive options for media buys, marketers are facing fresh challenges in 2023. Traditionally viewed as expense centers by CFOs and others, marketing teams must prove their value internally and set their department up as a strategic partner for the rest of the organization.

Here, a trio of industry professionals answer one simple question: What is one thing marketing teams should be reporting on?

Recipient-Based Reporting

Jill Sammons is senior vice president of marketing, well-being, and wealth advisors at BCU ($5.7B, Vernon Hills, IL).

“Too often marketing is considered a support function and not credited with the value it deserves. To be recognized, we must share worthwhile information. Marketers tend to get excited about how many opens, clicks, and views they get. Although top-of-the-funnel engagement data is vital, it’s not revenue-generating. Marketers are better off using vanity metrics to help them test, learn, and iterate.

“Marketing should be sharing slightly different messages with various teams across the organization. Senior leaders want to understand marketing’s influence on conversion rates, attribution, and ROI. How are you increasing your credit union’s share of member wallet? Product and sales teams should understand the quality of leads your marketing generates. Do they have prospects to contact because members took the action you asked them to take in your marketing?

“Every person in the organization needs to see themselves in your brand and purpose. Whatever role they have, they can influence someone to act. If you have 500 employees in your credit union, you essentially have a marketing department of 500. Tell your credit union story as often as you can internally. Make believers out of everyone you work with so they can’t help but talk about the value of doing business with you.

“Lastly, share every promotion you have coming up and in-market so they are easily accessible to the front line. Informed employees inform members. In BCU’s case, we use Salesforce Marketing Cloud for marketing distribution. Because we also use Salesforce Sales and Service, every representative can see all the promotions we sent within the member account view.”

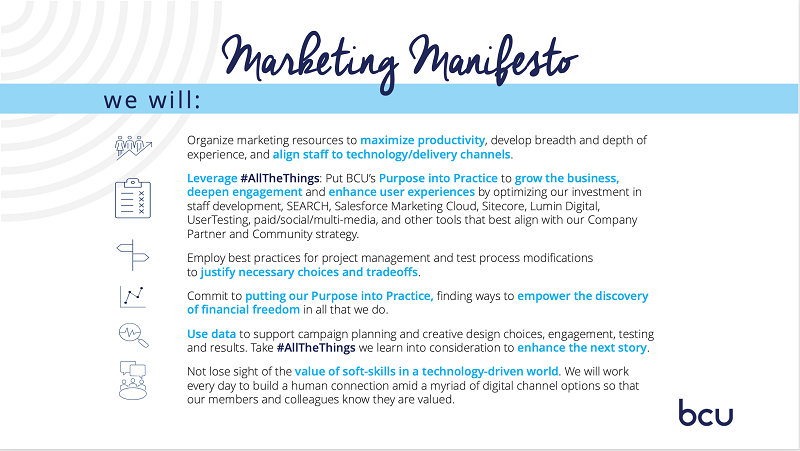

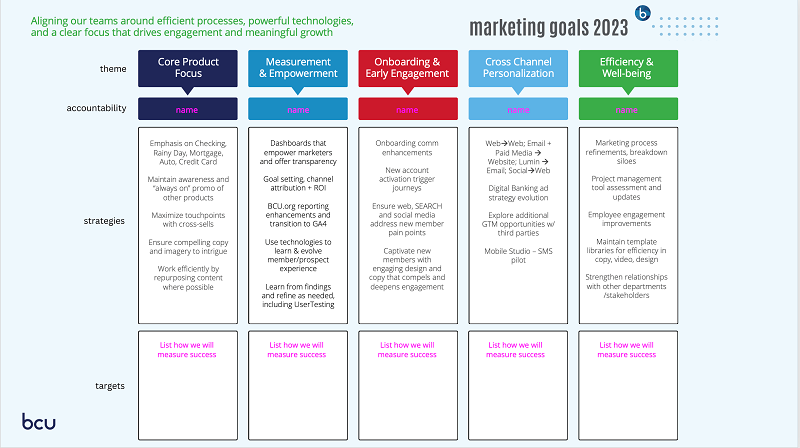

BCU’s marketing team makes its purpose and goals clear, positioning itself as a strategic partner for the entire organization.

BCU’s marketing team makes its purpose and goals clear, positioning itself as a strategic partner for the entire organization.

A Method To Measure ROI

Bethani Williams is vice president of marketing at Spero Financial Federal Credit Union ($630.9M, Greenville, SC).

“The ideal metric would be reporting ROI directly tied to marketing initiatives. Depending on the marketing channel, paired with consumer buying behavior (i.e., being served multiple touchpoints before converting), this is a lot easier said than done.

“At Spero, one way we measure true ROI is in our pre-screen offers. The process is a direct partnership with our lending department. Using the pre-screen list, we send a series of communications to promote the offer. Cross-referencing the list at the end of the campaign, we can determine true conversion rate, revenue per conversion, and cost per conversion — and, ultimately, the ROI in interest revenue.

“We benchmark year-after-year to determine the success of the promotion and optimize for future promotions. We also use past conversion rates to back into the pre-screen list size to hit our lending team’s production goal. This year, we are taking it a step further to determine the most impactful marketing channel with A/B testing. Depending on the channel, we can decrease the cost per conversion significantly, which directly increases ROI.”

Member Satisfaction

Alissa Sykes Tulloch is the executive vice president and chief operating officer at AmeriCU ($2.7B, Rome, NY).

“The Net Promoter Score provides insights into our members’ overall experience with the credit union — areas where we exceed expectations and areas where we need to make improvements. I call these the ‘silent killers.’

“For example, this past year our call center NPS score started to decline. From the trending data and comments provided, we identified that we had an issue and reacted quickly with a resolution. If we didn’t have that insight, we would not have been able to react so quickly to rectify the issue and move things back in the right direction.

“A close second would be sharing consumer trends — such as propensity to consume, product usage, demographics, etc. — for members and the marketplace. This also provides us with crucial information to make strategic decisions.”